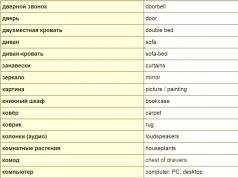

2.1. The concept of long-term financial policy of the enterprise, its importance in the development of the enterprise

In a market economy, fierce competition, the importance and relevance of long-term financial policy. It is obvious that the well-being of an enterprise fundamentally depends on the proper organization of financial policy. The main problem of most domestic enterprises is the inability of management to manage the enterprise in accordance with modern economic realities. Undoubtedly, Russian enterprises have extensive experience in the development of financial policy, forecasting and planned work, estimates economic efficiency projects that should not be ignored. However, use in modern conditions theories that have lost their economic relevance, inevitably leads to a crisis in the management of many domestic enterprises. Business conditions have changed, so it is necessary to form a long-term financial policy, taking into account not only Russian practice but also the achievements of the world economy.

With the development of market relations in our country, the increase in the efficiency of the financial policy pursued by enterprises is gaining momentum. greater value. It is for this reason that "Long-term financial policy» as an independent study course is included in the curricula of universities in accordance with the new State Educational Standard.

The relationship of the directions of development of the enterprise, as well as the construction of a mechanism for achieving these goals with the help of financial resources, are implemented through financial policy.

Financial policy of the enterprise- a set of measures for the purposeful formation, organization and use of finance to achieve the goals of the enterprise.

Financial policy is the most important component of the general policy of enterprise development, which also includes investment policy, innovation, production, personnel, marketing, etc. If we consider the term "politics" more broadly, it is “actions aimed at achieving a goal”. So, the achievement of any task facing the enterprise, in one way or another, is necessarily connected with finance: costs, income, cash flows, and the implementation of any solution, in the first place, requires financial support. Thus, financial policy is not limited to solving local, isolated issues, such as market analysis, developing a procedure for passing and agreeing contracts, organizing control over production processes, but is comprehensive.

Currently, in many enterprises, financial resources are spent on coordinating conflicting tasks and solutions for different levels management, so it is difficult to move on to the next stage - the choice of optimal mechanisms that allow as soon as possible and achieve your goals at the lowest possible cost.

Basis for long-term financial policy- a clear definition of a single concept for the development of an enterprise in the long term, the choice of optimal mechanisms for achieving the goals set from the whole variety, as well as the development of effective control mechanisms.

Long-term fiscal policy provides answers to next questions.

How to optimally combine the strategic goals of the financial development of the enterprise?

How to achieve the set goals in specific financial and economic conditions?

What mechanisms are best suited to achieve the goals?

Is it worth changing financial structure enterprises using financial instruments?

How and by what criteria can the achievement of the set goals be monitored?

Goals, objectives and directions of formation of long-term financial policy

The main goal of creating an enterprise– ensuring the maximization of the welfare of the owners of the enterprise in current period and for the future. This goal is expressed in ensuring the maximization of the market value of the enterprise, which is impossible without the effective use of financial resources and the construction of optimal financial relations both at the enterprise itself and with contractors and the state.

To implement the main goal of financial policy, it is necessary to find the optimal ratio between strategic directions:

1) profit maximization;

2) ensuring financial stability.

Development first strategic direction allows owners to receive a return on invested capital, second direction provides the enterprise with stability and security and relates to risk control.

Development financial strategy implies certain stages:

1) critical analysis of the previous financial strategy;

2) substantiation (adjustment) of strategic goals;

3) determining the duration of the financial strategy;

4) concretization of strategic goals and periods of their implementation;

5) distribution of responsibility for achieving strategic goals.

Sometimes non-economic components are also included in the strategic goals of an enterprise, such as motivation for power, prestige, security of owners, and management. In addition, one should not neglect the fact that large companies are subject to pressure from the state and are forced to take on social, environmental and other goals that often run counter to their internal goals and, especially, to the goals of the owners themselves.

Financial tactics- these are operational actions aimed at achieving one or another stage of the financial strategy in the current period.

Thus, in contrast to the financial strategy, financial tactics is associated with the implementation of local tasks of enterprise management.

In order to maximize profits, it is necessary first strategic direction:

increase sales volume;

effectively manage the process of formation of profitability;

uninterruptedly provide production with financial resources;

control costs;

minimize the period of the production cycle;

optimize the amount of reserves, etc.

minimization of financial risks;

synchronization of cash flows;

careful analysis of counterparties;

sufficient volumes Money;

financial monitoring, etc.

It is necessary to rank strategic goals, for example, by setting weights. When optimizing the capital structure, managing current assets or any kind of cash flows, it is important to choose the right development priorities, since both the degree of financial stability of the enterprise and the level of production profit depend on this.

The priority of strategic goals periodically changes both at one enterprise and from enterprise to enterprise. Many factors influence the priority of a particular strategic goal, which together can be divided into two categories: internal and external.

Main internal factors:

1) the scale of the enterprise;

2) the stage of development of the enterprise itself;

3) the subjective factor of the management of the enterprise, owners.

Enterprise scale plays an important role. In small and medium-sized enterprises, autonomy (independence) usually occupies a dominant place. In large enterprises, the rate of profit prevails in the strategic direction, and the greatest attention is paid to economic growth.

Enterprise development stage significantly affects the ranking of its strategic goals. concept "cycle of life" allows you to identify the problems that arise in the enterprise throughout the entire period of its development, and clarify various combinations financial tasks who successfully guide its activities.

AT childhood when the turnover of the enterprise is small, the enterprise mainly faces survival problems that arise in the financial sector in the form of difficulties with cash; he needs to find funds not only directly to meet the economic expenses, but also to the necessary investments for his future development. This is where financial stability plays the most important role.

AT adolescence growth in sales volumes, first profits allow the company to solve its problems with cash, and its leaders can gradually shift the goals from financial stability to economic growth.

AT maturity period When an enterprise has already occupied its niche in the market and the ability to self-finance is quite significant, the enterprise tries to extract the maximum profit from all the opportunities that its size gives it, as well as technical and commercial potentials.

AT old age When the growth of turnover slows down, the vector of strategic development of the enterprise again moves towards financial stability.

In addition, the vector of strategic development of an enterprise also depends on subjective factor. As a rule, the main goals are formed by the owners of the enterprise. On the large enterprises when there are many owners, for example, a large joint-stock company, the main strategic directions can be formed by the board of directors or the general director, but in the interests of the owners. Indeed, despite the fact that shareholders do not directly make business decisions, especially daily ones, they remain loyal to the enterprise as long as their interests are satisfied.

External factors also have an impact on the priority of a particular strategic goal of the enterprise. In particular, the state of the financial market, tax, customs, budgetary and monetary policies of the state, the legislative framework affects the main parameters of the functioning of the enterprise.

In this way, long-term financial policy is always a search for a balance, the optimal ratio of several areas of development at the moment and the choice of the most effective methods and mechanisms to achieve them.

The financial policy of an enterprise cannot be unshakable, determined once and for all. On the contrary, it should be flexible and adjusted in response to changes in external and internal factors.

One of the main principles of financial policy- it should be based not so much on the actual situation as on the forecast of its change. Only on the basis of foresight does financial policy acquire stability.

2.3. Subjects and objects of long-term financial policy of the enterprise

Long-term financial policy- the basis of the financial management process of the enterprise. Its main directions are determined by the founders, owners, shareholders of the enterprise. However, the implementation of a long-term financial policy is possible only through the organizational subsystem, which is a set of individual people and services that prepare and directly implement financial decisions.

Implement long-term financial policy in enterprises in different ways. It depends on the organizational and legal form of the business entity, the scope of activities, as well as the scale of the enterprise.

Subjects of management in small enterprises, a manager and an accountant can act, since small business does not imply a deep division of managerial functions. Sometimes external experts and consultants are involved to adjust development directions.

At medium-sized enterprises, current financial activities can be carried out within other departments (accounting, planning and economic department, etc.), while serious financial decisions (investment, financing, long-term and medium-term distribution of profits) are made by the general management of the company.

In large companies, it is possible to expand the organizational structure, staffing and quite clearly differentiate powers and responsibilities between:

information bodies: legal, tax, accounting and other services;

financial authorities: financial department, treasury department, securities management department, budgeting department, etc.;

control bodies: internal audit, audit.

In large enterprises, the structure for the development and implementation of financial policy may be centralized or decentralized. However, even in a decentralized structure, financial activity remains tight in the strategic directions of development.

Main control objects have following directions.

Capital Management:

determination of the total capital requirement;

capital structure optimization;

minimization of the price of capital;

ensuring the efficient use of capital.

Dividend policy: determination of the optimal proportions between the current consumption of profit and its capitalization.

Asset Management:

determination of the need for assets;

optimization of the composition of assets from the standpoint of their effective use;

ensuring the liquidity of assets;

acceleration of the asset turnover cycle;

selection of effective forms and sources of asset financing.

When developing and implementing a long-term financial policy, the management of an enterprise is forced to constantly make management decisions from a variety of alternative directions. Choosing the most profitable solution essential role plays timely and accurate information.

Information support of the financial policy of the enterprise can be divided into two major categories: formed from external sources and internal.

The system of indicators for information support of the financial policy of the enterprise, formed from external sources:

Indicators characterizing general economic development

growth rate of gross domestic product and national income;

volume of issue of money in the period under review;

cash income of the population;

deposits of the population in banks;

inflation index;

central bank discount rate.

Indicators characterizing the financial market situation:

types of basic stock instruments (shares, bonds, etc.) circulating on the exchange and over-the-counter stock markets;

quoted offer and demand prices of the main types of stock instruments;

credit rate individual commercial banks, differentiated by the timing of the provision of financial loans;

the deposit rate of individual commercial banks, differentiated by demand deposits and term deposits;

the official exchange rate of individual currencies.

Indicators characterizing the activities of contractors and competitors.

Regulatory indicators.

The system of indicators for information support of financial management, formed from internal sources , divided by two groups.

Primary information:

accounting forms;

operational financial and management accounting.

Information obtained from financial analysis:

horizontal analysis (comparison of financial indicators with the previous period and for several previous periods);

vertical analysis ( structural analysis assets, liabilities and cash flows);

comparative analysis(with industry average financial indicators, competitors' indicators, reporting and planned indicators);

analysis financial ratios(financial stability, solvency, turnover, profitability);

integral financial analysis, etc.

In addition, the enterprise must pursue an open information policy, especially with potential investors, creditors, and authorities. Long-term financial policy, not supported by regular, reliable information exchange with investors, adversely affects the market value of the enterprise.

3. Methods of formation of long-term financial policy of the enterprise

Abstracts

3.1. Equivalence of different types of interest rates

Let us continue a detailed study of methods for determining interest money, which are the essence of most financial calculations.

Equivalent interest rates- these are interest rates of different types, the application of which, under the same initial conditions, gives the same results.

Notation used before:

i- simple annual interest rate;

d- simple annual discount rate;

i c - Compound annual interest rate

d c - compound annual discount rate.

Equating pairwise formulas for determining the accumulated amount, one can obtain ratios expressing the relationship between any two different interest rates.

Equating ratios ![]() , we get:

, we get:

; (3.1)

Example 3.1

The maturity of the debt obligation is six months, the discount rate is 18%. What is the profitability of this operation, measured as a simple lending rate?

Solution.

We use the formula for a simple annual loan interest rate (3.1):

![]() .

.

Example 3.2

The loan was issued for six months at a simple loan interest rate of 19.8% per annum. What is the profitability of this operation, acceptable in the form of a simple discount rate?

Solution.

We use the simple discount rate formula (3.2):

From the formulas we can obtain the equivalent rates of the simple and compound annual loan interest rates:

; (3.3)

![]() . (3.4)

. (3.4)

Example 3.3

The initial amount is 300,000 rubles. invested for 2 years using a compound annual lending rate of 16%. Determine the equivalent simple annual lending rate.

Solution.

We use formula (3.3):

Example 3.4

The amount is 300,000 rubles. invested for 2 years using a simple annual lending rate of 17.28%. Determine the equivalent compound interest rate.

Solution.

We use formula (3.4):

The results of calculations in examples 3.3 and 3.4 confirm the correctness of the use of formulas.

For various cases of compound interest, we obtain an equivalence equation by equating the formulas ![]() :

:

![]() ; (3.5)

; (3.5)

![]() . (3.6)

. (3.6)

The resulting compound annual lending rate ( i c ) equivalent to the nominal interest rate is called effective compound interest rate.

3.2. Accounting for inflationary depreciation of money in financial decision making

Let S α - the amount, the purchasing power of which, adjusted for inflation, is equal to purchasing power amounts without inflation. Through ∆S Let us denote the difference between these sums.

Attitude ∆S/S expressed as a percentage is called inflation rate.

When calculating, the relative value of the inflation rate is used - inflation rate (α).

Then to determine S α we get the following expression:

S α =S+Δ S=S+Sα =S(1+α ) . (3.8)

Value (1 + α ) showing how many times S α more S(i.e., how many times prices have increased on average), they call inflation index (I and ).

I and = 1 + α. (3.9)

The dynamics of the inflation index over several years reflects the changes taking place in inflationary processes. It is clear that an increase in the inflation index for a certain period compared with the previous same period indicates an acceleration of inflation, a decrease indicates a decrease in its rate.

Let α be the annual rate of inflation. This means that in a year the sum S α // will be greater than the sum S α / by (1 + α) times. After another year, the sum S α // will be greater than the sum S α / by (1 + α) times, i.e., greater than the sum S by (1 + α) 2 times. After n years, the sum S α // will grow in relation to the sum S α / by (1 + α) n times. This shows that the inflationary growth of the sum S at the annual inflation rate α is the same as the accumulation of the sum S at the compound annual rate of interest α.

Of course, the same reasoning applies if any other time interval (quarter, month, day, etc.) is taken instead of a year.

It is very important to remember this analogy with compound interest, since one of the most common errors associated with calculating the inflation rate for a certain period is related precisely to the failure to take this circumstance into account.

Example 3.5a

Prices are rising by 3% every quarter. The bank attracts customers to invest at 13% per annum. It is required to determine whether such return on the contribution will cover the losses from inflation.

