One of the recent All-Russian online seminars, regularly held by the Garant company, was devoted to innovations and basic provisions of personal income tax. The event was hosted by Alexandra Aleksandrovna Lapina, Deputy Head of the Department of Taxation of Citizens' Income and Unified Social Tax of the Ministry of Finance of Russia.

When calculating personal income tax, tax agents have many questions. The main ones are related to the procedure for calculating material benefits, providing deductions, determining the tax rate and the status of an individual - employee.

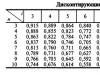

Personal income tax rates

Tax rates are set as a percentage of income received. Their size in relation to income depends on the type of such income and on the status of the individual.

When determining the tax status of an individual, any continuous 12-month period is taken into account, determined on the corresponding date of receipt of income, including those that began in one tax period (calendar year) and continued in another tax period (calendar year). The status is determined not from the moment a foreign employee is hired, but from the day he entered the territory of the Russian Federation, as evidenced by the mark in the passport.

In the current tax period (calendar year), the tax status of an individual may change, which entails a recalculation of the amount of tax payable. Thus, if on the date of payment of income an individual was not a tax resident, but during the tax period his tax status changed, the personal income tax, previously withheld at a rate of 30 percent, is subject to recalculation at a rate of 13 percent from the beginning of the calendar year. In this case, the taxpayer has the right to a refund of the overpaid amount of personal income tax. To do this, he must submit an appropriate application and documents confirming his tax status in the past year to a tax agent. He, in turn, is obliged to recalculate personal income tax for the specified year.

In practice, a situation may arise that an employer sends its employee to work abroad for a long period of time. If this is a military personnel or government employee, then the tax resident status does not change, since they are traveling on orders.

If the employee is sent from a commercial company, then the situation will be as follows. The tax agent will have to withhold personal income tax from payments to this employee at a rate of 13 percent as long as he is a tax resident. That is, the period of his stay abroad is less than 183 days. If a specialist lived abroad for 183 days or more, then he ceased to be a tax resident. In this case, the employer must withhold personal income tax on income paid to the employee at a rate of 30 percent. Upon the return of this employee from abroad, it is necessary to determine his tax status in the general manner - that is, based on 183 days within 12 consecutive calendar months.

Tax deductions

A tax deduction is an amount by which the payer’s income, taxed at a rate of 13 percent, can be reduced when calculating personal income tax.

The Tax Code establishes 4 types of tax deductions: standard, social, property and professional. Let's consider those that an employer can provide.  Each person can be provided with 2 standard tax deductions: one for the taxpayer himself, the other for his children. The application must be accompanied by documents confirming the right to the deduction (certificate from the previous place of work, child’s birth certificate, divorce certificate, etc.).

Each person can be provided with 2 standard tax deductions: one for the taxpayer himself, the other for his children. The application must be accompanied by documents confirming the right to the deduction (certificate from the previous place of work, child’s birth certificate, divorce certificate, etc.).

The standard tax deduction for most taxpayers is provided in the amount of 400 rubles per month and is valid until the month in which the cumulative income from the beginning of the year exceeds 40,000 rubles.

The deduction for each child of a taxpayer is set at 1,000 rubles and is valid until the month in which the taxpayer’s income from the beginning of the year exceeds 280,000 rubles. It applies to children under the age of 18, as well as to every full-time student until he reaches the age of 24. It is also important that the individual receiving the deduction provides (maintains) children. Both parents of a child can take advantage of the deduction, regardless of whether they are married or not.

An employee can take advantage of a double deduction for a child if the child under the age of 18 is disabled, as well as if he is a full-time student, graduate student, resident, student under the age of 24 and at the same time is a disabled person of group I or II. The only parent (adoptive parent), guardian or trustee also has the right to double deduction. This concept is not defined by law, so it should be understood literally: a child has only one parent. This category of persons includes:

a mother who gave birth to a child out of wedlock, but only on the condition that the child was not adopted by either the biological father or another man;

mother, if information about the father is not included in the child’s birth certificate (there is a dash) or is indicated according to the mother’s words;

one of the child’s parents, if the second one has died or is declared missing or declared dead.

