Beeline opens up new opportunities for its customers. Now he issues a plastic cardmastercard. You will learn about its features and options for use from the article.

What can a plastic card Beeline

With a Beeline plastic card, its owner has the opportunity to:- Go shopping. If he does this abroad, then the currency is converted at the rate set by the Bank of Russia.

- Pay for goods, services that are ordered via the Internet.

- Make recurring payments automatically.

- Transfer money.

- Make loan payments.

- Receive bonuses.

- Participate in promotions.

The card is issued and maintained free of charge. Beeline also provides a credit limit with the following options:

- use money for 2 months on privileged terms (without%);

- collect extra bonuses;

- perform the same operations as with a debit card.

Unlike the MTS plastic card, which is served by the bank of the same name, the Beeline loan is provided by Alfa-Bank.

- To control the bonus account, write sms to 6119, writing "Balance" from the phone that is linked to the plastic card. You will be informed about the remaining money and the number of bonuses.

- For contact with information center Beeline, you need to remember the code word. You will recognize it from the SMS on your phone, which will come immediately after purchasing a plastic card.

- A place was provided for the signature on the "plastic". Try to ensure that the autograph on the card and in the passport do not differ.

- When paying for goods, you may be asked to confirm that the card is yours. Since, by analogy with the MTS-money plastic card, the Beeline card is not registered, take with you the agreement concluded during the issuance of the card.

Beeline income card - today it is one of the best card products with free options and additional features. The plastic is equipped with the Paypass function for contactless payments and SecureCode protection for secure online transactions over the Internet.

Who is the card for? Why is she needed?

Profitable debit card Beeline RNKO Payment Center was created for people who need not only a standard payment card to use it daily, but also the opportunity to receive additional income.

Due to the accrual of interest on the balance, plastic performs the function of a contribution. At the same time, the conditions for guaranteed accrual are easier to fulfill, unlike most other organizations, and the percentage itself is above average.

The card also has a profitable function due to the return of part of the funds from transactions made with its use (cashback). Moreover, for all operations, an average fixed cashback is accrued, and for purchases in Favorite Stores, an increased cashback, increased by 5 times, is accrued. In this case, the client can choose up to 3 favorite stores. For example, these can be chain supermarkets near the house, a favorite cafe, etc.

Using the card is equally beneficial for both a pensioner or student, and ordinary workers and owners small business. Due to free service and SMS-banking, the card is available to anyone.

Advantages of plastic for the owner

Advantages of income debit card Beeline is really enough:

- Free issuance and maintenance, free SMS-Bank with WORLD premium card from Mastercard.

- Interest accrual on balance minimum requirements that anyone can do.

- Cashback for any card transactions, as well as increased cashback for your favorite stores, purchases at pharmacies, gas stations and restaurants. Up to 15% bonuses are returned from purchases from Beeline card partners: Perekrestok, Kari, Litres, etc.

- Free cash withdrawal from any ATM within the monthly limit. If you withdraw more, you will be charged a commission for the amount of the overlimit.

- Unlike the same Megafon card, it is not necessary for the owner of the Beeline card to connect services cellular communication. The client can have any mobile operator, since the card is not tied to the balance.

- Any able-bodied citizen of the Russian Federation over the age of 18 can apply for plastic if they have a passport.

- A wide network of Beeline mobile offices where you can arrange plastic. There are offices in almost every locality with a population of more than 50 thousand inhabitants, so the card can be obtained in any region of the Russian Federation.

Card Disadvantages

The Beeline debit income card has practically no flaws, with the exception of minor flaws:

- Small withdrawal limit per month without commission.

- Cashback is returned not with real money, but with bonuses that can be spent on communication or on payment for goods in partner stores.

How to get a Beeline card?

Ordering a Beeline card via the Internet will not work. The fact is that in order to process plastic, the client must personally contact the nearest Beeline mobile office with a passport and report his desire to receive a card.

Next, the consultant will fill out an application for income card Beeline and will offer to sign the relevant documents. After that, it will issue an unnamed instant issue card with all privileges and bonuses.