Solution.

Let us determine the inflation index by the formula (3.10):

Let us determine the inflation rate using the formula I and = 1 + α,where:

Answer.

The inflation rate is below the annual interest rate offered by the bank. The income from the deposit will cover the losses from inflation.

Example 3.5

If prices rise by 2% every month, then without thinking twice, they take 2% · 12 = 24% as the annual inflation rate. Such calculations are often used by banks and financial companies, attracting customers to invest, for example, at 25% per annum. Meanwhile, if the inflation rate is 2% per month, this means that prices increase by (1 + 0.02) = 1.02 times per month, and 1.02 times per year. 12 = 1.268 times. This means that the annual inflation rate is 1.268 - 1 = 0.268, i.e. the annual inflation rate reaches 26.8%. After such a calculation, the interest rate of 25% per annum loses its investment attractiveness and can only be considered in terms of minimizing losses from inflation.

If, in the usual case, the initial amount R at a given interest rate, it turns over a certain period into an amount S, then under inflation conditions it should turn into the sum S α , which requires a different interest rate.

Let's call her inflation-adjusted interest rate.

Let:

i α - the interest rate that takes into account inflation;

d α - discount rate that takes into account inflation.

Let us set the annual inflation rate α and the simple annual loan interest rate i. Then for the accumulated amount S, which, under inflation conditions, turns into the sum S α we get the formula:

For this sum, one more relation can be written:

Consider now various occasions interest rates adjusted for inflation. In this case, it is always convenient to use the value of the inflation index for the entire period under consideration.

For simple interest rates:

![]() . (3.13)

. (3.13)

At the same time, the equality must hold:

![]() . (3.14)

. (3.14)

Let's make an equivalence equation:

![]() ,

,

from which we get:

![]() . (3.15)

. (3.15)

Example 3.6

When issuing a loan in the amount of 40 million rubles. the real profitability of the operation, determined by a simple interest rate of 14% per annum, must be ensured. The loan is issued for six months, the inflation index will be 1.06. Calculate the value of the interest rate that compensates for losses from inflation and the accrued amount.

Solution.

According to the condition of the problem: P = 40 million rubles, n = 0.5 years, I = 0.14, I and = 1,06.

Using formula (3.15), we determine the interest rate that compensates for losses from inflation:

Using formula (3.11), we determine the accumulated amount:

The accumulated amount can also be determined by the formula (3.12):

The results of determining the accumulated amount are the same.

For the case of compound interest, to draw up an equivalence equation, we use the formulas:

From here:

Example 3.7

Initial capital in the amount of 20,000 rubles. issued for 3 years, interest is accrued at the end of each year at a rate of 8% per annum. Determine the accrued amount adjusted for inflation if the expected annual inflation rate is 12%.

Solution.

According to the condition of the problem, P = 20,000 rubles; n = 3 years; i c = 0.08; α = 0,12.

To determine the inflation index, we use formula (3.11):

According to the formula (3.12), we determine the accumulated amount:

3.3. Dividends and interest on securities. Profitability of operations with securities

Investments of money capital in various types of securities ( share in enterprises, loans to other enterprises against bills of exchange or other debt obligations) is an essential element of a developing market economy. Target financial investments– earning income and/or preserving capital from depreciation in the face of inflation. Therefore, it is necessary to be able to correctly evaluate the real income on various securities. Consider first the types of currently existing valuable papers, and determine the difference in the calculation of interest and the possibility of obtaining income from them.

The calculation of income for various types of securities is based on the formulas obtained in the previous paragraphs. Let's give some examples.

Example 3.8

Deposit certificate with a face value of 200,000 rubles. issued on May 14 with maturity on December 8 at 18% per annum. Determine the amount of income when accruing exact and ordinary interest and the amount of repayment of the debt obligation.

Solution.

We first find the exact (17 days of May + 30 days of June + 31 days of July + 31 days of August + 30 days of September + 31 days of October + 30 days of November + 8 days of December = 208 days) and approximate (17 days of May + 30 6 + 8 days of December = 205 days) is the number of days of the loan.

Forexact interest

from formulas ![]() we get:

we get:

I \u003d 0.18 200000 208 / 365 \u003d 20515 rubles.

Using the formula S \u003d P + I, we calculate the amount of repayment of the obligation:

S \u003d 200000 + 20515 \u003d 220515 rubles.

For the caseordinary interest There are several ways to calculate:

1) d = 208, K = 360. Then:

I \u003d 0.18 200000 208 / 360 \u003d 20800 rubles;

S \u003d 200000 + 20800 \u003d 220800 rubles.

2) d = 205, K = 365. Then:

I \u003d 0.18 200000 205 / 365 \u003d 20219 rubles;

S \u003d 200000 + 20219 \u003d 220219 rubles.

3) d = 205, K = 360. Then:

I \u003d 0.18 200000 205 / 360 \u003d 20500 rubles;

S \u003d 200000 + 20500 \u003d 220500 rubles.

Example 3.9

The payment obligation was issued for three months at 25% per annum with a maturity of 20 million rubles. Determine the income of the owner of this payment obligation.

Solution.

First, using the discounting formula, we determine the current value of the payment obligation:

.

.

The income of owner I will be:

I \u003d 20.0 - 18.824 \u003d 1.176 million rubles.

When buying (accounting) bills and other monetary obligations before maturity are used discount rates. Then the income accrued at the discount rate ( discount), becomes the income of the person who bought the bill when the due date comes. The owner of the bill receives the amount indicated in it, minus the discount, but ahead of schedule.

Example 3.10

The bill was issued in the amount of 10,000,000 rubles. due July 21st. The owner of the bill accounted for it in the bank on July 5 at a discount rate of 20%. Determine the bank's income and the amount received on the bill (K = 365).

Solution.

The period from the accounting date to the maturity date is 21 - 5 = 16 days.

According to the formula D = d S n, we obtain the bank's income:

D \u003d 0.2 10000000 16 / 365 \u003d 87671 rubles.

Accordingly, according to the formula P \u003d S - D, the amount received on the bill:

P \u003d 10000000 - 87671 \u003d 9912329 rubles.

When dealing with bonds source of income are fixed interest (in the case of coupon bonds), as well as the difference between the price at which the bond is purchased and the price at which it is redeemed. The redemption price of a bond is usually the same as its face value.

There are bonds without paying interest ( discount bonds), investing in which will be profitable only when they are purchased at a discount from face value, i.e. with a discount.

Let us introduce the notation:

N- face value of the bond;

P 0 - the purchase price of the bond;

I 0 - income from the bond;

n- period for which interest is charged;

i- interest rate;

i c is the effective compound interest rate.

When calculating income, use the concept bond rate (P k ):

Then:

(3.18)

Substituting expression (3.17) into this formula, we obtain:

![]() . (3.19)

. (3.19)

Example 3.11

A bond with a face value of 10,000 rubles, issued for five years, was purchased at a rate of 120. Calculate the yield on a bond if compound interest is accrued on it annually at a rate of 18%.

Solution.

The calculation of income on a bond is made according to the formula (3.19):

Introduction

capital financial planning dividend

Financial policy is a fundamental element in the financial management system, both at the macro and microeconomic levels. When organizing financial relations for the distribution, redistribution and use of gross domestic product and national income, the state determines the main goals and objectives facing society and, accordingly, the country's financial system, all its spheres and links.

Financial policy is the definition of goals and objectives for the solution of which the process of formation, distribution and redistribution of the gross domestic product is directed to provide financial resources for a continuous reproduction process and solve certain social, economic and political problems of society.

The main goal of financial policy is to create financial terms for the socio-economic development of society, improving the level and quality of life of the population. Achieving this goal is possible only with the effectiveness of specific forms of distribution, redistribution and use of the available financial resources of society and the financial potential of the state.

State represented by legislative (representative) and executive power is the main subject of the ongoing financial policy. It develops a strategy for the main directions of financial development for the future, determines the tactics of action for the coming period, determines the means and ways to achieve strategic goals. The subjects of financial policy are also local governments, organizations different forms property.

The objects of financial policy are monetary relations in the formation, distribution and use of funds of funds in all spheres and links of the financial system.

Financial strategy is a long-term course of financial policy, designed for a long-term perspective and, as a rule, providing for the solution of large-scale tasks.

Financial tactics - methods for solving financial problems in the most important areas of financial strategy.

The strategy and tactics of financial policy are interrelated.

. Long-term financial policy of the enterprise

1.1 Concepts and goals of the long-term policy of the enterprise

Financial policy of the enterprise- a set of measures for the purposeful formation, organization and use of finance to achieve the goals of the enterprise.

financial policy- the most important component of the general policy of enterprise development, which also includes investment policy, innovation, production, personnel, marketing, etc. If we consider the term « politics » more broadly, it is "actions aimed at achieving a goal."

So, the achievement of any task facing the enterprise, to one degree or another, is necessarily connected with finances: costs, income, cash flows, and the implementation of any solution, first of all, requires financial support.

Thus, financial policy is not limited to solving local, isolated issues, such as market analysis, developing a procedure for passing and agreeing contracts, organizing control over production processes, but is comprehensive.

Basis for long-term financial policy- a clear definition of a single concept for the development of an enterprise in the long term, the choice of optimal mechanisms for achieving the goals set from the whole variety, as well as the development of effective control mechanisms.

The main goal of creating an enterprise- Ensuring the maximization of the welfare of the owners of the enterprise in the current period and in the future. This goal is expressed in ensuring the maximization of the market value of the enterprise, which is impossible without the effective use of financial resources and building optimal financial relations both at the enterprise itself and with contractors and the state.

To implement the main goal of financial policy, it is necessary to find the optimal ratio between the strategic directions:

1. profit maximization;

2. ensuring financial stability.

The development of the first strategic direction allows the owners to receive a return on invested capital, the second direction provides the enterprise with stability and security and relates to risk control.

The development of a financial strategy involves certain stages:

· critical analysis of previous financial strategy;

· substantiation (adjustment) of strategic goals;

· determining the duration of the financial strategy;

· concretization of strategic goals and periods of their implementation;

· distribution of responsibility for achieving strategic goals.

It is always a search for a balance, the optimal ratio of several development directions at the moment and the choice of the most effective methods and mechanisms for achieving them.

The financial policy of an enterprise cannot be unshakable, determined once and for all. On the contrary, it should be flexible and adjusted in response to changes in external and internal factors.

One of the main principles of financial policy is that it should be based not so much on the actual situation as on the forecast of its change. Only on the basis of foresight does financial policy acquire stability.

Long-term financial policy- the basis of the process of financial management of the enterprise. Its main directions are determined by the founders, owners, shareholders of the enterprise. However, the implementation of a long-term financial policy is possible only through the organizational subsystem, which is a set of individuals and services that prepare and directly implement financial decisions.

Implement long-term financial policy in enterprises in different ways. It depends on the organizational and legal form of the business entity, the scope of activities, as well as the scale of the enterprise.

The subjects of management in small enterprises can be a manager and an accountant, since small business does not imply a deep separation of management functions. Sometimes external experts and consultants are involved to adjust development directions.

At medium-sized enterprises, current financial activities can be carried out within other departments (accounting, planning and economic department, etc.), while serious financial decisions (investment, financing, long-term and medium-term distribution of profits) are made by the general management of the company.

In large companies, it is possible to expand the organizational structure, staffing and quite clearly differentiate powers and responsibilities between:

· information bodies: legal, tax, accounting and other services;

· financial authorities: financial department, treasury department, securities management department, budgeting department, etc.;

· control bodies: internal audit, audit.

As a rule, the chief financial officer is responsible for posing problems of a financial nature, analyzing the feasibility of choosing one or another way to solve them. However, if the decision being made is significant for the enterprise, he is only an adviser to senior management personnel.

When developing and implementing a long-term financial policy, the management of an enterprise is forced to constantly make management decisions from a variety of alternative directions. Timely and accurate information plays an important role in choosing the most advantageous solution.

Information support of the financial policy of the enterprise can be divided into two large categories: formed from external sources and internal.

From external sources:

1.Indicators characterizing general economic development

countries:

· growth rate of gross domestic product and national income;

· volume of issue of money in the period under review;

· cash income of the population;

· deposits of the population in banks;

· inflation index;

· central bank discount rate.

This type of informative indicators serves as the basis for analyzing and forecasting the conditions of the external environment for the functioning of an enterprise when making strategic decisions in financial activities. The formation of a system of indicators for this group is based on published state statistics.

2.Indicators characterizing the financial market situation:

· types of basic stock instruments (shares, bonds, etc.) circulating on the exchange and over-the-counter stock markets;

· quoted offer and demand prices of the main types of stock instruments;

· lending rate of individual commercial banks.

The system of normative indicators of this group serves to make managerial decisions when forming a portfolio of long-term financial investments, when choosing options for investing free cash, etc. The formation of the system of indicators of this group is based on periodic publications of the Central Bank, commercial publications, as well as on official statistical publications.

3.Indicators characterizing the activities of contractors and competitors.

The system of informative indicators of this group is necessary mainly for making operational management decisions on certain aspects of the formation and use of financial resources.

4.Regulatory indicators.

The system of these indicators is taken into account when preparing financial decisions related to the peculiarities of state regulation of the financial activities of enterprises. Sources for the formation of indicators of this group are legal acts adopted by various government bodies.

From internal sourcesare divided into two groups.

1.Primary information:

· accounting forms;

· operational financial and management accounting.

The system of informative indicators of this group is widely used by both external and internal users. It is applicable in financial analysis, planning, development of financial strategy and policy on the main aspects of financial activity, gives the most aggregated view of the financial results of the enterprise.

2.Information obtained from financial analysis:

· horizontal analysis (comparison of financial indicators with the previous period and for several previous periods);

· vertical analysis (structural analysis of assets, liabilities and cash flows);

· comparative analysis (with industry-average financial indicators, competitors' indicators, reporting and planned indicators);

· analysis of financial ratios (financial stability, solvency, turnover, profitability);

· integral financial analysis, etc.