One of the parents cannot be recognized as the only one if:

the second was deprived of parental rights - he still bears the responsibility to support his child;

he and the second one are divorced and he does not pay alimony;  If the mother who gave birth to the child is on parental leave to care for a child under the age of one and a half years and, accordingly, does not receive income, then she cannot refuse to receive a deduction in favor of the second parent.

If the mother who gave birth to the child is on parental leave to care for a child under the age of one and a half years and, accordingly, does not receive income, then she cannot refuse to receive a deduction in favor of the second parent.

Keep in mind that standard tax deductions accumulate from the beginning of the tax period. Let's assume that from January 1 to March 31, 2010, a company employee was on maternity leave. Her salary for April was 10,000 rubles. The employer reduces the personal income tax tax base for April by the amount of deductions due for January-April 2010. That is, a standard deduction of 1,600 rubles (400 rubles x 4 months) and a deduction for a child of 4,000 rubles (1,000 rubles x 4 months) are taken into account. Thus, the tax base will be 4,400 rubles (10,000 – 1600 – 4000). You will need to pay personal income tax to the budget in the amount of 572 rubles (4400 rubles x 13%).

The following situation is possible: during certain months of the tax period, the amount of standard deductions exceeded the income of an individual. In this case, the employer needs to calculate the difference between the deduction and the salary and use it in the next month along with other deductions. In this case, the tax base for this period will be equal to zero. The balance of the deduction cannot be carried over to the next year (tax period).

If the standard deduction was provided in a larger or smaller amount, then the tax authority will make the recalculation based on the declaration and relevant documents.

In addition to standard deductions, the tax agent also provides social expenses for pension contributions paid under non-state pension agreements. Moreover, an individual can exercise this right before the end of the tax period by providing the employer with an application and documents confirming his actual expenses.

In addition, the employee may qualify for a property tax deduction from the tax agent. It is provided in the case of new construction or acquisition of residential buildings, apartments, rooms or shares in them on the territory of Russia. Its size is equal to the amount of expenses actually incurred, but cannot exceed 2,000,000 rubles. To do this, the employee must write an application and provide a notification from the tax office confirming the individual’s right to a property deduction.

If this deduction was not used in full in the current year (the amount of income was less than the amount of the deduction received), then its balance is carried over to the following years until it is fully used.

Calculation of material benefits

As a rule, companies issue loans to their employees on preferential terms. In this case, employees have a material benefit from saving on interest, with which they have to pay personal income tax.

In most cases, loans received from employers are either interest-free or have a reduced rate. In such a situation, the employee has a material benefit from saving on interest. The size of this indicator depends on whether the loan was received in foreign currency or rubles. In the first case, to calculate the material benefit, it is necessary to subtract the interest accrued under the agreement from the amount of interest calculated on the basis of 9 percent per annum. The amount received will be the benefit from interest savings.

If the loan was received in rubles, then to calculate the material benefit, you must first determine the amount of interest on the loan based on 2/3 of the Bank of Russia refinancing rate that was in effect on the day it was issued, and the amount of interest that the employee must pay for using the borrowed funds. Then subtract the second from the first indicator. The result will determine the material benefit of the employee.

The tax agent must withhold personal income tax on such material benefits at a rate of 35 percent.

If a loan was issued to an employee for the purchase of housing, there is no need to withhold personal income tax from the benefits of saving on interest, provided that he has confirmed his right to a property tax deduction. For example, an organization issued a loan to its employee to purchase an apartment in the amount of 2,000,000 rubles on October 1, 2009. He only purchased it in March 2010. The inspector provided a notification confirming the right to a property tax deduction on April 15, 2010. Consequently, from April 1, 2010, the employee does not have income in the form of material benefits. At the same time, the Code does not provide for the return to the taxpayer of amounts of excessively withheld personal income tax by reducing the amounts of tax to be transferred on income received from a given tax agent by other individuals. Amounts of tax withheld by a tax agent in the prescribed manner before he receives the taxpayer’s application for the right to receive a property tax deduction and the corresponding confirmation from the tax authority are not excessively withheld and are not subject to Article 231 of the Code. Consequently, a personal income tax refund for the period from January 1, 2010 can be made by the tax authority.

Prepared

E.N. Podlipalina,

magazine expert

1 tbsp. 224 Tax Code of the Russian Federation

2 p. 2 art. 207 Tax Code of the Russian Federation

3 p. 3 art. 207 Tax Code of the Russian Federation

4 tbsp. 218, 219, 220, 221 Tax Code of the Russian Federation

5 subp. 1 item 2 art. 212 Tax Code of the Russian Federation

What percentage is personal income tax in Russia? How is tax calculated, who pays it and from what income is it withheld? We will answer these and other questions in today's article.

The tax amount is calculated by multiplying the amount of income by the tax rate. The percentage depends on the type of monetary remuneration, as well as on whether the taxpayer is a resident or non-resident of the country.

Find out more about how to independently calculate the tax on the sale of an apartment in the article on our portal. Let's look at the changes in the rules in 2016, as well as how to register a declaration.

How to legally save on tax?

The state stipulates that in some cases Russians can count on a tax deduction. This is the name of a benefit that allows you to reduce the tax base and thereby get back part of the amount spent on purposes specified by the state.

Example. In 2017, Anna Viktorovna Zaitseva’s salary was 35,000 rubles per month or 420,000 rubles per year. 420 thousand rubles is the tax base from which income tax is withheld 420,000 * 13% = 54,600 rubles. Also in 2017, Zaitseva needed an operation costing 30,000 rubles. Anna Viktorovna, as a citizen of the Russian Federation, filed a deduction for treatment. As a result, the tax base decreased to 390 thousand rubles (420,000 - 30,000). And the income tax, taking into account the recalculation, amounted to 390,000 * 13% = 50,700 rubles. It turns out that for 2017, Zaitseva overpaid to the budget 54,600 - 50,700 = 3,900 rubles. And Anna Nikolaevna should be returned 3,900 rubles as overpaid.

2 million rubles.

Note! If the treatment of a Russian citizen is classified as “expensive”, there is no limit on the amount of deduction. The patient can receive a personal income tax refund on the entire amount he paid for the provision of medical services.

Most often, company employees receive deductions of 1,400, 3,000 or 500 rubles. Everyone who has minor children is entitled to the first type of deduction. The second is paid to the parent whose child has a disability. Five hundred rubles of tax money is returned to disabled adults.

How to apply for a benefit?

The procedure for applying for a tax deduction begins with submitting an application to the employer. You must also attach documents confirming your right to a refund:

- If a deduction is made for treatment, along with the application you must submit a 3-NDFL declaration, as well as checks and contracts for the provision of medical services.

- To apply for a deduction for property, contact the tax office and receive a notification about the possibility of returning your personal income tax indicating the exact amount. With the document from the Federal Tax Service and the application, go to the employer.

- Standard deductions are also processed by the company you work for. If you plan to receive benefits for a child, attach his/her birth certificate to the package of necessary documents.

Note! If at the end of the year the amount of deductions is greater than income, the tax base and calculated tax will be equal to zero.

Tax-free income

There are a number of incomes on which you are not required to pay personal income tax:

- compensation for expenses (for example, travel allowances);

- unemployment benefits;

- alimony ordered by the court;

- maternity and pregnancy benefits;

- scholarship;

- pension;

- social benefits.

Note! Income tax is withheld from sick pay.

Everyone is obliged to pay a percentage to the budget when receiving different types of income: salaries, profits from the provision of commercial services, cash prizes. And one of the most pressing questions is what is the personal income tax rate in 2019 on dividends. But – first things first.

Tax Features

To determine the amount of personal income tax for deduction to the budget, you need to use a simple formula:

PN – income tax;

S – the amount on the basis of which the calculation is made;

N – interest [personal income tax rate].

EXAMPLE

PJSC Antey awarded employee Govorov a salary of 35,800 rubles, as well as a bonus of 11,000 rubles. For him [personal income tax rate is 13]%. How much percentage of personal income tax salary should be transferred to the budget?

Solution:

(35,800+11,000) × 13%=6084 rub. – the amount of income tax.

As a result, Govorov will receive:

46,800 – 6,084 = 40,716 rubles.

It is important to remember that persons who received:

- state benefits for unemployment, pregnancy and childbirth;

- pensions and social benefits;

- scholarships;

- funds from inheritance;

- maternity capital.

Personal income tax: what percentage in 2019 for residents

Tax residents are persons who live on the territory of the Russian Federation and do not travel outside the country for a period of more than 183 days (except for cases provided for by law). This number is total. That is, when traveling abroad for a short period, the citizen remains a resident.

Has it changed? personal income tax rate in 2019 in Russia

It should be noted that from January 1, 2019, various amendments were made to the income tax regulations. However, legislators do not plan to adjust income tax rates this year. This means it will remain unchanged.

EXAMPLE

The personal income tax rate on dividends in 2019 for non-residents is 15%. How much tax should Skvortsov, who is a citizen of the Russian Federation and received 38,200 rubles in August, pay? such income from the Iceberg company?

The Tax Code has five types of personal income tax rates in 2019 - 9, 13, 15, 30, 35%. A table with all current tax values is in the article. The personal income tax rate depends on the type of income and the recipient - whether he is a tax resident or not.

First, we will analyze in detail in what cases this or that tax rate is applied, how much percent personal income tax is in 2019, and at the end of the article we will give a complete table with all rates.

Personal income tax at a rate of 13%

The rate of 13% is considered the basic one. It applies to all income of tax residents of the Russian Federation for which officials have not established special rates (clause 1 of Article 224 of the Tax Code of the Russian Federation).

For example, among the income taxed at a rate of 13% for personal income tax, there are salaries, bonuses, and dividends. Tax deductions are also applied to such income. But they do this before they apply personal income tax rates and calculate the amount of tax.

When calculating personal income tax on resident dividends, apply a rate of 13 percent. When calculating your tax, consider whether your organization received dividends from other companies or not.

When the organization does not have such income, calculate the tax using the formula:

Well, if, having received income from participation in other organizations, you have not yet paid dividends, then calculate your personal income tax as follows...

An example of calculating personal income tax on dividends accrued to the founders if:

- the organization did not receive income from equity participation in other organizations

- the organization received income from equity participation in other organizations, taxed at a zero rate

For more details on the rules for calculating and paying personal income tax, see the video lecture about personal income tax in the program "".

Personal income tax at a rate of 35%

Income subject to personal income tax at a rate of 35 percent is the income of residents. This is the highest tax rate (clause 2 of Article 224 of the Tax Code). Tax is calculated for each payment separately; deductions are not applied.

Federal Law No. 333-FZ of November 27, 2017 deserves special attention. The law introduced clarifications for cases of recognition of material benefits that employees receive from savings on interest for the use of borrowed funds.

This income is included in the base for calculating personal income tax if:

- borrowed funds were received from a company or entrepreneur who is a related party or with whom the recipient has an employment relationship;

- savings are actually material assistance, or a form of counter-fulfillment by an LLC or individual entrepreneur of an obligation to an individual.

Read more in the materials “How to withhold personal income tax from material gain” and “At what rate to withhold personal income tax from material gain”.

There is a situation in which you do not have to pay tax on interest-free loans. The new rules for calculating personal income tax for financial benefits are effective from January 1, 2018, regardless of when the company entered into a loan agreement with an individual. This was explained by officials (letter from the Ministry of Finance dated June 26, 2018 No. 03-04-07/43786). The Federal Tax Service sent a letter from the Ministry of Finance with this conclusion to lower-level inspectorates (letter dated July 2, 2018 No. BS-4-11/12663). Details