How to calculate the number of vacation days upon dismissal? The question is relevant mainly for calculating compensation for unused vacation. This article provides a step-by-step algorithm for calculating the duration of a vacation and the amount of its monetary compensation.

The right to leave upon dismissal

Art. 127 of the Labor Code of the Russian Federation provides the resigning employee with an alternative: to take off unused vacation days during the period of work or receive money for them. Moreover, if the payment of compensation is the obligation of the employer, then the provision of vacation “in kind” is his right. That is how the chh are formulated. 1 and 2 Art. 127 of the Labor Code of the Russian Federation.

Important! The dismissal of an employee for guilty actions excludes the possibility of granting leave, but does not relieve the employer of the obligation to compensate him.

Since the amount of compensation directly depends on the duration of the unused vacation, the need to calculate the number of days of vacation before the dismissal of the employee will arise if the employee does not take the vacation. The provision of leave with subsequent dismissal is carried out in full or in the part agreed upon by the employer and employee, since the provision of annual leave in proportion to the hours worked is not provided for by the Labor Code of the Russian Federation.

Calculation of the number of days of unused vacation

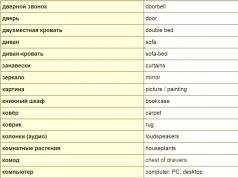

By virtue of clause 28 of the Rules approved by the USSR TNKT dated April 30, 1930 No. 169 (hereinafter referred to as the Rules), the number of unused vacation days is the product of the length of time actually worked in months and the duration of the prescribed vacation, divided by 12 - a number equal to the number of months in a year .

That is, the calculation formula is as follows:

Ku \u003d (Mo × Do) / 12,

where: Ku - the number of vacation days accumulated and not used by the time of dismissal;

Mo - the number of months worked (for the first year of work - in total, starting from the second - in the year corresponding to the dismissal);

To - the duration of the annual paid vacation in days;

12 is the number of months in a year.

Important! From the worked period, time should be excluded that is not counted as vacation experience (part 2 of article 121 of the Labor Code of the Russian Federation).

According to Part 1 of Art. 115 of the Labor Code of the Russian Federation, annual leave lasts at least 28 days (for more details on the duration of holidays, see the article Duration of the main annual paid leave). In this regard, a classic example of calculating vacation days upon dismissal is as follows:

Mo = 9 months.

Up to = 28 days.

Ku \u003d (9 × 28) / 12 \u003d 21 days.

The above formula is widely used by the courts when considering disputes over the amount of compensation for vacation (see, for example, appeal rulings of the Moscow Regional Court of August 23, 2012 No. 33-13622, St. Petersburg City Court of February 13, 2014 No. 33-2064 / 14).

If an incomplete month has been worked

In order to calculate the days of unused vacation, it is not the calendar month that should be taken into account, but the actually worked worker starting from the date of employment. This provision follows directly from the content of Art. 14 of the Labor Code of the Russian Federation, according to which the calculation of the terms associated with the emergence of labor rights and obligations begins from the date from which the beginning of their occurrence is determined.

But the period of work of an employee in the organization is rarely the full number of months. For example, the employment took place on January 14, and the dismissal is scheduled for November 19. That is, the employee worked 10 months 5 days. Should the 5-day balance be taken into account when calculating the duration of the vacation?

Clause 35 of the Rules prescribes that surpluses that make up less than half a month be excluded from the calculation base, while surpluses that exceed half a month, on the contrary, should be taken into account. The same position was stated by Rostrud in letters dated 06/08/2007 No. 1920-6, dated 12/31/2008 No. 5921-TZ, dated 12/18/2012 No. 15-19-6-1.

Important! The determination of the duration of unused additional paid leave is carried out according to the same rules with the only exception: only actually worked days are taken into account (part 2 of article 121 of the Labor Code of the Russian Federation).

- Additional leave for an irregular working day - duration and procedure for granting;

Calculation of the rest of the vacation, if part of it is used

Example

In the year corresponding to the dismissal, the employee worked 10 months 17 days, while taking 10 days of vacation out of 28 due. An excess of 17 days is more than half a month, and therefore counts as a full month. The balance calculation will look like this:

- (11 × 28) / 12 = 25.67 - the total number of vacation days due for the last working year;

- 25.67 - 10 \u003d 15.67 - the number of vacation days due to the employee at the time of dismissal.

Important! It is possible that as a result of the calculation of the rest of the vacation, a negative number is obtained. For example, if an employee rested for 15 days and worked only 4 months in the current year, it turns out that he owes the employer 5 days.

In this case, you cannot force the employee to complete the missing period, but you can deduct from his salary vacation pay paid for 5 days of vacation that were taken but not worked.

Note! The retention must be carried out in compliance with Part 2 of Art. 137 of the Labor Code of the Russian Federation and subject to the restrictions established by Art. 138 of the Labor Code of the Russian Federation.

How to calculate compensation for unused vacation

To determine the amount of monetary compensation for a vacation not taken by a departing employee, 2 indicators are needed:

- the number of unused vacation days;

- Average salary of an employee in 1 day.

The calculation formula will look like this:

Pk \u003d Kd × Zd,

where: Pk - the amount of compensation;

Kd - the number of days of unused vacation;

Zd - the average earnings of an employee per day.

Determination of the size of the average daily earnings

The calculation procedure here depends on the vacation unit. It can be calculated:

- In calendar days - according to the general rule established by Art. 120 of the Labor Code of the Russian Federation.

- In working days - in relation to certain categories of workers:

- working under a temporary employment contract concluded for a period of up to 2 months;

- seasonal workers.

If vacation is calculated in calendar days

The procedure for determining the average daily earnings for the payment of compensation for vacation provided in calendar days is established by Part 2 of Art. 139 of the Labor Code of the Russian Federation and clause 10 of the regulation approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922 (hereinafter - Regulation No. 922).

The formula is:

Zd \u003d Zp / 12 / 29.3,

Zp - actually accrued salary for the 12 calendar months preceding the dismissal;

12 is the number of months in a year;

29.3 is the average number of days in a month.

Calculation example

The date of dismissal is 12/01/2017.

Salary for the billing period from 12/01/2016 to 11/30/2017 - 420,000 rubles.

420,000 / 12 = 35,000 rubles. - Monthly earnings.

35,000 / 29.3 \u003d 1,194.54 - average daily earnings.

If vacation is calculated in working days

According to part 3 of Art. 139 of the Labor Code of the Russian Federation and clause 11 of Regulation No. 922, in order to determine the amount of compensation for vacation in the conditions of its calculation in working days, the average daily earnings are calculated using the following formula:

Zd \u003d Zf / RD 6,

where: Zd - average daily earnings;

Zf - actually accrued salary;

RD 6 - the number of working days according to the calendar of the 6-day working week.

Calculation example

The period of work is from 01.10.2017 to 01.12.2017.

Salary for October - 60,000 rubles.

Salary for November - 58,000 rubles.

The number of working days is 51.

60,000 + 58,000 = 118,000 rubles - salary for the entire period of work.

118,000 / 51 \u003d 2,313.73 rubles. - average daily income.

Rules for rounding the number of vacation days to an integer

Calculating using the formula above almost never results in an integer. For example, if an employee managed to work 8 months before leaving, the number of unused vacation days will be 12.67. The legislator does not say anything about rounding the number of vacation days to an integer, however, the employer still has such an opportunity (see, for example, letter of the Ministry of Health and Social Development dated 07.12.2005 No. 4334-17).

Note! If such an opportunity is used, the question of how to calculate vacation days upon dismissal, while receiving an integer number, should be resolved in accordance with the same letter from the Ministry of Health and Social Development. According to the document, the arithmetic rules do not apply in this case: rounding is always carried out in favor of the employee, that is, upwards.

For example, with 4 months worked, the duration of the required vacation will be 9.3 days. In such a situation, the employee must be provided with compensation for 10 days of rest or vacation pay for the same 10 days.

Important! Rounding off vacation days upon dismissal affects the amount of vacation pay or compensation for vacation, but not the duration of vacation actually provided (see letter from Rostrud dated December 24, 2007 No. 5277-6-1).

Compensation calculation: exceptions to the rules

There are situations when it is not necessary to calculate the number of vacation days based on the actual hours worked. So, according to part 2, clause 28 of the Rules, vacation compensation for a full working year is due to employees who have worked 11 months or more before dismissal. The same, by virtue of Part 3, Clause 28 of the Rules, applies to employees whose work experience in the last place ranged from 5.5 to 11 months, provided that they leave for one of the following reasons:

- upon liquidation of the employing organization;

- reduction of staff;

- conscription for military service.

Important! Rostrud in letters dated 09.08.2011 No. 2368-6-1 and dated 04.03.2013 No. 164-6-1 drew the attention of employers to the fact that these standards apply exclusively to employees who have worked part-time. That is, starting from the second working year, the number of days of unused vacation is calculated according to the general rules - based on the actual hours worked.

So, the duration of unused vacation is calculated in days, the number of which is directly proportional to the time actually worked. At the same time, periods that, according to the law, are not subject to offset in vacation experience, are excluded from the calculation base.

The calculation of the number of vacation days upon dismissal depends on how many people work in the company and how much rest. How to calculate vacation days upon dismissal, we will tell and show with examples.

See also:

How is non-vacation leave calculated upon dismissal

In the general case, the duration of vacations is calculated in calendar days (part 1 of article 120 of the Labor Code of the Russian Federation). The number of days of unused vacation upon dismissal provided in calendar days is also determined in calendar days.

On working days, leave is provided:

- employees engaged in seasonal work (Article 291 of the Labor Code of the Russian Federation);

- persons who have concluded employment contracts for up to two months (Article 295 of the Labor Code of the Russian Federation).

In this case, when determining number of days of compensation for unused vacation upon dismissal the method of converting working days into calendar days should be used. It is recommended in the letter of the Ministry of Labor of Russia dated February 1, 2002 No. 625-BB « On the calculation of the total duration of annual paid leave.

Advice

Calculate vacation compensation automatically

This will help the online service for calculating and processing payments,. The service will independently calculate the compensation and prepare the necessary documents (a note-calculation in the T-62 form, a certificate of earnings for 2 years for benefits and an order for dismissal).

How to calculate the number of days of vacation compensation upon dismissal

- duration of the employee's vacation period (number of years, months and calendar days);

- the total number of vacation days earned by the employee during the period of work in the company;

- the number of vacation days used by the employee.

How to calculate vacation time

In the event of dismissal of an employee, his vacation period ends. Getting a job with a new employer, the employee begins from the first day of work to re-earn vacation experience.

Vacation interruption

If any periods of time are not included in the vacation period, the end of the working year for the purposes of calculating the number of unused vacation days is shifted by the number of excluded days (letter of Rostrud dated 06/14/2012 No. 854-6-1). So, for example, the period of unpaid leave provided at the request of the employee, exceeding 14 calendar days during the working year (part 1 of article 121 of the Labor Code of the Russian Federation), parental leave (part 2 of article 121 of the Labor Code of the Russian Federation) is excluded from the vacation experience ), the time the employee was absent from work without good reason (part 2 of article 121 of the Labor Code of the Russian Federation). See below the calculation of non-vacation leave upon dismissal.

Example 1Calculation for unpaid leave upon dismissal, if there were unpaid holidays

S.Yu. Semenov was hired on May 16, 2016. In the first working year, at his request, he was granted three unpaid leave for 3, 6 and 5 calendar days. How to determine the end date of the working year?

According to general rules, the first working year of S.Yu. Semenov begins on May 16, 2016, and should end on May 15, 2017. Since the total number of days provided without payment does not exceed 14 calendar days (3 calendar days + 6 calendar days + 5 calendar days) during the working year, it is not necessary to shift its end date (part 1 of article 121 of the Labor Code of the Russian Federation). The last day of the first working year is May 15, 2017.

Example 2Calculation upon dismissal for non-vacation leave. Employee was on maternity leave before leaving

V.B. Karaseva was hired by Okunek LLC on August 15, 2014. From July 6 to November 22, 2015, she was on maternity leave, and from November 23, 2015, she took leave to care for a child up to one and a half years. It was supposed to end on May 22, 2017.

From February 3, 2017, by agreement with the employer, the employee went to work on a part-time basis, 4 hours 5 days a week. June 16, 2017 V.B. Karaseva resigned of her own free will. It is necessary to determine the vacation experience of V.B. Karaseva to calculate compensation for unused vacation.

The employee's first working year began on 15 August 2014 and was scheduled to end on 14 August 2015. From July 6 to November 22, 2015, she was on maternity leave, this period is included in the length of service, giving the right to the annual basic paid leave. There is no need to move the end date of the first working year.

The employee completed her first working year. She is entitled to an annual paid leave of full duration - 28 calendar days. The second working year began on August 15, 2015. It was supposed to end on August 14, 2016. But parental leave is not included in the length of service, which gives the right to annual paid leave.

V.B. Karaseva took care of the child from November 23, 2015 to February 2, 2017 (this period is excluded), and on February 3, 2017, the employee went to work on a part-time basis.

The period from February 3 to June 16, 2017 (the day of dismissal) does not need to be excluded from the vacation period (part 3 of article 93 of the Labor Code of the Russian Federation). From the vacation experience we exclude 438 calendar days of parental leave when the employee did not work, including:

- from November 23 to December 31, 2015 - 39 calendar days;

- from January 1 to December 31, 2016 - 366 calendar days;

- from January 1 to February 2, 2017 - 34 calendar days.

Thus, the end date of the second working year should be shifted by 438 calendar days - to October 26, 2017.

The second working year began on August 15, 2015 and lasted (taking into account the interruption) until the dismissal on June 16, 2017. In this period, there are two periods of time that are taken into account in the vacation experience:

- from August 15 to November 23, 2015 (maternity leave) - 3 months and 9 calendar days;

- from February 3 to June 16, 2017 (part-time work) - 4 months and 15 calendar days.

We add the duration of these two periods of time and get 7 months and 26 calendar days.

It turns out that the total vacation experience during the work of an employee at Okunek LLC is 1 year 7 months and 26 calendar days.

If an employee is dismissed for absenteeism, he is entitled to compensation for unused vacation, but the time of absence without good reason at work is excluded from the vacation period (part 2 of article 121 of the Labor Code of the Russian Federation).

Example 3How to determine vacation time if there were absenteeism

R.R. Kovalev was hired on September 2, 2016. Since April 3, 2017, R.R. Kovalev was not at work. The employee did not give a valid reason for the absence. On June 2, 2017, a decision was made to dismiss R.R. Kovalev for walking. It is necessary to determine the employee's vacation period to calculate the amount of compensation for unused vacation.

The period from April 3 to May 31, 2017 (time of absence from work without a good reason) is not included in the vacation period. For the period from September 2, 2016 to June 2, 2017, R.R. Kovalev worked for 9 months, of which absenteeism is excluded - 2 months. Vacation experience was 7 months (9 months - 2 months).

How to calculate vacation days upon dismissal

After you have found out the vacation experience, you can calculate the number of vacation days earned. To do this, the duration of the vacation in calendar days is divided by 12 months, and then multiplied by the number of months of vacation experience (clause 29 of the Vacation Rules):

In this case, less than half of the month is discarded, and more than half is rounded to the nearest whole (paragraph 35 of the Vacation Rules). Depending on the set vacation duration, you can calculate the number of vacation days set for each month of the working year, for example:

- 2.33 calendar days with a vacation duration of 28 calendar days;

- 2.92 calendar days with the duration of the main vacation of 28 calendar days and the additional vacation of 7 calendar days.

Please note: unlike vacation, which can only be granted in whole days, when calculating the number of days of unused vacation upon dismissal rounding is not required. However, the employer can independently provide for the rounding of the number of unused vacation days in order to calculate the amount of compensation by a local regulatory act (letter of the Ministry of Health and Social Development of Russia dated December 7, 2005 No. 4334-17). If such a decision is made in the company, then rounding should be done not according to the rules of mathematics, but each time upwards (in favor of the employee).

Example 4How to round up the number of days of earned vacation.

O.L. Kuznetsov worked for the company for 7 months. At his workplace, an annual paid leave of 28 calendar days is provided. It is necessary to determine the number of calendar days for which compensation will be paid for unused leave upon dismissal, if it is known that the Regulations on remuneration of the company have a rule on rounding this indicator to an integer.

According to a direct calculation, the number of earned calendar days of vacation is 16.31 (2.33 calendar days × 7 months). When rounding, we get an integer - 17 calendar days, for which compensation for unused vacation is due.

When is a full vacation due to dismissal?

One working year consists of 12 months. With an annual paid leave of 28 calendar days, the working year consists, as a rule, of 11 months of work and approximately one month of rest (clause 1, article 115 of the Labor Code of the Russian Federation). If an employee has worked in the company for at least 11 months, included in the length of service, giving the right to the annual basic paid leave, he is paid full compensation (Article 121 of the Labor Code of the Russian Federation and clause 28 of the Vacation Rules).

Example 5Calculation of the number of vacation days upon dismissal. Employee worked 11 months

V.V. Morskoy was hired by Leto LLC on July 11, 2016. On June 16, 2017, he resigns of his own free will. During this period, V.V. Marine leave was not granted. It is necessary to determine the number of calendar days for which compensation will be paid for unused vacation upon dismissal.

The first working year of V.V. Maritime starts on July 11, 2016 and is due to end on July 10, 2017, but the employee left early. Vacation experience as of June 16, 2017 was 11 months and 6 calendar days. 6 calendar days - this is less than half a month, they are not taken into account (clause 35 of the Vacation Rules). In this case, V.V. Morskoy worked at Leto LLC for 11 months, so he must be paid full compensation for unused vacation - for 28 calendar days.

An employee who has worked for an employer for 12 months without a vacation is also entitled to compensation for 28 days of vacation.

Employees who have worked from 5.5 to 11 months can also count on full compensation for unused vacation if they leave for the following reasons (subparagraph “a”, paragraph 28 of the Vacation Rules):

- liquidation of an enterprise (institution) or its individual parts, reduction of staff or work, as well as reorganization or temporary suspension of work;

- entry into active military service;

- secondment in accordance with the established procedure to universities, technical schools, to preparatory departments at universities;

- transfer to another job at the suggestion of the labor authorities or commissions attached to them;

- found to be unfit for work.

Example 6 Calculation of vacation days upon dismissal. Dismissal in connection with conscription for military service.

Worker G.B. Sadov has been working at Senokos LLC since October 13, 2016. The employee is entitled to annual paid leave of 28 calendar days. On March 31, 2017, he resigned due to conscription (clause 1, article 83 of the Labor Code of the Russian Federation). G.B. Sadov did not have time excluded from the vacation experience. It is necessary to determine the number of calendar days for which compensation should be paid for unused vacation upon dismissal.

The employee's leave of absence was:

- from October 13, 2016 to March 12, 2017 - 5 full months;

- from March 13 to March 31, 2017 - 19 calendar days. 19 calendar days are rounded up to a full month (clause 35 of the Vacation Rules). Vacation period will be 6 months.

Since the employee has worked for more than 5.5 months, upon dismissal due to conscription for military service, he is entitled to full compensation for unused vacation. It will be paid within 28 calendar days.

How to calculate compensation for non-vacation leave upon dismissal, if the leave is extended

Some categories of workers are provided with an extended annual basic paid leave (clause 2, article 115 of the Labor Code of the Russian Federation). For example, teachers (Article 334 of the Labor Code of the Russian Federation). Thus, the duration of the annual basic extended paid leave of teachers depends on the position and type of institution and is 42 or 56 calendar days (Decree of the Government of the Russian Federation of May 14, 2015 No. 466). For teachers who are provided with a vacation of 42 calendar days, upon dismissal, full compensation for unused vacation is paid if the employee has worked for at least 11 months in the current working year (clause 28 of the Vacation Rules).

And if the annual paid leave is 56 calendar days, then full compensation is due upon dismissal after 10 months of the school year. This rule is spelled out in paragraph 6.6. Industry agreement on organizations under the jurisdiction of the Ministry of Education and Science of the Russian Federation for 2015-2017, approved by the Trade Union of Public Education and Science Workers of the Russian Federation, the Ministry of Education and Science of Russia dated December 22, 2014.

Lecturer R.F. Gracheva was hired at a secondary school on August 26, 2016. On June 30, 2017, she resigned of her own accord. At the same time, the main annual leave of 56 calendar days for the current working year on the day of dismissal was not granted to the employee. It is necessary to determine the number of calendar days for which compensation will be paid for unused vacation upon dismissal.

For the current working year from August 26, 2016 to June 30, 2017, 10 full months and 5 calendar days were worked, according to the rules for rounding off vacation experience - 10 months. Teacher R.F. Gracheva can claim compensation for unused vacation of full duration - 56 calendar days.

How to calculate the days upon dismissal for unused vacation, if not the whole year is worked out

If a resigning employee has not worked at the given enterprise for a period giving him the right to full compensation, he is entitled to proportional monetary compensation.

How to calculate non-vacation leave upon dismissal if the vacation period is less than a month

Compensation for unused vacation is due to an employee who has worked under an employment contract for more than 15 calendar days (clause , of the Rules on Vacation, letters of Rostrud dated 06/08/2007 No. 1920-6 and dated 06/23/2006 No. 944-6). Upon dismissal, such an employee should be paid compensation for unused vacation in proportion to the time worked by him.

N.K. Egorushkin was hired by CJSC Stroytekhmekhanizatsiya on May 26, 2017. He has an indefinite employment contract. The employee is entitled to annual paid leave of 28 calendar days. N.K. Yegorushkin decided to quit of his own accord. June 20, 2017. - the last day of his work. For how many days is it necessary to pay compensation for unused vacation in this case?

The first working month is from May 26 to June 25, 2017 (Article 14 of the Labor Code of the Russian Federation). As of the date of dismissal of N.K. Yegorushkin worked for the company for 26 days, that is, more than half a month. Therefore, he is entitled to compensation for 2.33 calendar days (28 calendar days: 12 months × 1 month), and if the company provides for rounding, then for 3 calendar days.

How to calculate the days of non-vacation leave upon dismissal if the vacation period is several months

If an employee voluntarily leaves after less than 11 months of service, he is entitled to proportional compensation.

N.D. Radov worked for 5 months and 19 calendar days and is resigning at his own request. For how many days will compensation for unused vacation be calculated?

The working year has not been fully completed. The reason for dismissal does not entitle the employee to full compensation. Vacation experience, taking into account rounding, is 6 months (clause 28 of the Vacation Rules). The number of vacation days earned for which compensation must be paid is calculated in proportion to the length of the vacation period. Compensation will be paid for 14 calendar days (28 calendar days: 12 months × 6 months).

How to calculate the days of compensation for unused vacation upon dismissal

Let's use the condition of the previous example, changing the date of employment to May 27, 2016. How to calculate the number of vacation days subject to compensation upon dismissal, if the rounding of their number is provided for by the Regulation on wages?

1. The number of vacation days during the work of a psychologist

In the period from May 27, 2016 to January 12, 2017, the vacation period was 7 months and 17 calendar days, according to the rules for rounding off the vacation period - 8 months (clause 35 of the Vacation Rules). The number of unused vacation days subject to compensation upon dismissal will be 28 calendar days (42 calendar days: 12 months × 8 months).

2. The number of vacation days during the work as a referent

For the period from January 12 to June 30, 2017, the employee worked 5 full months and 19 calendar days. Vacation experience - 6 months. The number of unused vacation days subject to compensation is 14 calendar days (28 calendar days: 12 months × 6 months)

3. Total vacation days to be compensated

Let's add two results. The total number of vacation days earned will be 42 calendar days (28 calendar days + 14 calendar days). Reduce it by the number of vacation days used. We get that compensation for unused vacation must be paid for 37 calendar days (42 calendar days - 5 calendar days).

How to count unused vacation days upon dismissal if the employee goes on vacation with subsequent dismissal

At the written request of the employee, all unused vacations can be granted to him with subsequent dismissal, with the exception of cases of dismissal for guilty actions (part 2 of article 127 of the Labor Code of the Russian Federation). Rostrud specialists believe that leave with subsequent dismissal should be provided for the full specified duration. At the same time, only those of his days are paid that would be subject to monetary compensation upon dismissal (and Determination of the Constitutional Court of the Russian Federation dated January 25, 2007 No. 131-О-О).

The vacation period with subsequent dismissal does not increase the employee's vacation period, since in fact the employment relationship with the employee is terminated from the moment the vacation begins (letter of Rostrud dated December 24, 2007 No. 5277-6-1), although the last day of vacation will be considered the day of dismissal (part 3 of article 127 of the Labor Code of the Russian Federation). All cash settlements are made before the employee goes on vacation, since after its expiration the parties will no longer be bound by obligations (letter of Rostrud dated December 24, 2007 No. 5277-6-1).

A.A. Fedkin was hired on September 2, 2016. On June 9, 2017, he applied for leave from June 16, 2017, followed by dismissal. An employee is entitled to an annual paid leave of 30 calendar days. He actually used 10 calendar days of vacation. It is necessary to determine how many vacation days will be provided and paid to the employee, as well as the date of his dismissal.

The employee will be given 30 calendar days of vacation. The day of dismissal is the last day of vacation (July 15, 2017). As of June 16, 2017 A.A. Fedkin worked 9 months and 14 calendar days. His vacation experience is 9 months. A.A. Fedkin will be paid 12.5 calendar days of vacation (30 calendar days: 12 months × 9 months - 10 calendar days).

The calculation of compensation for unused vacation depends on the reason for dismissal, the number of days worked and the official time off taken. In this article, we will consider the general rules and examples of compensation for vacation upon dismissal.

In what cases is compensation due and what determines its amount

According to the Labor Code of the Russian Federation, paid leave lasting 28 days relies on one working year ().

Vacation can be taken after 6 months of continuous work from one employer. As a general rule, the number of vacation days is made up of 2.33 calendar days for each month worked in a year: 2,33 * 12 = 27,96.

The value of the month in labor law is taken as 29.3 days(average monthly number of calendar days). Based on these data, the calculation of compensation for unused vacation is built:

Amount of compensation for unused vacation = Average daily earnings x Number of unused vacation days

However, the amount of compensation also depends on two important factors:

- reasons for dismissal (employee's initiative or employer's initiative),

- vacation experience (that is, the number of days worked that affect compensation).

Voluntary dismissal compensation

- If the employee has worked for more than 6 months but less than a year

Example 1 The employee worked in the company for exactly 7 months with a salary of 20,000 rubles per month. Then he found a new job and quit of his own accord. For 7 months, the employee earned 140,000 rubles. How to calculate vacation pay?

First: determine how many vacation days an employee is entitled to:

2.33 days * 7 months = 16.31 days

Second: determine the amount of compensation. To do this, you must first calculate the average daily earnings:

we divide the total amount of the salary received by the number of months worked and by the average monthly number of calendar days: 140,000 rubles. / 7 months / 29.3 days = 682.6 rubles.

Thus, we define amount of compensation:

RUB 682.6 * 16.31 days = 11,133 rubles. 2 kop.

- If the employee has worked for 11 months

Example 2 Suppose that an employee on the same conditions worked not for 7 months, but for 11 months, after which he quit. How to calculate the compensation for vacation in this case?

11 months is actually a year worked, therefore, in this case, the employee is entitled to compensation for all 28 days:

- If the employee has worked in the company for less than six months

Despite the fact that the employee did not receive the right to paid leave, he is nevertheless entitled to his compensation (). In this case, compensation is paid, as in the previous examples, according to the proportional principle: average daily salary * number of unused vacation days. However, if the length of service in this company did not exceed 15 days, no compensation is due.

Dismissal compensation, if it is not related to the employee's initiative

- If the employee has worked for more than six months

The employee is entitled to receive full compensation for all 28 days of vacation if he worked in the organization for more than six months, and then was fired for one of the following reasons:

- liquidation of the organization (its separate parts) or reorganization;

- reduction of staff (works) or temporary suspension of work;

- entry into active military service;

- found to be unfit for work.

Let's go back to our example 1(an employee who has worked for 7 months). Upon dismissal of his own free will, his compensation for vacation amounted to 11,133 rubles. 2 kop. However, if he were fired for one of the reasons given above, his compensation would be:

RUB 682.6 * 28 days = 19,112 rubles. 8 kop.

- If the employee has worked less than six months, but more than 15 days

In this case, the employee has the right to receive proportional compensation, that is, according to the formula: average daily salary * number of unused vacation days.

Clarifying points

- In Russian labor legislation, there is the concept of "extended leave" of 42 or 56 calendar days. It is assigned to such categories of employees as teachers.

- Payment of compensation to an employee must be made at the time of dismissal or no later than the day after the dismissed demand for payment is presented.

- The continuous work experience includes both the time of actual work and the time of maintaining the place of work - the time spent on sick leave, non-working holidays and weekends.

- The length of service does not include absenteeism without a valid reason and time off on account of vacation, so these days are not included in the calculation when compensating for vacation.

Pavel Timokhin, head of accounting department

Let's talk about how to calculate the main and additional leave and compensation for unused leave upon dismissal. For this, we need the calculation of average earnings, which is described in Government Decree No. 922 of 12/24/07.

How to calculate average daily earnings?

To calculate the amount of vacation pay and compensation for unused vacation, you must first calculate the average daily earnings for the 12 months that precede the start month of the vacation. If the employee has not worked for 12 months yet, then we calculate the average daily earnings from the day of his employment. We determine the amount of earnings for the billing period, include income in cash and in kind: salary, bonuses, bonuses, allowances for special working conditions. Sick leave, vacation pay, and other payments calculated on average earnings are not included here.

- if the month is fully worked out, then the average value of calendar days in 2018 is taken - 29.3;

- if there were periods in the month that are not included in the calculation (for example, sick leave, vacation, etc.), then the calendar days taken into account for this month are calculated proportionally: (Number of calendar days of the month - Days not included in the calculation) * 29.3 / Number of calendar days of the month.

Now we calculate the average daily earnings using the formula: Amount of payments for the billing period / Calendar days for the billing period.

How to calculate compensation for unused vacation

If an employee writes an application to replace part of the unused vacation with cash payments or quits without spending vacation days, you need to calculate the amount to compensate for unused vacation. And do not forget to withhold personal income tax. Read about calculating the number of days for which compensation is due. The formula for calculating the amount is as follows:

Compensation amount = Average daily earnings * Number of days of unused vacation.

Indexation of average earnings with a salary increase

If before or during an employee’s vacation, the organization increased salaries (tariff rates), then you need to index the average earnings to calculate vacation pay. This is where the increase factor (KPV) comes in handy: KPV \u003d OH / OS, where OH is the new salary, OS is the old salary. There are three indexing options:

- Salary increased during the billing period. Then all payments taken into account when calculating vacation pay, from the beginning of the billing period to the month of salary changes, are multiplied by KVP.

- The salary increased after the billing period before the start of the vacation. All calculated average earnings are multiplied by the increase factor.

- Salary increased during vacation. Only part of the vacation pay increases, starting from the date of validity of the new salaries.

Vacation pay

Vacation pay must be paid at least 3 days before before the start of the vacation (Article 136 of the Labor Code of the Russian Federation). We take the number of vacation days from the order of the management on the provision of legal rest. We pay for all calendar days of vacation except non-working holidays (according to Article 120 of the Labor Code of the Russian Federation).

Usually the situation when the vacation starts at the beginning of the month raises questions. For example, an employee goes on vacation from July 1, 2018, and vacation pay must be paid on June 27. At the same time, the calculation requires a salary for June, which has not yet been accrued.

In this case, the payroll for June is first calculated: either assuming that the employee completes the last days of the month, or based on the days already worked. Then vacation pay is calculated. If the salary for June changes after vacation pay is calculated, you will need to recalculate and pay or withhold the difference.

How to calculate vacation pay using a calculator?

To calculate the amount of compensation due to an employee upon dismissal, you need to know 2 indicators:

- the size of the average salary of an employee for 1 day (based on the income of the past 12 months before the termination of the employment contract);

- the number of days of unrealized vacation for previous years or rest days that the employee “earned” in the current year by the time of dismissal.

The value of the average daily wage of an employee is calculated by the formula:

D - the total income of the worker for the last 12 months;

12 is the number of months in a year;

29.3 - an indicator established by Decree of the Government of the Russian Federation No. 922 dated December 24, 2007, which means the average number of days in each month of the year.

If in the reporting year the employee did not work all the days in some months, then the following formula is proposed for calculating the average daily salary:

D / (29.3 × Mn + Mn),

D - total earnings for the past year;

29.3 is the average number of days in each month of the year;

Mn - the number of months worked by the employee in full;

Mn - the number of days worked in partial months.

How to calculate the number of vacation days an employee is entitled to

If, upon termination of the employment relationship, it turns out that the employee did not take all the vacation for the past year, then there will be no problems with the calculation of compensation. But how to calculate how many vacation days an employee is entitled to for the current year?

There are 2 calculation methods:

- The first one is proposed in the Rules on regular and additional holidays approved by the NCT of the USSR on April 30, 1930 No. 169. The number of vacation days to which the employee is entitled is calculated by the formula:

(Mo × Ko) / 12,

Don't know your rights?

Mo - months worked by a person after the last vacation or after hiring; Ko - the duration of the annual vacation period of the employee in days;

12 is the number of months in a year.

- The second method was proposed by Rostrud and is used in some organizations, although it is somewhat controversial due to the existing error in the calculation.

This method uses a method to determine the number of vacation days that an employee earns for each month of work. At the same time, when calculating the surplus of a month, less than half is not taken into account, and more than half - allow you to round the month to the full.

Under this calculation method, with 28 days of leave for each month of work, the worker earns 2.33 days of future leave (28 days of leave / 12 months per year). Since when dividing 28 by 12, you get 2 integers and after the decimal point 3 in the period (2.3333333333), Rostrud proposed rounding the number of rest days "earned" per month to 2.33.

Due to a small error, sometimes an unexpected result is obtained. So, an employee who has worked for half a year is obviously entitled to half of the 28-day vacation (14 days), but multiplying 6 months by 2.33 gives 13.98 days. There is no information in the labor legislation on the rounding of vacation days. The Ministry of Health and Social Development of Russia in its letter dated December 7, 2005 No. 4334-17 specifically dwells on this issue, urging any errors to be rounded in favor of employees.

Thus, in the absence of better options for legally established methods for calculating the number of days of rest due to an employee, employers are entitled to choose from 2 available methods more suitable for their enterprise.

How to calculate compensation upon dismissal for unused additional leave

Some categories of workers are entitled to additional annual paid leave. These workers include workers: the Far North, industries with unfavorable working conditions, working irregular hours and some others.

Additional leave can be, for example, 3, 7 or more days, which are added to the annual paid leave. Therefore, in order to determine how vacation compensation is calculated upon dismissal of an employee who is entitled to additional leave, you must first add the days of the main and additional holidays, and then calculate the number of rest days that the employee has earned by the time of dismissal.

So, for example, if an employee, in addition to the main 28-day vacation, is entitled to 3 days for an irregular working day, then the total vacation of this employee will be 31 days. This means that when calculating the number of vacation days to which a person is entitled before dismissal, in both methods of calculation, one must proceed from a 31-day vacation.

Vacation pay for vacation with subsequent dismissal (calculation)

Labor legislation provides for an employee the opportunity to go on vacation before dismissal. In this case, all previously unused vacations, as well as vacation days for the current year, can be issued. To receive leave ending in dismissal, the employee must write an application. The last day of vacation will be considered the last day of the employee's work in the organization.

In this case, the employee will not receive compensation for the unused vacation period on the day of dismissal, but vacation pay - no later than 3 days before the start of the vacation. In this case, the calculation is made as for the payment of vacation pay. That is, first they find the average daily salary of an employee based on income for the past year, and then multiply the resulting figure by the number of vacation days that will be provided to the employee.

If an employee is entitled to a full 28-day vacation or several vacations for previous years, then vacation pay will be calculated for the entire period. If the employee did not earn a full vacation before dismissal, then you will first have to calculate the number of rest days to which the employee is entitled in the current year, issue these rest days to the employee and pay only them.

If the employee who took the vacation at the time of termination of the employment contract still has unrealized days of rest, then upon dismissal, such an employee will be entitled to compensation for the vacation.

Is compensation paid for unused vacation to part-time workers who leave of their own free will

Part-time workers - both external and internal - have the same set of rights and have the same guarantees as the main employees. They have the right to leave, the duration of which does not depend on the form of employment.

Therefore, if a part-time worker leaves, he must also be calculated and paid compensation for unused vacation. In addition, the calculation method for part-time workers and main workers is the same.

In addition, part-time workers, like the main employees, have the right, upon their application, to go on vacation with subsequent dismissal.

Read about the nuances of calculating compensation for part-time workers.

Is personal income tax payable on dismissal?

Chapter 23 of the Tax Code of the Russian Federation is devoted to personal income tax. Article 217 of this document indicates income exempt from personal income tax. Among others, the list includes all types of compensation payments related to the dismissal of employees. However, a reservation was further made: "except for compensation for unused vacation."

We conclude that compensation for unused vacation upon dismissal is subject to personal income tax.

Compensation for vacation upon dismissal is calculated by multiplying the days of vacation not taken off by the average daily wage. Compensation is the employee's income and is subject to personal income tax. Compensation is paid together with the payment of other income of the employee on the last working day.