Subsequently, the client can order the issue of a personalized bank card Beeline in your personal account of Internet banking.

The average production time of plastic takes about 5-7 days. The same can take delivery to the desired location.

Bonuses and discounts on the Beeline card

The only bonus program available to Beeline cardholders is a kind of cashback, thanks to which from 1% to 15% of the purchase amount is returned to a special account with bonuses at the rate of 1 bonus = 1 ruble.

The percentage of deduction directly depends on the place of payment by card. So, for example, for any purchases on the card, the client receives a fixed 1% of the amount to the bonus account.

For using the card at gas stations, pharmacies and restaurants - 5% of the transaction amount. But for purchases from partners you can earn up to 15%.

At the same time, there are restrictions on the maximum amount of credited bonuses per month, which should not exceed 3,000 rubles.

The accumulated bonuses can be spent on free Beeline communication, payment for up to 99% of the cost of phones, smartphones or accessories at Beeline offices, as well as goods from partners. Among the partners are Perekrestok, Litres, Kari, Kari Kids, Apteka.ru, RAMK, etc.

Bonuses are also waiting for cardholders from payment system mastercard. These are discounts from partners around the world: Formula Cinema, Burger King, Shokoladnitsa, iLux, Taxi Friday, Kinokhod.ru, etc.

Also all owners plastic cards Mastercard can take part in the "Priceless Cities" promotion, which guarantees a discount of up to 20% when paying with a card for tickets to the most significant cultural, gastronomic and sporting events in one of the 33 participating cities around the world. Among them are Moscow, St. Petersburg, London, Shanghai, Paris, New York, etc.

Beeline debit card in 2018year. Of course, they will seem more interesting to customers using the connection of this operator.

Get a Beeline card

Beeline debit card, getwhich can be at any office of the company, in 2018 is issued in two formats: Mastercard Standard or World. Absolutely any citizen who applied with a passport can get standard plastic. To request world map you need to act as a subscriber of the company and have 500 rubles, which you need to put on the account when issuing. Having one of these cards, any client has the right to exchange it for a contactless one, the tariffs and terms of service of which can be found on the operator's website.

Contactless card

Contactless cardW orld M astercard Beeline refers to an international product that can be used worldwide. When exchanging, the account balance, accumulated bonuses and other parameters are automatically transferred to New Product. The convenience of the contactless option is major degree security, because any payment operations or using payment terminals are made by touching - bringing plastic to the device.

Get Beeline contactless cardcan also be done via the Internet. To do this, you need to fill out an application, and the card will be sent by mail. The delivery fee is 200 rubles.

You can order a contactless World Mastercard Beeline card by leaving a request on the company's website and receive it by mail, tariffs can be found on the company's website

You can order a contactless World Mastercard Beeline card by leaving a request on the company's website and receive it by mail, tariffs can be found on the company's website Card limits

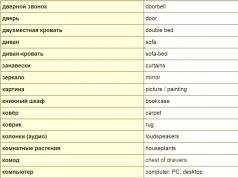

If we consider the tariffs of 2018, the limits on the Beeline debit card are providedin these sizes:

- balance on mastercard standard or World: up to 100 thousand rubles;

- balance on contactless and when connecting the function of receiving income on the balance: up to 600 thousand rubles;

- translation into bank accounts: 1 million rubles;

- receiving cash in banks that are partners of the "Golden Crown" (according to pre-order transactions via the Internet): 1 million rubles;

bonus program

The World format debit card allows you to receive points in the following sizes:

- 1% of the purchase amount;

- 5% of the costs at gas stations, pharmacies and restaurants;

- up to 15% from partners of the company.

Bonuses are not accrued when making payments via the Internet Bank and mobile app. You can use the accumulated points to replenish your phone account or to receive a discount at the offices of partners or Beeline.

Beeline debit card within bonus program 2018 allows its users to accumulate points that can later be used for payment mobile communications and shopping

Beeline debit card within bonus program 2018 allows its users to accumulate points that can later be used for payment mobile communications and shopping Profitability of the Beeline card

At the office of the company, you can connect the option "Interest on the balance". This allows you to receive income on the balance under the following conditions:

- 4.6% with a balance of 0.5-15 thousand rubles;

- 5.1% - 15-50 thousand rubles;

- 7.2% - 50-150 thousand rubles;

- 9% - over 150 thousand rubles.

When issuing a Beeline debit card, you can also connect an additional option that allows you to receive income on the balance Money on the map

When issuing a Beeline debit card, you can also connect an additional option that allows you to receive income on the balance Money on the map Cost and tariffs

Debit card Beeline tariffs in 2018has a very loyal. Any of the Beeline debit card options is issued and serviced free of charge. When withdrawing cash from an ATM, no commission is charged if we are talking about the amount over 5 thousand rubles. With a smaller amount, the commission is 99 rubles. Withdrawal of the amount over 50 thousand rubles is not subject to additional payment. You can use devices of any banks.

Transfers to accounts in any banks and replenishment of the card occur without commission. Internet banking services, SMS informing and mobile application are free.

conclusions

As seen, Beeline debit cardacts as a convenient payment instrument for the operator's customers. It allows you to receive bonuses and income on the balance, as well as perform simple banking operations for free (deposit, transfer, withdrawal). Tariffs and terms of service for the Beeline 2018 debit card can be found on the company's website.

Beeline credit card is a payment plastic card that allows you to make purchases in stores and on the Internet, pay for services and receive bonuses. When paying for purchases with a card, the received points can be used to pay for mobile communications.

Modern shops, supermarkets, cafes and pharmacies are equipped with terminals, and it is possible to pay for goods or services not in cash, but with credit cards. The greater the turnover of funds on the card, the more bonuses you can get.

Peculiarities

Map mobile operator is not banking, this is the main difference from other credit cards.

Beeline offers to issue such cards:

- Master Card Standard;

- World Master Card;

- Nominal contactless.

The standard can be issued by any subscriber even of another operator. When making a payment, 1% of the amount is a bonus.

World can only be issued by Beeline subscribers and at the same time the bonus percentage is higher, and amounts to 1.5%.

The name card is equipped with a chip - the most prestigious, provides more financial opportunities with high level protection and security. Beeline subscribers who previously issued Standard or World can get a card.

Use Beeline cards very profitable:

Credit limit

Beeline cardholders can provide a passport at the operator's office, issue a credit limit and use the funds in the grace period.

The maximum loan amount is 300,000 rubles with a grace period of 60 days. During grace period interest is not charged, it is possible to return the amount spent without overpayments.

When withdrawing cash from cards with a credit limit, a commission of 4.9% and an additional 500 rubles are charged, regardless of the amount.

Name card

Beeline subscribers can apply for a personalized card online, through their Personal Account.

Chip card support wireless communication more secure and convenient.

There is no need to pay for the production and maintenance of the card, only delivery by mail in the amount of 200 rubles is paid.

Terms and rates

The Standard card allows you to use the amount up to 15,000 rubles with a grace period of 60 days. The annual percentage is 41.99%. You need to deposit an amount of 100 rubles on the card.

Photo with conditions and comparative characteristic bank cards:

When applying for a World Master Card, 300,000 rubles are provided interest-free during a sixty-day grace period. When registering, the subscriber deposits 3,000 rubles to the account. Interest rate 34.99% per annum, bonus - 1.5% on all purchases, in some categories of goods, cashback can be 5%. When withdrawing cash from an ATM, the commission is 500 rubles plus 4.9% of the withdrawn amount.

Clients who have one of the Standard or World cards will also be able to issue a personalized card for free, all bonuses and funds will be automatically transferred from the previous card. You don't need to top up your account.

How and where to apply?

A citizen of the Russian Federation aged 21 to 65 years old can issue a card; a passport and any other document are needed.

After filling out the questionnaire, a Beeline office specialist will send an application, in half an hour there will be an answer, if it is positive, then in another half an hour the card will be ready.

Beeline credit card from Tinkoff

Tinkoff Bank issues a loan from 15,000 to 30,000 rubles. with a rate of 34.9%, a grace period of 55 days. For the first year of service, you need to pay 500 rubles, then - free of charge. Commission for cash withdrawal 4.9% of the amount and an additional 500 rubles.

Tinkoff Bank issues a loan from 15,000 to 30,000 rubles. with a rate of 34.9%, a grace period of 55 days. For the first year of service, you need to pay 500 rubles, then - free of charge. Commission for cash withdrawal 4.9% of the amount and an additional 500 rubles.

The age of the borrower must be from 18 to 70 years, he must have the citizenship of the Russian Federation and a cell phone number.

Credit card Beeline from Alfa-Bank

Alfa-Bank issues from 15000 to 90000 r., with an interest-free period of 60 days and a rate of 35.99%. You don't have to pay for the service. When withdrawing cash, the commission is 4.9% plus 500r.

Alfa-Bank issues from 15000 to 90000 r., with an interest-free period of 60 days and a rate of 35.99%. You don't have to pay for the service. When withdrawing cash, the commission is 4.9% plus 500r.

The borrower can be a citizen of the Russian Federation aged 21 to 65 who has a driving license or a passport, landline phone living in the Beeline office area, with work experience of 3 months or more.

Also, proof of income must be provided.

Can I apply online?

How to get a credit card online? It is possible to issue a card through the company's website. On the "Payment and Finance" tab, go to "Beeline card", then "Get a card".

We fill out a short questionnaire: indicate the name, phone number, address Email, passport data, residence permit and the amount of income. Submitting the application for review.

If the application is approved, then you can get a card at the nearest office.

Payment cabinet

It is very convenient to replenish the account, control all operations, make payments through the payment cabinet.

In the cabinet you can check bonuses, it is possible to pay from the bonus account for communication services and the Internet.

You can create recurring payments and automatically top up your phone account, as well as use transfer and payment templates.

Getting a pin code

The PIN code can be obtained by calling 8 800 234 57 55 within 14 days after receiving the card from the phone associated with the card. The call is free .

If more than 14 days have passed, the help desk will help 8 800 700 61 19.

How to find out the balance of a Beeline credit card by sms?

You can find out the balance not only through the payment account, but also using the phone through special application or sms.

If you send an SMS to number 6119 with the word balance, then in response you will receive an account balance. For Beeline customers, SMS is free.

Through messages, the company will remind you of the amount and terms of the minimum loan installment. It is advisable to pay off the debt a few days before the deadline.

A detailed statement can be ordered by calling 8 800 700 61 19.

Pros and cons

The main advantage of the Beeline card is free service and obtaining a loan under a simplified scheme. It is possible to transfer money to other accounts without commission.

The main advantage of the Beeline card is free service and obtaining a loan under a simplified scheme. It is possible to transfer money to other accounts without commission.

A convenient program of bonuses for purchases made, the ability to pay for goods and services on the Internet with a credit card. It is also possible to convert funds into other currencies.

The advantages also include a convenient payment account, where you can find out the balance of the spending limit, simple replenishment of the account with mobile phone, through the terminal, at the operator's office or with a transfer from another card.

The main disadvantage is that if you need a loan in Beeline in cash, then the commission is 4.9% + 500 rubles. The disadvantage can be considered the lack of a credit limit, a relatively small loan amount. Big enough annual percentage 34.99% for using cash.

Beeline credit cards are not bank, deposits are not insured. Moreover, it is limited maximum amount(up to 100000r) own funds that can be deposited on the card.

After weighing all the pros and cons, we can conclude that Beeline's payment instrument is quite convenient in daily use. Simplicity and speed of registration gives the right to use advantageous offer from the largest mobile operator and make purchases with cashback. The main thing to remember is that timely payment of the loan a few days before the end of the grace period will save you from unpleasant delays in payments and extra interest on the use of funds.

Survey for visitors

Video: How to get a credit card

There are many videos on the Internet about what microcredit is and how to get a credit card from a telecom operator. Check out one of them on YouTube: