In our time, there are many foreign concepts in the Russian language, the meaning of which still remains a mystery to many. Nowadays, one can often hear the phrase "fashion trends" on TV screens in various programs about style, cinema or music. What is the essence of this concept and how should it be understood?

Meaning and general meaning

This newfangled term is translated as "current" or "trend", meaning a short-term direction in any area. For example, in nanotechnology, it is a modern science course. But most often this word can be found in the areas of culture and art.

What is a trend in fashion? In this case, the concept indicates actual things and stylish trends in a certain period. Anyone who follows current trends will always look fashionable and stylish. If they say about a person that he is in a trend, then this means one thing: you can discuss with him all the new fashion items, the latest designer collections, and also talk about the world of cinema and music.

Examples of using

Outfits that are relevant for one period of time, most likely, will no longer be a trend for the next seasons. Fashion trends generally refer only to a certain time period, usually not very long. It can be one or two seasons of the same year. For example, spring-summer or autumn-winter. In this case, you need to pay attention to the things that are presented in the collections of a particular period. But it must be remembered that too extravagant models in the next season may no longer be relevant. Do not confuse the concept of "fashion" and "trend". Clothing can represent an entire era, for example, the style of the 60s or 90s. In this case, it is not considered a trend, since it is not fleeting. But if things are relevant only this season, then, undoubtedly, this is a trend.

Attributes of fashion trends

The first sign that things are considered fashionable is mass. For designers, it is undoubtedly important to create clothes or some other product that will be in demand among a large number of people. Therefore, if you ask leading fashion designers what a trend is, they are guaranteed to answer: these are easily recognizable items among a wide range of buyers and are in high demand.

The second and one of the main attributes of fashion trends is exclusivity. A collection of clothes, of course, cannot be created by an unknown person. Basically the trend of the year is developed by a group of people with worldwide recognition. After that, manufacturers of cheaper goods produce inexpensive similar things that can satisfy the needs of all sectors of society.

The third sign of fashion trends is temporality. Answering the question of what a trend is, we can confidently say: these are things for a couple of seasons. They are periodically updated, so designers present their collections to the public at least once every six months. Accordingly, in order to keep up with the modern style, it is necessary to constantly follow the new products and be in the center of the current events in the fashion world.

Components of the trend

Newest trends tend to have an early stage of popularity, a peak in demand, and an end. World fashion designers create their collections and show shows, focusing on two seasons ahead. The main fashion trends are necessarily applied in clothing, footwear and accessories. This applies to both masculine and feminine items. So what is a trend anyway? The term can be a popular color scheme in a certain period of time, as well as a fashionable ornament or material from which things are made in a particular season, a model of clothing and its length.

What do the fashion trends of this year look like?

Our life does not stand still, therefore the wardrobe must be constantly updated, in line with all the new trends in the fashion industry. This should be done by those people who want to always remain at their best and, as they say, be in trend. The current colors this year are presented in soft and natural tones that have a fresh and pleasant look. The shades of things are as close to natural as possible, respectively, the acid palette is gradually disappearing from all world catwalks.

This year's trendy clothing has an incredibly elegant look and is presented in a loose fit, which makes it almost universal and able to suit every person. It looks great on any body shape, and the correct use of accessories can highlight all its advantages.

What will they wear in the spring?

Fresh and vibrant colors will be in vogue this season this year: emerald palette and turquoise shades. Designer collections are presented in the form of off-shoulder dresses and blouses combined with joggers, striped clothing that can be wide, narrow, asymmetric cut. In particular, short jackets with voluminous sleeves will be fashionable. Spring trends this year have several fashion directions. This can be clothes presented in the style of the 70s, a variety of floral prints and additional accessories in small quantities. If all these trends are taken into account in your wardrobe, then, undoubtedly, you will get a very stylish spring look.

Summer fashion trends

In the hottest season of the year, dresses in a sporty style will be relevant, which, of course, will appeal to fans of an active lifestyle. Also, the hit of this period of time will be clothes with folds, lace, embroidery or a variety of romantic outfits. The real summer trend is presented in the form of tiered and cascading skirts. Those who prefer a little simpler silhouettes can choose a tulip, pencil or flared model.

Not a single fashionista's wardrobe is complete without a beautiful pair of shoes. This summer, heels, laces and wedges will be relevant. And, of course, high-heeled sandals do not lose their popularity among the fair half of humanity. Do not forget about bags as a great addition to any look. In the warm season, clutches will be in fashion, as well as models that have the shape of a bag or are made of transparent materials.

Whether it is worth following fashion trends and staying always in trend, everyone decides for himself. But you should always remember: the current fashion is very changeable. What is in demand during this period will already fade into the background next season.

Therefore, changing your wardrobe with such frequency is very difficult and almost impossible. People often forget that fashion is a real art that many people use to express themselves. You can skillfully combine new outfits from those things that are already in stock, and always be in trend at the same time.

Therefore, changing your wardrobe with such frequency is very difficult and almost impossible. People often forget that fashion is a real art that many people use to express themselves. You can skillfully combine new outfits from those things that are already in stock, and always be in trend at the same time.

On large time intervals, the randomness of events is leveled and the price movement becomes more definite. In other words: the influence of intraday news becomes completely invisible on weekly bars and, therefore, the “random walk of the price” within the day on minute intervals, develops into a clear, regular movement, fully explained by fundamental and macroeconomic factors.

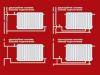

When the price moves in a certain direction, the currency pair is said to be trending. If the price moves up, then they say about an up trend:

If prices move down, then they say about a downtrend or a down trend:

If prices are mainly moving sideways, then the market will have a sideways, non-directional movement - sideways or flat:

Analysis of the charts of various currency pairs shows that most of the time prices spend in the absence of directional movement and only a third of the "life" are in an upward or downward trend. Each trend has three phases: inception, development and completion. It is trends that allow traders to extract a significant portion of the profit from the market. With good trends, quotes can vary from 50 to 500% of the original cost. The beginning of the emergence and the moment of the end of the trend is what the overwhelming majority of traders seek to find faster than others.

REASONS FOR TRENDS

As a rule, the emergence occurs under the influence of strong news. It is believed that the main condition of incoming information should be that the news is “long-playing”, ie. the factors underlying it will act for a long time, namely:

- central bank rate;

- GDP growth;

- unemployment rate

and other important news coming to the market.

If the news or events are clearly positive, investors start buying and opening long positions, thereby changing the market balance of supply and demand. As long as there is an imbalance, there is a trend. It is this constant factor that pushes prices up or down. After eliminating the imbalance between supply and demand, the trend ends.

In the last stage of trend completion, its development often becomes explosive or exponential. Growth is accelerating, and the impression is that there will be no end to the movement. It is this deceptive impression that pushes new players to make hasty purchases at any, seemingly even yesterday, unthinkable prices. As a rule, the last buyers and sellers are the most inexperienced investors, read by analysts in newspapers and magazines.

Of course, the change in the imbalance of supply and demand in the opposite direction must be caused by something else, in addition to the banal withdrawal of sellers or buyers from the market, and such a change occurs for several reasons:

- Firstly, the action of the root cause that caused the movement of quotations up or down does not last forever and gradually fades away. At the moment when the action of the root cause is exhausted, the reasons for the continuation of the trend are also exhausted. When a sufficient number of players realize that there is no reason, a correction phase begins, followed by price consolidation, and the market exits the trend.

- Secondly, the trend can end under the influence of news or events that have the opposite meaning to the current trend.

SIGNS OF TREND COMPLETION

It is quite difficult to recognize the moment when the trend ends. However, there are several signs that can help with this.

Let's consider some of them typical for stock market trading:

- The first is that paper that is in trend is gaining incredible popularity among well-known analysts and magazines. As soon as you come across a statement that the trend is developing successfully, be alert: the end of the trend is already very close!

- The second sign: before the end of the trend, there are very strong movements in the opposite direction. Players often accept such movements with a normal correction within the trend itself and, accordingly, with a good trend entry point. However, it is not. At such moments, the most informed investors, confident in the imminent end of the trend, exit their positions and open trades in the opposite direction in anticipation of a reversal.

- A third trend end sign that works well in technical analysis is a breakout of an uptrend support line or an uptrend resistance line.

At the beginning of the 20th century Charles Doe(Charles Dow) - founder of stock indices and trend science, formulated his ideas as follows:

- market movement consists of three trends: long-term, medium-term and short-term;

- there is always a long-term trend on the market. The characteristic period of the pre-term trend is several years (from 2 to 10). This trend is clearly visible on weekly, monthly or quarterly charts;

- the long-term trend consists of medium-term up and down trends. Moreover, the mid-term, the direction of which coincides with the long-term, is called confirming trend, and the medium-term trend, the direction of which does not coincide with the direction of the long-term one, is called corrective or counter-trend... Medium-term trends, as a rule, are several times smaller than long-term ones - from 2-3 months to a year. Medium-term trends are clearly visible on daily intervals;

- both long-term trends are composed of medium-term, and medium-term are composed of short-term market movements. In relation to medium-term trends, short-term trends are also divided into confirming and correcting (counter-trends);

- the trading volume must confirm the trend. In the direction of the main trend, the volumes are constantly growing, and in the direction of the corrective trend, they are gradually falling;

WHY DO MOST PARTICIPANTS NOT SEE THE BREAKING TENDENCY?

Firstly, because the dynamics of the market is determined by large players and investment funds, which closely monitor the state of the economy. And secondly, the psychological mood of the majority of market participants who trade with small funds plays a role here. It is very difficult to quickly adjust and change the strategy of the game, admit your mistakes in trading and an obvious change in trend. As a rule, when the player discovers that the trend has changed, it is too late to act in the new circumstances. So you should always remember that trends are not endless, and times of economic development will surely be replaced by a period of depression.

Do you know the main principle of trading anything on any exchange? This sacred advice, generously distributed by seasoned traders, by which no newbie could pass.

"Trade only with the trend", "the trend is your friend."

How to figure out what a trend is? Its definition is quite understandable. This is an existing trend, the movement of prices in the market in a certain direction.

It is recommended to build your trading strategy on the assumption that the current trend is more likely to continue, or at least not change suddenly. This tactic will help at least avoid losses from unreasonable emotional trading decisions.

Read more about the interpretation and use of trend lines in the article.

What is the strength of the trend

The trend is the main direction of the market movement. But since the market moves in waves, and not in a straight line, then a trend (tendency) should be understood as the main direction of the market's wave movement up or down, which can be noticed and evaluated. A trend is always especially noticeable when it has been going on for some time.

Since the market can go both down and up, the following trends are distinguished:

- Upward - a trend in which each subsequent high and low is higher than the previous ones.

- Downward - the dynamics of the market price, at which each subsequent minimum and maximum are below the previous ones.

Probably, each of us knows that the emotions of people trading on the exchange (they are called traders) have an impact on the value of an asset. Everyone should be familiar with the expression that emotion drives the exchange. So: an uptrend (trend) always lasts longer, and market movements are smoother, as traders open positions in the hope of further growth.

As a rule, many novice traders do not notice upward movements immediately, but when they notice they will enter the market in the hope of continuing the movement. Sometimes it is desirable for them not to do this, because the trend may come to an end or a correction will occur, but the desire to make easy money and greed will do the trick.

On the contrary, market falls always occur quickly and abruptly, because during a crisis on the stock exchange, people are driven by panic and fear of losing their earnings, speculators and investors close their positions by making active sales.

The basic rule of successful trading

If you already have some experience of trading on the stock exchange - no matter what: stock or foreign exchange (forex), then most likely you have heard that the most profitable trading strategies are exactly those that trade with the trend. And this, by the way, has been proven not only by me personally, but also by a number of successful domestic and foreign traders.

It doesn't matter what you trade: stocks, futures, options or currencies - always align your trading system in accordance with the current trend. Why is it so? Because the trend is much more likely to continue than change direction.

And even if, nevertheless, a trend change is outlined, it will not happen abruptly, since the market will spend a certain amount of time in consolidation.

Therefore, do not think that "the market has nowhere else to rise or fall", but just look at the trend and continue working in its direction - this way you will at least avoid one of the main mistakes of beginner stock traders.Well, and finally, accordingly, a piece of advice: use in your trading strategy a clear algorithm for determining the market trend for today, for example, build an indicator and if the price turns out to be relative to the line of this indicator somewhere, then the trend is up / down and vice versa.

And do not include emotions and your guesses about the market, but just follow the position of the price relative to the indicator - there you will earn more (much more than interest rates on deposits in banks, for example).

Source: "finansiko.ru"

What is trend, definition, types

If you look closely behind the price chart, you can see the chaotic movement of the trend, which is also called a trend. What is a trend? It turns out that there is no incomprehensible meaning behind this word. A trend is a certain direction of price movement in any direction.

In this case, the main task of the technical analysis of the Forex market is precisely to determine the direction of this movement, that is, the trend line (characteristic of the price movement from the moment of the movement to the end).

There are three types of trend:

- Bullish.

- Bearish.

- Side.

Now let's look at each type of trend in more detail.

Bullish

Bullish trend (also called uptrend) - prices rush up. Special feature: Each subsequent maximum rise is higher than the previous one, and likewise, each subsequent maximum decline is higher than the previous one. If you draw a line through the minimum values of the recessions (as shown in the figure below), which will be a kind of support for the trend movement, in this case they say that this is a "support line".

Usually, here attention is paid to the bottom border, since with such a price movement, the trader focuses on the price rise. If the price slightly crossed the support line, and then quickly rushed up, this means that the price is testing the line we have drawn for strength.This can be a signal that warns us that the dominant trend is already weakening or even changing its direction. The following image shows an uptrend (bullish trend):

Bearish

Bearish type of trend (downtrend) - prices are rushing down. A characteristic feature: Each subsequent high is lower than the previous one and, accordingly, each subsequent decline is lower than the previous one. As you can see in the figure below, the trend line is drawn through the maximum peaks, which serves to limit the price movement from above. This line is usually called the "resistance line".

A similar rule applies here: if the price just crossed the resistance line and then quickly rushed down, this indicates that the price is testing the drawn line for strength. It can also be a signal of a weakening trend or even a change in its direction. See the following figure:

Side

There is no clear direction of price movement here. He moves, as if adhering to a horizontal position. However, support and resistance lines also work here. I would like to say that the specific direction of the trend is quite rare. Because the price movement in the Forex market is usually chaotic.

The price in the Forex market never moves in a strictly straight line in one direction. It constantly forms a series of vibrations. These fluctuations, constant ups and downs, together form the trend in the market.

There is one very important point: "The trend is your assistant." Never trade against the trend!

Trend lines

Straight lines drawn through major peaks (highs) or also drawn through major lows are called trend lines. Along these lines, you can trace the development of a trend in the Forex market.

Also, trend lines can be conditionally divided into 3 types:

- Rising trend lines.

- Downward trend lines.

- Side trend lines.

A trend line is usually drawn through 2 highs or 2 lows. The third point of contact will confirm its movement.

Until the trend line is broken, the trend will go in one price channel, keeping its direction. But even if the price has broken the trend line, there is usually a period of consolidation after that.

Breaking the trend line

In most cases, breaking through the trend border does not always indicate a change in its direction. When it comes time to consolidate prices, pay attention to its duration. The longer the price consolidation lasts, the more intense the future trend movement.

When the price breaks through the resistance level and rushes up, the resistance line now becomes a support line for it. Conversely, the price breaking through the support line with a further downward movement turns support into resistance.In addition, the breakout of the trend line is considered complete if the price moves 3% outside of it.

Price channel

Two parallel lines, one of which is drawn along the maximum tops, and the second - along the minimum values on the chart, generally form a price channel. The figure below shows a rising channel:

Resistance line

The resistance line (translated from English Resistance) is drawn through important tops or peaks of the market. These lines appear when market participants no longer open buy trades because prices may have increased.

The number of sellers exceeds the number of buyers, as a result of which an uptrend (tendency) is replaced by a downward one, i.e. fall.

Support line

The support line (translated from English Support) is drawn through the important lows (lows) of the market. They appear when market participants no longer open sell trades due to the fact that prices may have declined.

The number of buyers falls and is replaced by sellers, the downtrend (tendency) turns into an upward one.

When the price breaks down the support line, it becomes resistance. Conversely, when the price breaks up the resistance level, it becomes support.

Channel lines

It also happens that the price goes between two parallel lines. In this case, the price is said to be in the channel. Channels, in turn, are directed upward, downward and horizontal. The figure shows a descending channel:

Trend correction

Trading on the Forex exchange is somewhat similar to trading on other financial markets, because the price of currencies, however, like other financial instruments, does not change clearly in one direction without hesitation. Experienced traders have learned to follow the correction in relation to the main trend.

Today, there are 3 main approaches to predicting a trend correction in the Forex market:

- According to Dow Theory, a trend retracement occurs at 1/3 (that's 33 percent), 1/2 (that's 50 percent), and 2/3 (that's 66 percent) of the main move. A deviation of more than 66 percent usually warns of a change in the current trend.

- By Fibonacci levels. The analysis is done based on the following numbers: 0.382 (which is 38 percent), 0.50 (which is 50 percent) and 0.618 (which is 62 percent).

- According to the Gann levels, the correction will be a multiple of 1/8 of the movement of the main trend.

Source: "t-traders.com"

How to determine the direction

The trend is the general direction of the market movement. No market moves strictly in a straight line, so we need to identify a general trend: upward or downward.

Opening a trade in the direction of the trend helps to increase the chances of success. Of course, Price Action setups against the trend also work, sometimes quite well, but when trading only along the trend, we can be calmer, because the risk of getting a loss is significantly reduced.

There are a huge number of forex indicators, systems and theories for determining the current direction of a trend in the market.

But trading by Price Action implies exactly the rejection of indicators, tracking the situation on the market based only on the behavior of the main indicator - the price itself.

Therefore, when determining the trend, we will be guided only by the price, based on the most classical interpretation of trends in the Forex currency market.

Ascending

An uptrend is a series of rising peaks and troughs. Based on this rule, we determine whether there is a bullish trend in the market. As soon as the rule of having rising highs and lows is broken, we look for opportunities to sell. In an uptrend, after the breakdown of the previous minimum, one can consider a possible trend change to a bearish one.

Descending

A downtrend is a series of declining peaks (highs) and troughs (lows). From here we derive the rule: A downtrend reversal can be said when the market has broken the previous maximum.

I do not understand what the trend is now, how to be

Quite an important point - if you cannot understand what the trend is now, and this often happens during periods of consolidation, when the market moves in a horizontal direction, then just do nothing. Many people make the mistake of thinking that they should always trade. No way.

If you only take "beautiful", clear and understandable setups, it will be much more profitable than trying to grab every point. Be selective in your deals, do not understand where the market is heading now - do not trade, wait for the situation to clear up.

When is the best time to enter the market

As we said at the very beginning of this article, the market does not move in a straight line. There will always be periods of pullbacks and consolidations. It is during such periods that it is worth entering a position, guided by the main direction of the trend.

Yes, sometimes Price Action setups are formed on impulse movements and work well, but entries on pullbacks are safer and ultimately profitable:

And remember: the trend is your friend.

Source: "tradelikeapro.ru"

What is a trend

How many times have you, regardless of your period of passion for trading, heard such expressions: "the trend is your friend" or "do not trade against the trend." These phrases are heard by reading any book on securities trading or browsing the forums. Willy-nilly, you understand that you need to listen to these words and, most importantly, understand.

For many, trend-following trading is associated with position trading. In fact, any trader, be it intraday, swing, or positional, looks for a trend on the chart.

Give yourself an answer to the question: why? Based on the information we have already received about the phases of the market and the Elliott wave theory, it can be authoritatively asserted that the trend is a gold mine, a source of profit.The trend is really our friend. Therefore, the ability to recognize the trend and its changes on the chart (learn how to determine the trend reversal in 80% of cases) is paramount.

Definition and main characteristics

Once, on a chat for traders, I read the following correspondence (nicknames are invented):

- Beginner: how an uptrend and a downtrend are determined

- Experienced: If you look at the chart and see that the price is moving towards the upper right corner of the screen, this is an uptrend. If to the bottom - descending.

All ingenious is simple. This could be the end of the trend definition, but ... Every self-respecting trader should speak the language of technical analysis.

A trend is a vector that indicates the direction of market dynamics. It consists of separate waves: rising and falling, which in turn form tops and bottoms.

You can observe three types of trend: uptrend, downtrend, horizontal. In the literature, the latter is also called flat, trading range or sideways corridor. All these values are equivalent.

Below is a schematic representation of the trends:

- BB - towering peaks

- VM - Rising Lows

- PV - descending peaks

- PM - falling lows

- A flat or trading range is the first and third phases of the market. It has been noted a long time ago, and we will only confirm, that the markets are trending about 30% of the time. In the rest of the period, they move in any side corridors without a definite direction.

- The second phase is an uptrend and is characterized by a series of rising tops and bottoms.

- The fourth market phase is the downtrend. It is characterized by a series of declining peaks and troughs.

This is how a trading range looks like schematically:

Prices move with no apparent direction. This means that neither sellers nor buyers are in certainty. Should you look for profit here?

As we can see, prices move in a completely disordered manner. Of course, there are trading strategies dedicated to working in the trading range of the market. But why complicate your life and trade securities that "jump" up and down, if you can choose those that show beautiful, reliable trends.

If you are trying to make money in the trading range, then this is a direct way to drain all your capital down the drain. Stick to trends!Here is an example of a stock with a strong uptrend:

A great example of Apple's uptrend

And this security is traded in a trading range:

The price is trading in the $ 40-55 price range for 2012. Atlas Air Worldwide Holdings Inc

Source: "trader-blogger.com"

The way to consistently make money on Forex is to trade with the trend

The easiest way to consistently make money on Forex is to trade with the trend. For those who use The Trendis Your Friend, most trades are profitable and mistakes are minimized. But in order for the money to flow into your account on its own, you still need to correctly determine the general direction of the trend.

Where the price goes is the PRIMARY question. Without answering it, we cannot decide whether to buy or sell.

In the meantime, anyone who is engaged in real trading and tries to analyze complex zigzag curves of charts has two more important practical questions:

- Where can you find a clear definition of a bullish or bearish trend?

- If the essence of the solution to the problem is so simple (trade with the trend and do not worry about anything), then why do most traders continue to “lose” deposits with enviable consistency?

It is often said about the chaos that reigns in the heads of traders. It can be seen in numerous discussions on forums concerning the application of classical theory in practice.

For example, in such disputes, one can notice attempts to literally transfer the conclusions of theorists, including the classics of the past, to the modern foreign exchange market and apply them without any adjustment to existing conditions.As a result:

- some blindly follow the definition of Charles Dow: A trend is a directional price movement, in which each subsequent high is higher / lower than the previous one and each subsequent low is higher / lower than the previous one. At the same time, they do not even admit that such a definition may turn out to be outdated for the modern market;

- others take advantage of Eric Nyman's statement: There are no hard and fast rules. As a result, even attempts to determine the current trend in the market stop, and the trader begins to open orders wherever they go.

Agree, both the first and second points of view are harmful for a person who wants to make deliberate operations in Forex and consistently make a profit.

The classic definition of Charles Doe and modernity

Charles Doe gave the classic definition of the trend back in the 30s of the last century. But until now, it migrates from textbook to textbook, causing irreparable harm to Forex traders. Few of them ponder why Charles Doe's definition does not reflect the realities of the current trend.

Is each subsequent high really higher / lower than the previous one and each subsequent low higher / lower than the previous one?

And this is where the logic of placing stops comes from. Using the Bill Williams "safety cushion", which is also mentioned in almost all textbooks, traders set them just a few points above / below the supposed top or bottom.

As a result, positions are automatically closed prematurely. It’s also good if we are talking about a lack of profit, and not about fixing losses in potentially profitable trades.

Here's how the classic stop loss technique leads to the loss of positions in Forex:

Setting stops according to Charles Doe theory

However, in real trading, we can see a completely different picture, when, with a continuing trend, the highs and lows are not formed the way Dow wrote about it. What will happen to the trader's deposit if he tries to apply the classical theory in this case:

Movement of quotes along a trend, in which blindly following the advice of Charles Doe and Bill Williams will lead to losses

Directional price movement between two reversal patterns in opposite directions

A trend is a directed price movement between two reversal patterns in opposite directions. Movement in each direction is zigzag: after each wave of impulse, a wave of retracement follows.

The ratio of momentum and correction to each other shows the direction of the trend:

- in a bullish trend, the length of the upward impulse is longer than the corrective bearish wave;

- in a bearish current, the length of the bearish impulse is longer than the corrective upward wave;

- in lateral movement, the impulse and correction lengths are the same.

The movement of quotes in an upward trend

And here is a real example of trading the USD / CAD currency pair, when a head and shoulders reversal pattern led to a change in an uptrend to a downtrend:

- the downward impulse is LONGER than the upward correction;

- the bearish trend on w1 for the USD / CAD currency pair continues until a reversal pattern appears.

Change of direction after the appearance of the "head and shoulders" pattern

And on this w1 chart for the USD / CAD currency pair, you can see that the bearish trend continues in 2003-2006, since the reversal pattern has not been formed:

Bearish trend is unchanged as there is no reversal pattern

The trend continues until there are clear signs of a reversal

That is why reversal patterns are so important. Each directional trend begins with one such pattern and ends with another. The distance between them is the area where this or that TREND develops. For practical application, a trader must remember that:

- the upward trend in quotes starts from one of the reversal patterns of the PREVIOUS bearish trend;

- the continuation of the price movement in the bullish direction is also confirmed by one of the corresponding patterns. Such patterns are types of pullbacks that allow you to open trades with a trend;

- the end of the rise in prices is accompanied by the appearance of the next reversal pattern.

Trend reversal

Classic trend reversal patterns can be divided into two categories:

- Patterns in which the next resistance or support level is not broken (respectively, in the bullish and bearish directions):

- double top;

- triple top;

- double bottom;

- triple bottom.

- Reversal patterns in which a false breakout of the next resistance or support level occurs:

- head and shoulders;

- inverted head and shoulders;

(Drawings of classic patterns are taken from books by Murphy, Schwager, Elder, Luke, Nyman).

Triple top

Triple bottom

Triple "top" and "bottom" lead to a change in the direction of the trend

Head and shoulders

Inverted head and shoulders

Continuation of the trend

Their essence is mainly reduced to the rules of the zigzag movement of quotes:

- After the impulse, the software is rolled back AGAINST it.

- The length of the impulse is always greater than that of the correction (the axiom of Elliott wave analysis).

- Continuation patterns are VARIATIONS of Elliott retracement waves.

Therefore, each of these CONTINUATION patterns has the same properties as a correction (pullback), followed by another wave within the existing trend.These patterns include:

- gap (Gaps);

- quadrangle;

- triangle;

- flag;

- pennant;

- wedge.

For example, in a bullish flag pattern, an upward impulse is LONGER than a pullback to the bottom:

Bullish flag

Bullish pennant

Bull wedge

Quadrangle

General conclusions

- A trend is a directed price movement between two reversal patterns in opposite directions.

- The movement is zigzag. Each impulse wave is followed by a pullback wave. This ratio of momentum and correction to each other shows the direction of the course.

- Classic continuation patterns are correction (rollback) patterns, after the end of each of which there is another wave of growth / decline in a given direction.

Consider again the example given at the beginning of this chapter. According to the classical canons, the rate should reverse, since, as seen on the chart, the price dropped below the previous minimum (1.9647). But the growth continues!

An example of a trend continuation contrary to Dow theory

Here we can draw two important conclusions:

- The trend does not necessarily reverse if Charles Doe's rule that retracements tops and bottoms must be ABOVE previous ones is broken.

- Instead of setting stop losses, it is better to use the lock-lock method.

For the staunch supporters of stop loss limiting, we ask a few questions: “Are you sure the trend WILL BREAK at this point? When in doubt, why place a stop?