Thus, for the successful implementation of the long-term financial policy of the enterprise, management must, firstly, have reliable information about the external environment and predict its possible changes; secondly, to have information about the current parameters of the internal financial situation; thirdly, to systematically conduct an analysis that allows to obtain an assessment of the results of economic activity of its individual aspects, both in statics and in dynamics.

1.2 Cost of major sources of capital

Often the term "capital" is used in relation to both sources

funds as well as assets. With this approach, when characterizing sources, they speak of “passive capital”, and when characterizing assets, they speak of “active capital”, subdividing it into fixed capital (long-term assets, including construction in progress) and working capital (this includes all working capital).

Capital- these are the funds that a business entity has to carry out its activities with the aim of making a profit.

The capital of the enterprise is formed both at the expense of its own (internal) and borrowed (external) sources. The main source of funding is equity. It includes authorized capital, accumulated capital (reserve and added capital, accumulation fund, retained earnings) and other receipts (target financing, charitable donations, etc.).

Authorized capital- this is the amount of funds of the founders to ensure the statutory activities. On the state enterprises- this is the value of property assigned by the state to the enterprise on the rights of full economic management; at joint-stock enterprises - the nominal value of all types of shares; for limited liability companies - the sum of the shares of the owners; for a rental enterprise - the amount of contributions of its employees.

The authorized capital is formed in the process of initial investment of funds. Contributions of the founders to the authorized capital can be in the form of cash, property and intangible assets. The value of the authorized capital is announced during the registration of the enterprise and when adjusting its value, re-registration of the constituent documents is required.

Added capitalas a source of enterprise funds is formed as a result of the revaluation of property or the sale of shares above their nominal value. accumulation fundis created at the expense of the profit of the enterprise, depreciation deductions and the sale of part of the property.

The main source of equity capital replenishmentis the profit of the enterprise, at the expense of which accumulation, consumption and reserve funds are created. There may be a balance of retained earnings, which before its distribution is used in the turnover of the enterprise, as well as the issue of additional shares. Funds special purpose and target financing -these are gratuitously received values, as well as non-refundable and reimbursable budget allocations for the maintenance of social and cultural facilities and for the restoration of the solvency of enterprises that are on budget financing.

Borrowed capital- these are loans from banks and financial companies, loans, accounts payable, leasing, commercial paper, etc. It is divided into long-term (more than a year) and short-term (up to a year).

Any organization finances its activities, including investment, from various sources. As a payment for the use of financial resources advanced to the activities of the organization, it pays interest, dividends, remuneration, etc., i.e. incurs some reasonable costs to maintain its economic potential. As a result, each source of funds has its own value as the sum of the costs of providing this source. In the process of assessing the cost of capital, the cost of individual elements of equity and debt capital is first assessed, then the weighted average cost of capital is determined.

Determining the cost of capital of an organization is carried out in several stages:

1. the identification of the main components that are the sources of formation of the organization's capital is carried out;

2. the price of each source is calculated separately;

3. the weighted average price of capital is determined based on the share of each component in the total amount invested capital;

4. measures are being developed to optimize the capital structure and form its target structure.

An important point in determining the cost of capital of an organization

is the choice of the base on which all calculations should be carried out: before tax or after tax. Since the goal of managing an organization is to maximize net profit, the analysis takes into account the impact of taxes.

It is equally important to determine what price of the source of funds should be taken into account: historical (at the time of attraction of the source) or new

(marginal characterizing the marginal costs of attracting funding sources). Marginal costs give a realistic estimate of the prospective costs of the organization required to compile its investment budget.

The cost of capital depends on its source (owner) and is determined by the capital market, i.e. supply and demand (if demand exceeds supply, then the price is set at a higher level). The cost of capital also depends on the amount of capital raised.

The main factors under the influence of which the cost of capital of an organization is formed are:

· general state financial environment, including financial markets;

· commodity market conditions;

· the average loan interest rate prevailing in the market;

· the availability of various sources of funding for organizations; profitability of the organization's operating activities;

· level of operating leverage;

· level of concentration of own capital;

· the ratio of the volume of operating and investment activities; the degree of risk of the operations carried out;

· industry-specific features of the organization's activities, including the duration of the operating cycle, etc.

The level of cost of capital differs significantly for its individual elements (components). An element of capital in the process of assessing its value is understood as each of its varieties according to individual sources of formation (attraction).

These elements are capital raised by: 1. reinvestment of the profit received by the organization (retained earnings);

2. issue of preferred shares;

3. issue of ordinary shares;

4 . receiving bank loan;

5. bond issues;

6. financial leasing, etc.

For a comparable assessment, the value of each element of capital is expressed as an annual interest rate. The level of value of each element of capital is not a constant value and fluctuates significantly over time under the influence of various factors.

An analysis of the structure of the balance sheet liability, which characterizes the sources of funds, shows that their main types are:

· own sources (authorized capital, own funds, retained earnings);

· borrowed funds (bank loans (long-term and short-term), bond issues);

· temporary borrowed funds (accounts payable).

Short-term accounts payable for goods (works, services) wages and does not participate in the payment of taxes in the calculation, since the organization does not pay interest on it and it is a consequence of current operations during the year, while the calculation of the cost of capital is carried out for a year to make long-term decisions.

Short-term bank loans, as a rule, are temporarily attracted to finance the current needs of production in working capital, so they are also not taken into account when calculating the cost of capital.

Thus, to determine the cost of capital, the most important are the following sources: borrowed funds, which include long-term loans and bond issues; equity, which includes common and preferred shares and retained earnings.

Depending on the duration of existence in this particular form, the assets of the organization, as well as sources of funds, are divided into short-term (current) and long-term. As a rule, it is assumed that current assets are financed from short-term, durable funds, from long-term sources of funds; this optimizes the total cost of raising funds.

Borrowed capital is assessed by the following elements:

· the cost of a financial loan (bank and leasing);

· the cost of capital raised through the issuance of bonds;

· the cost of a commodity (commercial) loan (in the form of a short-term and long-term deferred payment);

· the value of current settlement obligations.

The main elements of borrowed capital are bank loans and bonds issued by the organization. In some cases, when a significant amount of funds is needed for investment at a time (purchase of new equipment), financial leasing and commercial (commodity) credit (forfeting), loans from other organizations are used.

The cost of borrowed capital depends on many factors: the type of interest rates used (fixed, floating); a developed scheme for accruing interest and repaying long-term debt; the need to form a debt repayment fund, etc.

1.3 Dividend policy of the enterprise: concept, specifics and factors of influence

Along with solving investment problems related to increasing the organization's assets and determining the sources of their coverage, the process of forming the owner's share in the profit received in accordance with his contribution, or dividend policy.

Its purpose is to determine the optimal ratio between the consumed and capitalized parts of the profit. In the future, this will ensure the strategic development of the organization, maximize its market value and determine specific measures aimed at increasing the market value of shares.

Dividends- cash payments that a shareholder receives as a result of the distribution of the corporation's net profit in proportion to the number of shares. The broader concept of dividends is used for any direct payment by a corporation to its shareholders.

The company's dividend policy includes making decisions on the following issues:

1. Should the business pay all or part of its net income to shareholders in the current year, or invest it for future growth? This means choosing the ratio in the net profit of the part that goes to the payment of dividends, and the part that is reinvested in the assets of the corporation.

2. Under what conditions should the value of the dividend yield be changed? Should one stick to one dividend policy in the long run, or can it be changed frequently?

3. In what form to pay shareholders the earned net profit (in monetary form in proportion to the shares held, in the form of additional shares or through a share buyback)?

4. What should be the frequency of payments and their absolute value?

5. How to build a policy of paying dividends on shares that are not fully paid (in proportion to the paid part or in full)?

· legal restrictions. The purpose of such restrictions is to protect the rights of creditors. In order to limit the company's ability to “eat up” its capital, the legislation of most countries clearly specifies the sources of dividend policy payments, and also prohibits the payment of dividends in cash if the company is insolvent;

· restrictions due to insufficient liquidity. Dividends can be paid in cash if the company has cash on its current account or cash equivalents in an amount sufficient for payment;

· restrictions due to the expansion of production. Enterprises that are at the stage of intensive development are in dire need of sources of financing for their activities. In such a situation, it is advisable to limit the payment of dividends, and reinvest profits in production;

· restrictions in connection with the interests of shareholders. The total income of shareholders consists of the amounts of dividends received and the increase in the market value of shares. Determining the optimal size of the dividend, it is necessary to assess how the amount of dividends will affect the price of the enterprise as a whole;

In accordance with the Tax Code of the Russian Federation, Part I, Art. 43 any income received by a shareholder (participant) from an organization in the distribution of profit remaining after taxation (including in the form of interest on preferred shares) on shares (participants) owned by a shareholder (participant) is recognized as a dividend.

Decisions on dividend payments by Russian entities affect both ordinary and preferred shares.

If the level of dividends on ordinary shares depends on the financial performance of the organization and is determined general meeting shareholders (on the recommendation of the board of directors), then the payment on preferred shares is a mandatory fixed payment set out in monetary units or as a percentage of the dividend to the par value of the preferred share.

In practice, the following main methods of forming a dividend policy are distinguished:

·conservative;

· compromise, or moderate;

·aggressive.

Each of these methods allows you to develop your own type of dividend policy:

Table 1. Types of dividend policy

Determining approach to the formation of dividend policyVariants of used types of dividend policyConservative approach1. Residual dividend policy 2 .Stable Dividend Policy Moderate (compromise) approach3 .Minimum stable dividend policy with premium in certain periodsAggressive approach4 .Policy of stable dividend payout rate 5 .Policy of constant increase in the size of dividends

Residual dividend policy paymentsassumes that the dividend payout fund is formed after the need for the formation of its own financial resources is satisfied at the expense of profit, ensuring the full realization of the investment opportunities of the company.

It is most appropriate to implement this policy when the internal rate of return on ongoing projects is higher than the weighted average cost of capital or the level of financial profitability.

AT this case the use of profits ensures a high rate of capital growth, further development organization and the growth of its financial stability. However, a potentially low level of dividend payments may adversely affect the formation of the level of market prices for shares.

Stable Dividend Policy involves the payment of a constant amount of them over a long period (at high inflation rates, the amount of dividend payments is adjusted for the inflation index).

The advantage of such a policy is its reliability and the invariability of the size of the current income of shareholders per share, which leads to stable quotations of these shares on the market. The disadvantage of this policy is a weak relationship with the financial performance of the organization.

The policy of the minimum stable size of dividends with a premium in certain periods has: the advantage that provides stable guaranteed dividend payments in the minimum stipulated amount with a high connection with the financial performance of the organization. This relationship allows you to increase the amount of dividends during periods of favorable economic conditions, without reducing the level of investment activity.

The main disadvantage of this policy is that with the continued payment of the minimum dividend, the investment attractiveness of the organization's shares decreases and, accordingly, their market value falls.

Policy of stable dividend rate paymentsprovides for the establishment of a Long-term rate of such payments in relation to the amount of net profit. The advantage of this policy is the simplicity of its development, and the close relationship with the size of the generated profit.

The main disadvantage is the instability of the size of dividend payments per share, determined by the instability of the amount of generated profit. This causes fluctuations in the market value of shares in certain periods and prevents the maximization of the market value of the organization.

Policy of constant increase in the size of dividends provides for a stable increase in the level of dividend payments per share. The increase in dividends occurs, as a rule, in a firmly established percentage of growth in relation to their size in the previous period.

The advantage of such a policy is to ensure a high market value of the company's shares and the formation of its positive image among potential investors. The disadvantage is the lack of flexibility in the implementation of this policy and the constant increase in financial tension.

The practice of forming a company's dividend policy consists of a number of stages:

First stage - assessment of the main factors that determine the formation of the dividend policy. In this case, all factors are usually divided into four groups.

.Factors characterizing the investment opportunities of the organization:

· stage life cycle firms;

· the need to expand the firm's investment programs;

· degree of readiness of highly effective investment projects for implementation.

.Factors characterizing the possibilities of generating financial resources from alternative sources:

· sufficiency of equity reserves, the amount of retained earnings of previous years;

· the cost of acquiring additional

· share capital;

· the cost of attracting additional borrowed capital;

· availability of loans in the financial market;

.Factors related to objective limitations:

· the level of taxation of dividends;

· the level of taxation of property of organizations;

· achieved effect of financial leverage;

· the actual amount of profit received and the level of return on equity.

Other factors:

· the market cycle of the commodity market, in which the company is a participant;

· the level of dividend payments by competing companies;

· urgency of payments on previously received loans;

· the possibility of losing control over the management of the firm;

Second phase - choosing the type of policy that would be in line with the firm's strategy;

Third stage - determination of the profit distribution mechanism corresponding to the company's strategy.

The dividend policy of the organization takes into account the whole range of interests: obtaining additional resources for investment through the issue of shares, ensuring sufficient dividends for their holders, optimizing the ratio "profit - investment - dividend", taking into account the real conditions for the development of the organization.

Dividend policy intertwines the interests of the firm as a whole and the interests of shareholders. The effective combination of these interests is one of the important tasks of the company's financial strategy.

2. Methods and models of financial planning

financial planning - subsystem of internal planning. Objects of financial planning:

1. financial resources - these are cash incomes and receipts at the disposal of a commercial organization and intended for the implementation of expenses for expanded reproduction, economic incentives, fulfillment of obligations to the state, financing of other expenses;

2. financial relations - monetary relations arising in the process of expanded reproduction;

3. cost proportions - proportions that are formed during the distribution of financial resources. These proportions must be economically justified, since they affect the efficiency of the commercial organization;

4. financial plan of the enterprise - a document reflecting the volume of receipts and expenditures of funds, fixing the balance of income and directions of expenses of the enterprise, including payments to the budget for the planned period.

Goalsfinancial planning of a commercial organization depends on the selected criteria for making financial decisions, which include maximizing sales; profit maximization; maximizing the property of company owners, etc.

Main goalsfinancial planning - providing financial resources for the production, investment, financial activities of the enterprise; determination of ways of effective investment of capital, assessment of the degree of its rational use; identification of on-farm reserves for increasing profits; establishment of rational financial relations with the budget, banks, contractors; observance of the interests of investors; control over the financial condition of the enterprise.

The value of financial planning lies in the fact that it embodies the developed strategic goals in the form of specific financial indicators; provides financial resources for the economic proportions of development laid down in the production plan; provides an opportunity to determine the viability (efficiency) of an enterprise project in a competitive environment; serves as a basis for assessing investment attractiveness for investors.

Financial planning at the enterprise includes three main subsystems: long-term financial planning, current financial planning, operational financial planning.

Strategic financial planning determines the most important indicators, proportions and rates of expanded reproduction, is the main form of achieving the goals of the enterprise. Covers a period of 3-5 years. Period from 1 year to 3 years conditional, since it depends on economic stability and the ability to predict the volume of financial resources and directions for their use. Within the framework of strategic planning, long-term development guidelines and goals of the enterprise, a long-term course of action to achieve the goal and allocate resources are determined. Alternative options are being searched, the best choice is being made, and the enterprise strategy is based on it.

Long-term financial planning is “doing” planning. Covers a period of 1-2 years. It is based on the developed financial strategy and financial policy for certain aspects of financial activity. This type of financial planning consists in the development of specific types of current financial plans that enable the enterprise to determine for the coming period all sources of financing for its development, form the structure of its income and costs, ensure its constant solvency, and also determine the structure of its assets and capital of the enterprise at the end planned period.

The result of the current financial planning is the development of three main documents: cash flow plan; profit and loss plan; balance sheet plan.

The main purpose of constructing these documents is to assess the financial position of the enterprise at the end of the planning period. The current financial plan is drawn up for a period equal to 1 year. This is explained by the fact that seasonal fluctuations in market conditions are mainly leveled out over 1 year. The annual financial plan is divided quarterly or monthly, since during the year the need for funds may change and in some quarter (month) there may be a lack of financial resources.

Short-term (operational) financial planning complements the long-term, it is necessary in order to control the receipt of actual revenue to the current account and the expenditure of cash financial resources. Financial planning includes the preparation and execution of a payment calendar, cash plan and calculation of the need for a short-term loan.

Conclusion

Long-term financial policy should be aimed at implementing structural changes, accelerating scientific and technological progress, reorienting social production to meet social needs and raising the standard of living of the population.

In general, it seems promising to implement budget expenditures on the basis of optimizing their volume and structure to the extent of increasing incomes based on the growth of the efficiency of material production, the basis for which is created by new economic levers of management, development and strengthening of full self-financing and self-financing in all levels of management.

One of the main principles of long-term financial policy is that it should be based not so much on the actual situation as on the forecast of its change. Only on the basis of foresight does financial policy acquire stability. This aspect in the current conditions of the financial crisis is the most relevant.

List of used literature

1.Enterprise Finance: Proc. manual for universities / ed. Kolchina. - M.: UNITI, 2010 - 447 p.

.Fundamentals of financial management. Ch 1: Proc. allowance / Kaliningr. Univ. - Kaliningrad, 2008 - 120 p.

.Krasnova S.V. Financial mechanism for regulating the cash flows of an enterprise within the framework of the financial and industrial group / S.V. Krasnova / Finance. - 2003. - No. 1. - With. 73-74.

.Molyakov D.S., Shokhin E.I. Theory of enterprise finance: Proc. allowance. - M.: Finance and statistics, 2012. - 112 p.

.Finance and credit: Tutorial for universities / A.M. Kovaleva, N.P. Barannikova; Ed. A.M. Kovaleva. - M.: Finance and statistics, 2009. - 512 p.

6.Finance, money, credit: Textbook for universities / S.I. Dolgov, S.A. Bartenev and others; Ed. O.V. Sokolova. - M.: Lawyer, 2007. - 783 p.

7.Basovsky L.E. Financial management: Textbook - M. INFRA - M, 2010. - 240 p.

Tutoring

Need help learning a topic?

Our experts will advise or provide tutoring services on topics of interest to you.

Submit an application indicating the topic right now to find out about the possibility of obtaining a consultation.

1. Concept, goals of long-term financial policy……………………3

2. The cost of the main sources of capital…………………………………9

3. Dividend policy of the enterprise…………..……………………….15

4. Methods and models of financial planning…………………………20

List of sources used………………………………………25

1. Concept, goals of long-term financial policy

Financial policy of the enterprise- a set of measures for the purposeful formation, organization and use of finance to achieve the goals of the enterprise.

Financial policy is the most important component of the general policy of enterprise development, which also includes investment policy, innovation, production, personnel, marketing, etc. If we consider the term « politics » more broadly, it is "actions aimed at achieving a goal." So, the achievement of any task facing the enterprise, to one degree or another, is necessarily connected with finances: costs, income, cash flows, and the implementation of any solution, first of all, requires financial support. Thus, financial policy is not limited to solving local, isolated issues, such as market analysis, developing a procedure for passing and agreeing contracts, organizing control over production processes, but is comprehensive.

Basis for long-term financial policy- a clear definition of a single concept for the development of an enterprise in the long term, the choice of optimal mechanisms for achieving the goals set from the whole variety, as well as the development of effective control mechanisms.

1. Indicators characterizing general economic development

countries:

The growth rate of gross domestic product and national income; the volume of money issued in the period under review; cash income of the population; deposits of the population in banks; inflation index; central bank discount rate.

This type of informative indicators serves as the basis for analyzing and forecasting the conditions of the external environment for the functioning of an enterprise when making strategic decisions in financial activities. The formation of a system of indicators for this group is based on published state statistics.

2. Indicators characterizing the financial market situation:

Types of basic stock instruments (shares, bonds, etc.) circulating on the exchange and over-the-counter stock markets; quoted offer and demand prices of the main types of stock instruments; lending rate of individual commercial banks.

The system of normative indicators of this group serves to make managerial decisions when forming a portfolio of long-term financial investments, when choosing options for investing free cash, etc. The formation of the system of indicators of this group is based on periodic publications of the Central Bank, commercial publications, as well as on official statistical publications.

3. Indicators characterizing the activities of contractors and competitors.

The system of informative indicators of this group is necessary mainly for making operational management decisions on certain aspects of the formation and use of financial resources.

4. Regulatory indicators.

The system of these indicators is taken into account when preparing financial decisions related to the peculiarities of state regulation of the financial activities of enterprises. Sources for the formation of indicators of this group are legal acts adopted by various government bodies.

From internal sources are divided into two groups.

1. Primary information:

Forms of financial statements;

Operational financial and management accounting.

The system of informative indicators of this group is widely used by both external and internal users. It is applicable in financial analysis, planning, development of financial strategy and policy on the main aspects of financial activity, gives the most aggregated view of the financial results of the enterprise.

2. Information obtained from financial analysis:

Horizontal analysis (comparison of financial indicators with the previous period and for several previous periods); - vertical analysis (structural analysis of assets, liabilities and cash flows);

Comparative analysis (with industry average financial indicators, competitors' indicators, reporting and planned indicators);

Analysis of financial ratios (financial stability, solvency, turnover, profitability);

Integrated financial analysis, etc.

Thus, for the successful implementation of the long-term financial policy of the enterprise, management must, firstly, have reliable information about the external environment and predict its possible changes; secondly, to have information about the current parameters of the internal financial situation; thirdly, to systematically conduct an analysis that allows to obtain an assessment of the results of economic activity of its individual aspects, both in statics and in dynamics.

2. The cost of the main sources of capital

Often the term "capital" is used in relation to both sources

funds as well as assets. With this approach, when characterizing sources, they speak of “passive capital”, and when characterizing assets, they speak of “active capital”, subdividing it into fixed capital (long-term assets, including construction in progress) and working capital (this includes all working capital).

Capital- these are the funds that a business entity has to carry out its activities with the aim of making a profit.

The capital of the enterprise is formed both at the expense of its own ( domestic), and at the expense of borrowed ( external) sources.

The main source of funding is equity. Its composition includes statutory capital, accumulated capital (reserve and added capital, accumulation fund, retained earnings) and other receipts (target financing, charitable donations, etc.).

Authorized capital- this is the amount of funds of the founders to ensure the statutory activities. At state enterprises, this is the value of property assigned by the state to the enterprise on the basis of full economic management; at joint-stock enterprises - the nominal value of all types of shares; for limited liability companies - the sum of the shares of the owners; for a rental enterprise - the amount of contributions of its employees.

The authorized capital is formed in the process of initial investment of funds. Contributions of the founders to the authorized capital can be in the form of cash, property and intangible assets. The value of the authorized capital is announced during the registration of the enterprise and when adjusting its value, re-registration of the constituent documents is required.

Added capital as a source of enterprise funds is formed as a result of the revaluation of property or the sale of shares above their nominal value.

accumulation fund is created at the expense of the profit of the enterprise, depreciation deductions and the sale of part of the property.

The main source of equity capital replenishment- is the profit of the enterprise, due to which accumulation, consumption and reserve funds are created. There may be a balance of retained earnings, which before its distribution is used in the turnover of the enterprise, as well as the issue of additional shares.

Special Purpose and Special Purpose Financing- these are gratuitously received values, as well as non-refundable and reimbursable budget allocations for the maintenance of social and cultural facilities and for the restoration of the solvency of enterprises that are on budget financing.

Borrowed capital- these are loans from banks and financial companies, loans, accounts payable, leasing, commercial paper, etc. It is divided into long-term (more than a year) and short-term (up to a year).

Any organization finances its activities, including investment, from various sources. As a payment for the use of financial resources advanced to the activities of the organization, it pays interest, dividends, remuneration, etc., i.e. incurs some reasonable costs to maintain its economic potential. As a result, each source of funds has its own value as the sum of the costs of providing this source.

In the process of assessing the cost of capital, the cost of individual elements of equity and debt capital is first assessed, then the weighted average cost of capital is determined.

Determination of the cost of the capital of the organization is carried out in several stages: 1) the identification of the main components that are the sources of formation of the capital of the organization is carried out; 2) the price of each source is calculated separately; 3) the weighted average price of capital is determined based on the share of each component in the total amount of invested capital; 4) measures are being developed to optimize the capital structure and form its target structure.

An important point in determining the cost of capital of an organization

is the choice of the base on which all calculations should be carried out: before tax or after tax. Since the goal of managing an organization is to maximize net profit, the analysis takes into account the impact of taxes.

It is equally important to determine what price of the source of funds should be taken into account: historical (at the time of attraction of the source) or new

(marginal characterizing the marginal costs of attracting funding sources). Marginal costs give a realistic estimate of the prospective costs of the organization required to compile its investment budget.

The cost of capital depends on its source (owner) and is determined by the capital market, i.e. supply and demand (if demand exceeds supply, then the price is set at a higher level). The cost of capital also depends on the amount of capital raised. The main factors under the influence of which the cost of capital of an organization is formed are:

General condition of the financial environment, including financial markets; commodity market conditions; the average loan interest rate prevailing in the market; the availability of various sources of funding for organizations; the profitability of the organization's operating activities;) the level of operating leverage; level of concentration of own capital; the ratio of the volume of operating and investment activities; the degree of risk of the operations carried out; industry-specific features of the organization's activities, including the duration of the operating cycle, etc.

The level of cost of capital differs significantly for its individual elements (components). An element of capital in the process of assessing its value is understood as each of its varieties according to individual sources of formation (attraction). Such elements are the capital attracted by: 1) reinvestment of the profit received by the organization (retained earnings); 2) issue of preferred shares; 3) issue of ordinary shares; 4) obtaining a bank loan; 4) issue of bonds; 5) financial leasing, etc.

For a comparable assessment, the value of each element of capital is expressed as an annual interest rate. The level of value of each element of capital is not a constant value and fluctuates significantly over time under the influence of various factors.

An analysis of the structure of the balance sheet liability characterizing the sources of funds shows that their main types are: own sources (authorized capital, own funds, retained earnings); borrowed funds (bank loans (long-term and short-term), bond issues); temporary borrowed funds (accounts payable).

Short-term accounts payable for goods (works, services), wages and taxes are not included in the calculation, since the organization does not pay interest on it and it is the result of current operations during the year, while the calculation of the cost of capital is carried out for a year to make long-term decisions.

Short-term bank loans, as a rule, are temporarily attracted to finance the current needs of production in working capital, so they are also not taken into account when calculating the cost of capital.

Thus, to determine the cost of capital, the most important are the following sources: borrowed funds, which include long-term loans and bond issues; equity, which includes common and preferred shares and

retained earnings. Depending on the duration of existence in this particular form, the assets of the organization, as well as sources of funds, are divided into short-term (current) and long-term. As a rule, it is assumed that current assets are financed by short-term, and non-expendable funds. from long-term sources of funds; this optimizes the total cost of raising funds.

Borrowed capital is estimated by the following elements: 1) cost

financial credit (banking and leasing); 2) the cost of capital raised by issuing bonds; 3) the cost of a commodity (commercial) loan (in the form of a short-term and long-term deferred payment); 4) the cost of current settlement obligations.

The main elements of borrowed capital are bank loans and bonds issued by the organization. In some cases, when a significant amount of funds is needed for investment at a time

(purchase of new equipment), use financial leasing and commercial (commodity) credit (forfeiting), loans from other organizations. The cost of borrowed capital depends on many factors: the type of interest rates used (fixed, floating); a developed scheme for accruing interest and repaying long-term debt; the need to form a debt repayment fund, etc.

3. Dividend policy of the enterprise

Along with solving investment problems related to increasing the organization's assets and determining the sources of their coverage, the process of forming the owner's share in the profit received in accordance with his contribution, or dividend policy . Its purpose is to determine the optimal ratio between the consumed and capitalized parts of the profit. In the future, this will ensure the strategic development of the organization, maximize its market value and determine specific measures aimed at increasing the market value of shares.

Dividends are cash payments that a shareholder receives as a result of the distribution of a corporation's net profit in proportion to the number of shares. The broader concept of dividends is used for any direct payment by a corporation to its shareholders.

The company's dividend policy includes making decisions on the following issues: