- Determine the bank that will act as a guarantor of the execution of the contract. You can choose only from the list of banks established by the Ministry of Finance of Russia. The list of banks is posted on the official website of the Russian Ministry of Finance and is regularly updated. Please note that many banks require that the participant has an account opened with this particular bank. A bank guarantee, if it was issued by a bank that is not included in the list of the Ministry of Finance, cannot be accepted as an appropriate security for the performance of a contract or application.

- Specify the conditions under which the bank is ready to issue a guarantee to the participant.

The bank guarantee must be included in the register of bank guarantees posted in the EIS (clause 8, article 45 of Law No. 44-FZ). The bank that issued the guarantee to the procurement participant is obliged to enter all information about it into the register within the next business day after its issuance.If the guarantee was issued, but for some reason was not entered in the register, then the customer is obliged to refuse to accept it ( p. 1 h. 6 art. 45 of Law No. 44-FZ).

Electronic bank guarantee or regular?

You can receive a bank guarantee both in writing and in electronic form. For aboutThe electronic bank guarantee will require a digital signature. This guarantee has several advantages:

- no need to go to the bank with documents - you can apply remotely;

- fast processing speed.

When issuing an electronic bank guarantee, you need to provide all documents in electronic form. The list of documents is the same as when issuing a regular guarantee.

Documents for issuing a bank guarantee

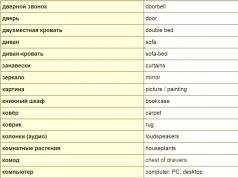

The list of documents requested by different banks may differ. The bank will definitely require the following six documents:

- Application for a bank guarantee (in the form of a bank).

- Information about the person to whom the bank guarantee is provided (in the form of a questionnaire).

- Copies of constituent documents.

- Copies of documents confirming the authority of the head and other persons authorized to act on behalf of the organization.

- Financial statements for the last reporting periods, transcripts to it.

- Draft contract.

The participant will receive from the bank:

- A copy of the bank guarantee agreement.

- Original bank guarantee.

- Extract from the register of bank guarantees.

Mandatory conditions of a bank guarantee

It is unacceptable to include in the text of a bank guarantee the following provisions:

- Provision on the right of the guarantor bank to refuse to satisfy the customer's demand for payment under a bank guarantee in the event that the customer fails to provide the guarantor with notice of the supplier's violation of the terms of the contract or termination of the contract.

- The requirement for the customer to provide the guarantor bank with a report on the execution of the contract.

- The requirement for the customer to provide the guarantor bank with documents that are not included in the list of documents approved by Decree of the Government of the Russian Federation dated November 8, 2013 No. 1005, submitted by the customer to the bank simultaneously with the requirement to pay the amount of money under a bank guarantee.

Check your bank guarantee carefully!

Dmitry Chernov, General Director of Fintorg Center for Financial Services, comments:

“I strongly recommend reading several articles of Law No. 44-FZ. The most important article is 45, paragraphs 2, 3, 4, which sets out clear requirements for a bank guarantee: what it should contain, what should not be contained, what is presented by the customer when disclosing a bank guarantee. Many do not bother reading this article and punish themselves very much. Thousands of companies are rejected for bank guarantees simply because of banal ignorance of the law. In some cases, this is the malicious intent of banks that issue “fake” bank guarantees with confusing wording. Even a specialist cannot always distinguish a low-quality bank guarantee and understand in what wording lies the catch.

Watch an interview with Dmitry Chernov "" - here are more tips from the CEO of a financial organization.

What is included in a bank guarantee

A bank guarantee used in public procurement must be irrevocable and contain (clause 2, article 45 of Law No. 44-FZ):

- the amount of the bank guarantee payable by the guarantor to the customer, or the amount of the bank guarantee payable by the guarantor to the customer in case of improper performance of obligations by the principal;

- obligations of the principal, the proper fulfillment of which is ensured by a bank guarantee;

- the obligation of the guarantor to pay the customer a penalty in the amount of 0.1% of the amount of money payable for each day of delay;

- the condition according to which the fulfillment of the obligations of the guarantor under the bank guarantee is the actual receipt of funds to the account on which, in accordance with the legislation of the Russian Federation, operations with funds received by the customer are recorded;

- validity period of the bank guarantee;

- a suspensive condition providing for the conclusion of an agreement for the provision of a bank guarantee for the principal's obligations arising from the contract upon its conclusion, in the event that a bank guarantee is provided as security for the performance of the contract;

- the list of documents established by the Government of the Russian Federation, provided by the customer to the bank simultaneously with the requirement to pay the amount of money under a bank guarantee.

Unsecured bank guarantee - how realistic is it? If the amounts are small, then bank guarantees are usually unsecured and do not require a guarantee. If the amount is more than, for example, 10 million rubles. (exceeds the portfolio of homogeneous loans), the clarification begins: will a current account be opened, will a deposit be placed and will there be a guarantee.

We remind you that a bank guarantee can be issued on paper and in the form of an electronic document.

Government Decree FZ No. 44 “On the contract system in the field of procurement of goods, works, services to meet state and municipal needs” strictly regulates the requirements for security under state and municipal contracts. To enforce its obligations, the bidder or bidder may:

- transfer money to the customer's account,

- provide a bank guarantee.

Although some nuances are left to the discretion of the organizer of the auction, he can only act within the framework clearly defined by the legislator. The requirements for bid security and contract security should always be specified in the tender documentation, draft contract, procurement notice.

For many organizations, a bank guarantee to ensure the performance of a contract under 44 Federal Laws is the most convenient and rational way. It is important for a potential executor to carefully study the requirements for a bank guarantee set out in the tender documents. If the conditions of the bank guarantee under 44 FZ are not met, then the customer may refuse to conclude a contract with the winner of the auction.

Types of bank guarantee under 44-FZ on procurement

- Tender guarantee (guarantee to secure the bid). Paragraph 1 of Art. 44 44-FZ states that bidders for the conclusion of a government contract must provide security for their application. Security can be provided in the form of a guarantee (provided that the auction was not held in the form of an electronic auction - in this case, the application can only be secured with funds transferred to the customer's account). Bid security is required in order to guarantee the organizer of the auction that their participant will not refuse to conclude a contract if he wins the tender.

- Guarantee to ensure the performance of the contract. The need to provide security for the execution of a state contract is due to clause 1. Art. 96 44-FZ. Clause 3 of the same article allows the use of a bank guarantee for security. Such a guarantee protects the customer from unscrupulous performers. If the contract is executed partially, poorly, or the contractor refuses to provide goods and services under the current contract at all, the bank will reimburse the money under the guarantee to the injured party - the state customer.

- Bank guarantee for the return of the advance. In accordance with Art. 96 clause 6 of 44-FZ, if the maximum (initial) price of the contract exceeds 50 million rubles, then the customer must establish in the tender documentation the requirement to secure the performance of the contract in the amount of 10-30% of its initial cost. In this case, if the contract provides for the payment of an advance, then the security cannot be less than the amount of this advance. If the advance payment is more than 30% of the initial price of the state contract, then the amount of the security for the performance of the contract is set in the amount of the advance payment.

Validity period of a bank guarantee under 44-FZ in government orders

- The guarantee to secure the application must be valid for at least 2 months after the deadline for accepting applications for the tender, which is expressly stated in paragraph 3 of Art. 44 44-FZ.

- The guarantee for the performance of the contract must be valid for the entire duration of the contract and at least a month after its completion (clause 3, article 96).

- A bank guarantee for the return of the advance must also be valid throughout the entire duration of the contract and at least one month after its expiration.

As a rule, the guarantee takes effect from the moment it is issued by the credit institution. In some cases, the issue date and the effective date do not match. Then it is separately specified in the guarantee.

The amount of the guarantee under 44-FZ

The amount of the bank guarantee to secure the contract is always indicated in the tender documents. It is installed by the customer, while he must be guided by the provisions of 44-FZ:

- According to Art. 44, paragraph 14, the guarantee to secure the application (tender) must cover 0.5-5% of the initial cost of the state contract. If the price of the state contract does not exceed 1 million rubles, then 1%. The maximum tender guarantee coverage threshold can be reduced from 5% to 2%. Cases where this is possible are listed in paragraph 15 of Art. 44.

- The size of the guarantee to ensure the performance of the contract should be in the range of 5 to 30% of the initial price of the government contract. With an initial cost of over 50 million rubles. — from 10 to 30%. If the contract provides for an advance payment, then the guarantee to ensure the performance of this contract cannot be less than the amount of the advance payment. If the bidder significantly (by more than a quarter) reduces the initial cost, then the anti-dumping measures provided for in Art. 37 . The amount of the guarantee under the contract should be increased by 1.5 times. In some cases, an increase in the guarantee can be avoided - all of them are also directly listed in Art. 37.

- Bank guarantee for the return of the advance. If the tender under 44-FZ provides for the payment of an advance, then a security for the performance of the contract is established not less than the amount of the advance payment.

When a Warranty Is Not Required

Public procurement legislation provides for situations where a bidder is exempted from the obligation to provide a guarantee. For example, if the contractor is a municipal organization. In a number of cases, customers have the right, at their discretion, to release the contractor from the need to provide security: if the amount of the contract is insignificant (less than 100,000 rubles), if cultural property, weapons are purchased, a contract is concluded with natural monopolists, etc. All such cases are given in 44-FZ and in government decree No. 199 dated March 6, 2015

Mandatory requirements for a guarantee under 44-FZ

- The Civil Code explicitly states a number of key requirements that a bank guarantee must meet. Among them: the name of the guarantor, the duration of the guarantee, its amount, to whom and for what purposes it was issued, the terms of payment.

- According to 44-FZ, a bank guarantee cannot be issued by a credit institution that is not included in the relevant . Requirements for such banks are listed in paragraph 3 of Art. 74.1 of the Tax Code. The current list can always be found on the official website of the Ministry of Finance: http://www.minfin.ru/ru/perfomance/tax_relations/policy/bankwarranty/.

- After issuing a guarantee, the bank must enter it into the official register of guarantees http://zakupki.gov.ru/epz/bankguarantee/quicksearch/search.html. If a guarantee is not included in the register, it cannot be used to participate in auctions and conclude contracts under 44-FZ.

Issue a bank guarantee under 44-FZ

You can get a bank guarantee to secure an application, to secure the execution of a contract or to return an advance payment under 44-FZ using the TenderHelp service in just a few steps: provision in the shortest possible time and without leaving your computer. You only need to collect the necessary documents once, register a personal account on the site, upload a package of documents and send an application to the bank. The issuance process is as simple as possible. Applications for guarantees up to 5 million are considered within 3 hours, up to 15 million - no more than 12 hours, and more than 15 million - no more than 3 days. You will receive a valid without visits to the bank, without unnecessary hassle and without wasting time.

Evgeny Malyar

bsadsensedynamick

#

Banks for business

The essence of a bank guarantee

A bank guarantee is an obligation of a financial and credit organization to compensate for losses from non-fulfillment of contractual obligations by the contractor to the customer.

Article navigation

- The essence of a bank guarantee

- Parties to the Bank Guarantee Agreement

- Validity period of the bank guarantee and conditions for its early termination

- When is the indisputable write-off of a bank guarantee applied?

- How is the amount of the bank guarantee calculated?

- How to get a bank guarantee

- How to check the received bank guarantee

- Banks issuing guarantees

- Sample Bank Guarantee

- The cost of a bank guarantee, calculator

A bank guarantee is an alternative to material security for the fulfillment of contractual obligations. Its main advantage is the absence of the need to divert significant working capital. How to use it, and what is needed for this? How to get a bank guarantee quickly? Read about it in our article.

The essence of a bank guarantee

When concluding a contract, the customer of a product or service in most cases takes risks. He tries to protect himself in various ways, but basically they come down to a choice between two main requirements:

- material support (pledge);

- a guarantee (guarantee) from a solvent person or a financial and credit institution.

From the point of view of the customer, in terms of their effectiveness, these methods of risk insurance are equivalent. If there is a pledge, it will be used to compensate for financial losses in case of default by the counterparty. An alternative option with a guarantee provides for the payment of a penalty by a person-guarantor (guarantor).

On the other hand, the performer, proving his a priori good faith, is forced in some cases to provide security property or a monetary pledge, which entails additional costs. The most common warranty claims are:

- to participate in the tender for public procurement (securing the application);

- in export-import (foreign trade) operations;

- upon receipt of an advance payment (guaranteed return in case of non-fulfillment of conditions).

A bank guarantee is an obligation of a financial and credit organization to compensate for losses from non-fulfillment of contractual obligations by the contractor to the customer. As is clear from this definition, the generally accepted name of the service does not quite correctly reveal its essence. The guarantor theoretically can be not only a bank, but practically any person who is objectively trustworthy.

The exception is guarantees that ensure the fulfillment of the terms of contracts concluded with government agencies (under 44-FZ). In this case, the guarantee can really only be a bank guarantee. In addition, not every bank can provide it, but only one of those included in a special list of the Ministry of Finance of the Russian Federation. However, more on that later. The terms of the bank guarantee under 44-FZ apply to transactions:

- public procurement;

- concluded as a result of the competition;

- related to the payment of customs duties to the budget;

- long-term deferred payment.

Parties to the Bank Guarantee Agreement

According to articles 368, 379 of the Civil Code, participation in obtaining a guarantee from a credit broker is allowed. The classic scheme is four-sided. The subjects of the guarantee agreement are:

- The beneficiary is the recipient of the guarantee. Usually this is the payer (customer).

- Principal - a person whose obligations are covered by the guarantee (executor, supplier, contractor).

- Guarantor - a person who undertakes to fulfill the obligation of the principal if he does not do it himself (a bank or other financial and credit institution).

- The bank serving the principal. As a rule, an application is sent from him to the guarantor. The principal's bank can itself act as a guarantor - in this case, the contract becomes tripartite.

Validity period of the bank guarantee and conditions for its early termination

According to the law 44-FZ regulating the public procurement procedure, the validity period of a bank guarantee ensuring participation in the tender is at least two months after the date of termination of bids. The guarantee that ensures the performance of the contract is valid for a month after the expiration of its term (44-FZ, part 3). In other cases, the parties determine the end date of the guarantee on their own and indicate it in the contract. There are also circumstances under which the obligations of the guarantor may be canceled ahead of schedule:

- receipt of money by the beneficiary;

- voluntary waiver of the beneficiary's rights.

It is impossible to terminate the guarantee agreement by the principal and the guarantor bank without the consent of the beneficiary.

Changing the essential terms of the supply contract may lead to the loss of the guarantee of relevance. Action will be required to establish the correspondence between these two documents (extension of the period, increase in the amount). Most often practiced replacement warranty. Federal Law 44-FZ allows it to be carried out in the following cases:

- Changes made by the customer to the contract, expressed in an increase in cost. Since in this case the amount of the advance payment increases (it is up to 30% of the final price of the contract), the guarantee does not cover the risks of the payer.

- Unforeseen occurrence of objective circumstances that prevent the execution of the contract within the previously agreed time frame.

- An increase in the volume of supplies (services) provided for by the contract at the initiative of the beneficiary.

- Bankruptcy of the financial institution that issued the guarantee or deprivation of its license. The probability of this event after the introduction of changes in the Federal Law-44 in March 2018 is negligible, but its possibility determines the existence of this condition.

- Mutual agreement of the parties on the principal to make a security deposit in exchange for the guarantee.

There are no other situations in which a guarantee is replaced in Law 44-FZ.

When is the indisputable write-off of a bank guarantee applied?

The beneficiary (customer) gets the opportunity to write off the amount of security from the guarantor's account without acceptance (that is, without his notice and consent) under the following circumstances:

- the contract is concluded with one supplier (mandatory condition);

- the contractor occupies a monopoly position in the market and was not selected based on the results of the auction;

- there is a decision of the court or arbitration;

- such a provision is included in the text of the guarantee agreement.

In addition, an indisputable write-off is possible no earlier than five days after the expiration of the deadline for delivery specified in the contract, if it has not been made. Unacceptable (indisputable) cancellation of a guarantee may be challenged by the executor in court or arbitration.

How is the amount of the bank guarantee calculated?

The amount of the guarantee depends on its purpose. When securing applications for participation in tenders, it, according to 44-FZ (Article 44, clause 14), is limited to the following percentages:

- 1% of the initial value of the contract, if it is up to 3 million rubles.

- from 0.5 to 5% of the initial cost, if it exceeds 3 million rubles.

The guarantee that ensures the performance of the contract is 5–30% of its initial amount, but cannot be less than 10% if the conditions provide for an advance payment or the price exceeds 50 million rubles.

A special condition is specified in Article 37 of Law 44-FZ. If during the bidding process the initial value of the contract decreased by a quarter or more, the percentage of the guarantee increases by one and a half times, which serves as an anti-dumping measure. The amount of the bank guarantee is calculated by multiplying the specified interest rates by the value of the contract.

How to get a bank guarantee

To issue a bank guarantee, you need to go through approximately the same procedure as when obtaining a loan. Experts distinguish between three methods, depending on the choice of the guarantor. Each of them has its own advantages and disadvantages.

When analyzing the above table, the similarity between providing a guarantee and lending becomes more obvious. In both cases, banks seek to protect themselves from non-fulfillment of the terms of the contract, that is, a situation in which they will have to fulfill the obligations of the principal instead of him. There are three modes of obtaining a guarantee, depending on the period of approval of the application:

- Traditional. The guarantor bank is provided with the usual package of documents confirming the solvency, good faith and good reputation of the client. It is used when the value of contracts exceeds 20 million rubles.

- Accelerated. The package of documents is simplified, the requirements for the principal are minimal. The decision on approval or refusal is made within five days. The cost of the service is increasing.

- Electronic. The application and a set of documents are sent via the Internet with a digital signature. The fastest way (no longer than 4 days). It is used when the purchase of the necessary goods must be made urgently.

A typical package of documents attached to an application for a bank guarantee includes:

- a copy of the contract to be secured;

- detailed information about the organization;

- financial statements for several reporting periods or a tax return (depending on the legal form of the enterprise and the taxation system);

- registration and constituent documents of the enterprise;

- taxpayer's certificate;

- extract from the Unified State Register of Legal Entities.

How to check the received bank guarantee

Unfortunately, attackers try to fake everything, including bank guarantees. Even employees of financial institutions are sometimes involved in criminal schemes, so a simple check of the document for the correct details and license number may not give a reliable result. The following signs should be alert:

- too fast processing of the application;

- no requirement for collateral;

- satisfaction with copies of documents.

Careful control of the financial situation of the applicant is a prerequisite for providing a bank guarantee. You can check its authenticity according to 44-FZ using the following sources of information:

- Official site Ministry of Finance of the Russian Federation.

- Unified Register of Bank Guarantees.

On these resources, you can find out how authorized the bank is to provide a guarantee and whether the existing document is officially registered.

The obligation to verify the guarantee by the customer is not directly specified in 44-FZ, but indirectly it follows from part 5 of article 45, which prescribes the consideration of the document within three days for acceptance or rejection.

It should be taken into account that there are no data on closed auctions and tenders in the public Unified Register of Bank Guarantees. They can be obtained from the Treasury by submitting a request in writing.

Banks issuing guarantees

The list of banks issuing bank guarantees under 44-FZ is contained in the register of the Ministry of Finance of the Russian Federation. It may undergo changes due to amendments and additions made to the Tax Code. The requirements for financial institutions set out in Article 45 (Part 1) of 44-FZ and Article 74.1 (Part 3) of the Tax Code remain unchanged. They describe which banks can act as guarantors:

- licensed by the Central Bank;

- employed for more than five years;

- having own capital of more than a billion rubles;

- not showing signs of bankruptcy (inability to meet the obligations assumed) according to the criteria of the Central Bank;

- fulfilling the norms of the Law "On the Central Bank" (86-FZ).

Since June 2018, these main features have been supplemented by the requirement to comply with the BBB-(RU) national credit rating level, assessed by the Central Bank of the Russian Federation. The register includes a large number of banks authorized to issue guarantees. Here are a few of them:

Sample Bank Guarantee

The standard form of a bank guarantee, in accordance with Article 45 of Law 44-FZ, contains the following items.

A convenient tool that ensures the fulfillment of obligations is a bank guarantee. This term is understood as a document obliging the bank (guarantor) to pay the creditor (beneficiary) a certain amount in accordance with the contract if the principal has not fulfilled his obligations to the creditor in due time. Simply put, if the supplier does not fulfill its obligations to the customer, the bank compensates the financial side of the contract, after which the supplier remains indebted to the bank, and not to the customer. The diagram below shows this interaction:

Most often, the requirement for such insurance is a prerequisite for everyone applying for participation in public procurement. Even in its absence, the actions associated with obtaining bank collateral are fully justified in case of unforeseen risks, being less expensive than obtaining a commercial loan. There are a number of requirements for bank guarantees, as well as for financial institutions to which they are provided. The main requirements are contained in the articles of the Federal Law No. 44 "On the contract system" and in the Federal Law No. 223 "On the procurement of state-owned companies".

Bank guarantee under 44-FZ

To issue a bank guarantee, hereinafter BG, you need to select a bank from the list posted on in order to submit an application. The next step will be to provide the financial institution with the necessary documentation, the list of which may vary depending on the requirements of the bank itself, however, there are a number of mandatory documents that will be required in any case at the stage of consideration of the application. Required documents to be submitted to the financial institution:

- Application for financial guarantee (according to the form of the institution).

- Information about the applicant.

- Copies of constituent documents.

- Copies of documents capable of confirming the authority of the person submitting the application.

- Accounting reports with transcripts.

- Draft contract for which a guarantee is required.

Important! Before submitting an application, you must carefully read the conditions under which a particular bank provides BG. For example, for many financial institutions, among other conditions, it is mandatory to have an applicant's current account at the place of application.

An example of what this document looks like:

Compliance with 44-FZ

It should be noted that a single sample form is not fixed by law, but the content of the document is regulated by the articles of the current bills 44-FZ, the Civil Code of the Russian Federation. The bank guarantee must be properly checked. The document must meet the following criteria:

- mandatory placement in the unified list of bank guarantees and on the official public procurement portal;

- is irrevocable;

- the BG contains full information about the amount in accordance with parts 2, 3, article 45 of the Federal Law No. 44;

- there should be no requirements for the provision of judicial acts confirming the improper fulfillment by the principal of the obligations assumed;

- the term of the BG must be at least one month longer than the term of the main contract.

Important! On the basis of paragraph 11, Article 45, Federal Law No. 44, the bank is obliged to place information in the register of a unified information system before the expiration of one business day from the date of issue of the guarantee.

Purchasing portal interface where you can view guarantees in a single registry:

bank requirements

Before applying for the necessary document, you should also check the bank itself, which is ready to act as a guarantor. An institution willing to provide a BG must meet the following requirements:

- must be included in the list of banks of the Ministry of Finance of the Russian Federation;

- the financial institution operates on the basis of a license issued by the Central Bank for a period of at least 5 years;

- equity capital over 1 billion rubles;

- the prescriptions of the Federal Law No. 86 dated July 10, 2002 were complied with for all reporting dates of the last six months;

- The Central Bank did not put forward any requirements regarding the stabilization of the financial situation in a particular bank.

Single register

All BGs, with the exception of agreements issued as security and containing information classified as state secrets, must be included in the general register of the unified information system. The latter are included in a separate closed list, which is not used for placement in a single information system. Control over the maintenance of the register, as well as over actions to place the contents of the register in a single information system, is carried out by the Federal Treasury. The registries themselves, both open and closed, must include the following information:

- name, TIN, legal address of the guarantor bank;

- name, TIN, legal address of the principal (supplier, contractor);

- the amount of money declared in the BG, which the guarantor must pay in accordance with Articles 44-FZ in the event that the procurement participant fails to fulfill its obligations;

- validity period of the document;

- a copy of the document itself, except for the BG entered in the closed register.

BG size

The amount of the BG should be 5-30% of the initial cost of the purchase lot. If the value of the lot is more than 50 million rubles, the cost of material security of the contract in such cases may be equal to 10-30% of the total initial price of the entire contract as a whole, but not less than the cost of the advance. In cases where the value of the advance is higher than 30% of the value of the entire contract, the amount of the BG will be equal to the amount of the advance.

Indisputable write-off

Articles 44-FZ give the customer the right to indisputably write off the funds due under the guarantee upon the occurrence of certain conditions. Undisputed write-off should be understood as the possibility of withdrawal of funds from the balance of the guarantor institution by the beneficiary in his own favor without prior application or notification. An indisputable write-off is possible if there are several good reasons:

- according to a court decision;

- if there is a relevant clause of the contract;

- in cases permitted by applicable law.

Warranty under 223-FZ

Articles of the Federal Law No. 223 of 18.06.0211 “On the Procurement of Goods, Works, Services by Certain Types of Legal Entities” are distinguished by loyalty in comparison with 44-FZ. There are several fundamental distinguishing differences that are characteristic of BG within the framework of 223-FZ:

- In accordance with Articles 223-FZ, a BG that is not included in the unified register is subject to acceptance.

- According to 223-FZ, it is not necessary for the Guarantor Institution itself to be on the official list of the Ministry of Finance of the Russian Federation.

- If under 44-FZ there is an obligation to provide 10-30% of the original price, provided that the value of the contract is more than 50 million rubles, then under 223-FZ there is no such need.

Contract insurance options under 223-FZ

There are three types of BG within the framework of 223-FZ:

- Ensuring participation in the tender.

- Ensuring advance payment.

- Ensuring compliance with the terms of the contract itself.

Requirements under 223-FZ

Despite the relative softness, the BG forms according to 223-FZ are subject to a number of unconditional prescriptions:

- mandatory irrevocable;

- mandatory existence of a validity period;

- the amount to be paid by the guarantor to the customer should be determined if the principal fails to fulfill the terms of the contract;

- the obligations of the procurement participant must be contained in full;

- the period during which the customer has the right to approve or reject the BG after receipt of the application must be indicated.

What is the difference between the forms of bank guarantee under 44-FZ and 223-FZ is described in the video:

You can download the full list of banks that comply with the requirements of the law, namely clause 3, article 74.1 of the Tax Code of the Russian Federation, at the link:

You can view information about a bank guarantee in a single register on the website

Post Views: 427

Each participant in public procurement must know what contract enforcement is, what it is used for and in what cases it can be dispensed with. Experts of the Credit-Insurance Agency tell about it. At the same time, we took into account all the changes made to the procurement legislation in 2018. Separately, we will talk about how to get a bank guarantee.

Let's start by answering the main question. Enforcement of the contract is a monetary obligation, which is provided by the winner of the tender at the conclusion of the contract to cover possible damage to the customer, in case of default or poor performance by the supplier of its obligations.

Thus, if the contractor violates his obligations under the contract or performs it improperly, the customer is guaranteed to be able to compensate for the damage caused to him at the expense of the security received. If the amount of damage is greater than the amount of the security received, the customer has the legal right to recover the difference from the contractor in court.

ENFORCEMENT OF CONTRACTS UNDER 44-FZ

Legislatively, the issues of ensuring the execution of contracts under 44-FZ are regulated by Article 96 of the law. Let us consider the main provisions of this article in sufficient detail due to the fact that in 2018 serious changes were made to Law 44-FZ, including the procedure for ensuring the execution of contracts.

1. When making a purchase the customer is obliged establish a requirement to ensure the performance of the contract, writing it in the notice of procurement, procurement documentation, draft contract, invitation to participate in a closed procurement.

However, the law provides for exceptions to this rule. Establishment of a contract enforcement requirement is a right and not an obligation of the customer in cases where:

The purchase is made by means of a request for quotations or a request for quotations in electronic form, if the initial (maximum) price of the contract (IMCC) does not exceed 500 thousand rubles;

Procurement is made through a request for proposals or a request for proposals in electronic form in cases where the subjects of the procurement are the supply of sports equipment and equipment for the needs of the Russian national teams, the supply of vital medicines, the supply of handicrafts or the provision of services to protect the interests of Russia in international courts;

The purchase is made from a single supplier.

2. The performance of the contract may be secured by the provision of a bank guarantee or the deposit of funds to the account indicated by the customer. Which method of security to choose - the customer decides on his own.

3. A bank guarantee for the purposes of securing the performance of a contract under 44-FZ must be issued by a bank that meets the requirements of Art. 45 of this law.

4. The term of the bank guarantee must exceed the term of the contract by at least 1 month. The winner of the procurement must carefully read the procurement documentation, as the exact expiration date of the bank guarantee may be indicated there. If not, you should be guided by the requirements of the law 44-FZ.

5. The contract is concluded only after the winner of the procurement provides the contract execution security. If the winner fails to provide security for the performance of the contract within the prescribed period, then he is considered to have evaded the conclusion of the contract. As a result - inclusion in the register of unscrupulous suppliers.

6. The amount of security for the performance of the contract under 44-FZ should be from 5 to 30 percent of the initial (maximum) price of the contract. If the NMTsK exceeds 50 million rubles, then the amount of security will be from 10 to 30 percent of the NMTsK, but not less than the amount of the advance, if such is stipulated by the contract. If the amount of the advance payment exceeds 30 percent of the NMTsK, then the amount of the security is set at the amount of the advance payment.

7. During the execution of the contract, the supplier has the right to provide the customer with a contract performance security, reduced by the amount of fulfilled obligations under the contract, in exchange for the previously provided contract performance security. This may change the way the contract is enforced.

This provision of the law may be relevant for participants who did not have time to issue a bank guarantee to ensure the fulfillment of obligations under a state contract in a timely manner. In this case, the execution of the contract can be secured in cash, and in the future, cash can be replaced by a bank guarantee. From an economic point of view, this is not profitable, but an alternative to such a solution is to include the winner of the purchase in the register of unscrupulous suppliers for evading the conclusion of a contract.

8. If in the course of the procurement the price was reduced by 25 percent or more in relation to the NCMC, the procurement participant with whom the contract is concluded provides security for the performance of the contract, taking into account the anti-dumping measures provided for in Art. 37 of the law 44-FZ.

Anti-dumping measures are as follows. If, during a tender or auction, the NMTsK is more than 15 million rubles and the procurement participant with whom the contract is concluded,  the price of the contract is proposed, which is 25 percent or more lower than the NCMC, the contract is concluded only after such a participant provides a contract performance security in an amount exceeding 1.5 times the size of the contract performance security specified in the tender or auction documentation, but not less than in the amount of the advance payment (if the contract provides for the payment of an advance payment).

the price of the contract is proposed, which is 25 percent or more lower than the NCMC, the contract is concluded only after such a participant provides a contract performance security in an amount exceeding 1.5 times the size of the contract performance security specified in the tender or auction documentation, but not less than in the amount of the advance payment (if the contract provides for the payment of an advance payment).

At the same time, if the NMCC is 15 million rubles or less and the procurement participant with whom the contract is concluded offered a contract price that is 25 percent or more lower than the NMCC, then an increase in the amount of security can be avoided by providing the customer with information confirming the good faith of such a participant on date of application.

It is possible to confirm the good faith of a procurement participant by providing the customer with information from the register of contracts confirming the experience of such a participant in the execution of several contracts for comparable amounts over the past few years. You can read more about this in part 3 of Art. 37 of the law 44-FZ.

9. The provisions of Law 44-FZ on securing the performance of a contract do not apply in cases where:

The contract is concluded with the procurement participant, which is a state institution;

Procurement of services to provide a loan;

The subject of the procurement is the issuance of a bank guarantee.

Assistance in obtaining bank guarantees, credits and loans for procurement participants.

So, we have learned that both cash and bank guarantees can act as security for the performance of a contract under 44-FZ. Which option would be preferable for the contract executor? Of course, a bank guarantee. Taking money out of circulation is not the best way out. Money must work and make a profit. Most companies are short of working capital and regularly use bank loans, the rates on which today average 12-15 percent per annum. At the same time, the bank's commission for providing a guarantee to ensure the performance of a contract under 44-FZ usually does not exceed 3-4 percent per annum. The difference is obvious. But the choice, of course, will be yours.

REQUIREMENTS FOR BANK GUARANTEES UNDER 44-FZ

What requirements should a bank guarantee for the performance of a contract under 44-FZ meet? To answer this question, one has to refer to Art. 45 of this law:

1. As security for applications and performance of contracts, customers accept bank guarantees issued by banks that meet the requirements established by the Government of the Russian Federation. These requirements relate to the size of the bank's capital and the level of the credit rating according to the national rating scale.

Detailed requirements for guarantor banks are set out in Decree of the Government of the Russian Federation dated April 12, 2018 No. 440 “On requirements for banks that are entitled to issue bank guarantees to secure applications and fulfill contracts”.

The current list of banks that meet the requirements is published several times a month on the official website of the Ministry of Finance of the Russian Federation. As of December 2018, the list included more than 200 credit institutions.

2. A bank guarantee under 44-FZ must be irrevocable and must contain:

The amount of the bank guarantee payable by the guarantor to the customer;

Obligations of the principal, the proper fulfillment of which is ensured by a bank guarantee;

The obligation of the guarantor to pay the customer a penalty in the amount of 0.1 percent of the amount of money payable for each day of delay;

The condition according to which the fulfillment of the obligations of the guarantor under the bank guarantee is the actual receipt of funds to the customer's account;

Validity period of the bank guarantee;

A suspensive condition providing for the conclusion of an agreement for the provision of a bank guarantee for the principal's obligations arising from the contract upon its conclusion, in the event that a bank guarantee is provided as security for the performance of the contract;

The list of documents established by the Government, provided by the customer to the bank simultaneously with the requirement to pay the amount of money under a bank guarantee;

Condition on the customer's right to indisputable debiting of funds from the guarantor's account (in cases provided for by the procurement documentation).

3. Information on the bank guarantee for the performance of the contract must be included in the register of bank guarantees posted in the Unified Information System in the Field of Procurement (UIS), no later than one business day following the date of its issue, or the day when changes are made to the conditions of the banking guarantees.

Please note that from July 1, 2018, the register of bank guarantees in the EIS became closed. Only the customer of the procurement can check the availability of a bank guarantee in the register, and such functionality is not available to the contractor. If it is necessary to verify the authenticity of a bank guarantee, the contractor must contact the guarantor bank directly using the contact numbers listed on the official website of the bank. In addition, the guarantor bank, at the request of the principal, is obliged to provide an extract from the register of bank guarantees, certifying it with its seal. Such an extract serves as confirmation of the fact of issuing a bank guarantee and can be presented to the customer, to the Federal Antimonopoly Service or to the court in the event of a dispute.

Bank guarantees under 44-FZ, 223-FZ, 185-FZ

Fast, inexpensive, minimum package of documents

HOW TO OBTAIN A BANK GUARANTEE

In conclusion, the experts of the Credit Insurance Agency offer you recommendations that, in our opinion, will help to avoid unpleasant situations associated with participation in procurement procedures.

1. When deciding whether to participate in procurement, consider the need to provide performance security. If your company does not have available funds or is not ready to withdraw them from circulation to be used as security for the duration of the contract, take care of obtaining a bank guarantee in advance. You can always find out from the specialists of the Credit Insurance Agency the cost of the guarantee you need in various banks and choose the most favorable conditions.

2. Plan the costs associated with participation in purchases, not only in size, but also in time. It is necessary to understand not only for how long the bid security or contract performance security will be frozen, but also by what date this security must be provided. In order to save money and time, consider using the limit on bank guarantees. By setting a limit in advance in one of the banks, you can quickly and on favorable terms receive bank guarantees when you need it. Our experts will help you do it.

3. Realistically assess the possibility of obtaining a bank guarantee for your company in large banks. Such banks often declare very low commission rates for issuing guarantees. But, as it turns out in practice, to submit such an application, it is necessary to prepare a large package of documents. At the same time, the official deadline for making a decision on the application is from 2 weeks and is not always kept. Be prepared for constant requests for more information.

Think about whether you are ready for such a marathon. Specialists of the Credit Insurance Agency will always be able to select several banks for your company, where you can get guarantees under 44-FZ in a short time with a minimum package of documents.

4. Always evaluate the profitability of the purchase. Before bidding, set a price limit below which you cannot go. Remember that a price reduction of 25 percent or more can increase the size of the performance security by 1.5 times. Consider if you can afford it. Evaluate in advance the possibility of obtaining a bank guarantee for such an amount and its cost by contacting the Credit Insurance Agency.

5. Before submitting an application, assess the availability of your own financial resources for the execution of the contract. Perhaps the terms of the purchase do not provide for advance payment. In this case, we recommend that you apply to the bank in advance for obtaining credit funds.

If you are accustomed to value your time, then the experts of the Credit and Insurance Agency will help you find financing for the execution of the contract. This can be either a loan for replenishment of working capital or tender factoring from our partner banks.

Good luck shopping in the New 2019!

About what changes in bank guarantees will occur in the law "On the contract system" from July 1, 2019. can be found in a new article on our website.

Credit Insurance Agency - bank guarantees, credits and loans for procurement participants!