If you are sure, why don't you open an order in the opposite direction immediately at the same time as the stop? How many traders in the world do you think, apart from you, set a stop loss at this point AS YOU? Are you sure that the Forex Game Organizer will not be tempted to knock them out of all traders in the world with one move, and then continue the OLD trend again? "

This example is taken from real trades on 01.12.2006. It makes you think about a few more questions:

- WHY are traders all over the world taught to set stop losses at the same points?

- WHY are outdated theories of Charles Doe and other classics of technical analysis being printed in millions of copies for ALL forex traders?

- Why is the share of losing traders approximately the same all over the world (97-99%)?

For your luck, study the chapters on reversal and trend continuation patterns in detail and carefully disassemble:

- the nuances of each rollback (correction);

- the nuances of each reversal pattern;

- inaccuracies and omissions in the works of the classics of technical analysis.

prompt

The chart shows that a reversal could have occurred in the middle of an uptrend. But the price did not continue to fall, since the emerging "head and shoulders" pattern has not been fully formed. Otherwise, the scenario would have developed according to options "A" or "B": quotations would begin to decline according to the reversal pattern.

The reversal pattern did not form: prices continued to rise

Swing trading databaseHello readers of the trading blog. Today we have on the order of the day an overriding topic - what is trend or trend (same thing). Why crucial? And tell me, how many times have you, regardless of your period of passion for trading, heard such expressions: “ trend is your friend" or " do not trade against the trend". These phrases are heard by reading any book on securities trading or browsing the forums. Willy-nilly, you understand that you need to listen to these words and, most importantly, understand. On this page we will analyze what a trend is.

For many, trend-following trading is associated with positional trading. In fact, any trader, be it intraday, swing, or positional, looks for a trend on the chart. Give yourself an answer to the question: why?

Based on the information we have already received about market phases and Elliott Wave Theory, it can be authoritatively asserted that the trend is a gold mine, a source of profit. The trend is really our friend. Therefore, the ability to recognize the trend and its changes on the chart (learn how to determine a trend reversal in 80% of cases) is the primary concern.

Running a little ahead of myself, I will say that to determine the direction of the market, we will use a moving average, which will greatly simplify our trading. And now a little theory.

What is trend - definition and main characteristics

Once, on a chat for traders, I read the following correspondence (nicknames are invented):

- Beginner: how an uptrend and a downtrend are determined

- Experienced: if you look at the chart and see that the price is moving towards the upper right corner of the screen, this is an uptrend. If to the bottom - descending.

All ingenious is simple. This could be the end of the trend definition, but ... Every self-respecting trader should speak the language of technical analysis.

A trend is a vector that indicates the direction of market dynamics. It consists, as you already know, of separate waves: rising and falling, which in turn form tops and bottoms. You can observe three types of trend: uptrend, downtrend, horizontal. In literature, the latter is also called flat, trading range or side corridor... All these values are equivalent.

Remember the article in which we discussed the phases of the market? So, the second phase is an uptrend and is characterized by a series of rising tops and bottoms.

Downtrend

The fourth market phase is the downtrend. It is characterized by a series of declining peaks and troughs.

Below is a schematic representation of the trends:

BB - towering peaks

VM - Rising Lows

PV - descending peaks

PM - falling lows

Trendvs... flat

A flat or trading range is the first and third phases of the market. It has been noted a long time ago, and we will only confirm, that the markets are trending about 30% of the time. In the rest of the period, they move in any side corridors without a definite direction. This is how a trading range looks like schematically:

Trading range. Prices move with no apparent direction. This means that neither sellers nor buyers are in certainty. Should you look for profit here?

As we can see, prices move in a completely disordered manner. Of course, there are trading strategies dedicated to working in the trading range of the market. But why complicate your life and trade securities that "jump" up and down, if you can choose those that show beautiful, reliable trends. If you are trying to make money in the trading range, then this is a direct way to drain all your capital down the drain. Stick to trends!

Here is an example of a stock with a strong uptrend:

A great example of an uptrend from Apple.

And this security is trading in a trading range.