The deductible limit is set for material assistance, gifts, prizes, per diem payments as part of travel expenses. An example of a record of gifts given to an employee Employee S. of the organization OOO Komanda received a gift from the employer on the day of the company worth 8,500 rubles. In the accounting of remuneration S. and 1-NDFL in the month of receiving the gift, the following are indicated:

- The value of the received gift in the amount of 8,500 rubles;

- Deduction code 501 for non-taxable personal income tax in the amount of 4,000 rubles (clause 28, article 217 of the Tax Code of the Russian Federation).

The card reflects the total amount, taxable and non-taxable, as well as the code and amount of the deduction. Users of information on the NDFL-1 card Cards 1-NDFL are internal documents of the enterprise. The form is completed for the calendar year with a cumulative total for each employee and is stored in the organization along with other tax registers.

Tax card for personal income tax in 2018

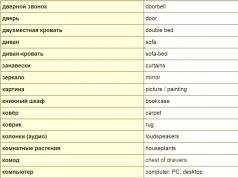

Mandatory information as part of the form data The form must contain information about the data that makes it possible to determine the correctness of the calculation of the base, tax, application of benefits, transfers to the budget for each employee. Details Description of data Data of the enterprise that calculates income tax Details of the tax agent are indicated Employee data natural form, as well as in the event of a material benefit from the conditions of activity Tax benefits Record the data of deductions granted on the basis of the right that arose from the employee Personal income tax Enter the indicators of the calculated and paid tax on income of individuals, the date of transactions The form reflects the amounts that make up the tax base for personal income tax.

Tax accounting register for personal income tax in 2018: sample filling, form, form

Attention

There is no separate indication of the terms of storage of registers in the legislation. At the end of the storage period, documents must be disposed of. A special commission is created to destroy documents containing important personal information about employees.

Important

Upon disposal, acts are drawn up, including information on the list of documents, the period of their creation. Upon liquidation of an enterprise, documents tax accounting relating to payroll are not transferred to the state archives. How to fill out the personal income tax card-1 The document is maintained by accounting employees or other persons whose duties include calculating wages.

When generating data, specialized programs are used. Accrual statement data is only used after month-end closing to avoid errors.

Tax card in the form of 1-NDFL and its completion in 2018

- type and details of the identity document;

- Date of Birth;

- citizenship;

- address of residence in the territory of the Russian Federation;

- address in the country of residence.

- Taxpayer status (resident or non-resident).

Residents are individuals who reside in Russian Federation at least 183 calendar days within 12 consecutive months (clause 2, article 207 of the Tax Code of the Russian Federation). The amount of the tax rate that will be applied to his income depends on the status of the person. For example, remuneration under an employment contract for a citizen of the Russian Federation is subject to a rate of 13%, and income individual- a non-resident under the same agreement must be taxed at a rate of 30%, except, for example, for the income of highly qualified non-resident specialists.

More about correct definition see status.

Personal income tax form-1 + step-by-step instructions for filling it out

But they are all reflected separately, for example, in various sections of the document. A similar system is used in 2-NDFL certificates, in which each rate has its own section. The frequency of the register for personal income tax is established by the taxpayer.

As a rule, the register for personal income tax per employee is started every year so that income to which the rate of 13% applies, as well as tax deductions, is reflected in it both monthly and on an accrual basis from the beginning of the year. Income to which other rates apply need only be indicated on a monthly basis. Income not subject to personal income tax may not be included (for example, maternity benefits).

Income, the amount of which is limited when calculating personal income tax, must be indicated in the register to monitor compliance with such a limit. One of these incomes is material assistance, which will not be subject to personal income tax until its amount reaches 4,000.00 rubles. per year (clause 28, article 217 of the Tax Code of the Russian Federation).

How is the personal income tax register maintained?

This approach ensures the simultaneous conduct of tax and accounting in the company and eliminates the possibility of discrepancies in information. The process of compiling 1-NDFL is as follows:

- In the accounting department of the employer, by the end of each month, statements are compiled for the payment of salaries, bonus and compensation payments, as well as vacation pay.

- Based on the information given in them, 1-NDFL certificates are compiled, which include information about each individual employee.

- The document is transferred to the IFTS. It provides the tax authorities with information about all the cash receipts of an individual employee and the actual amount of tax accrued on them.

The composition of the document (form) Form 1-NDFL 2018 is attached to this article.

Blanker.ru

Info

They are reflected in this part of the document. Section 6 - Tax Summary This section provides a summary of tax accrued and paid to the treasury at the rates of 13%, 30%, 9% and 35%. The results are summed up according to the data at the end of the month. Section 7 - income summary The seventh section shows the total income of each individual, as well as the total amount of taxes for each employee.

There are also tax deductions. The final amount is set at the end of the section. Section 8 - recalculations This part is designed specifically to correct errors made in the previous tax period. Here recalculations are given, after which an additional payment is made or a request is made to the Federal Tax Service Inspectorate for the return of part of the previously paid personal income tax.

Section 9 - 2-NDFL Here, the final information from the 2-NDFL certificate, as well as its details and date of issue, are written.

What is a report on the form 1-NDFL in 2018

When automatically filling out the document and correcting the indicators of the statements, the initial data is changed by the program without the participation of responsible person. When manually filling out the form, in case of correction of these statements in the document, an adjustment is made. Incorrect data is crossed out so that the corrected text is readable. A correct entry is made in the free space above or next to the text, indicating the person who certifies the correction. Read also the article: → "The procedure for calculating and paying personal income tax in 2018" Step-by-step instruction filling out the form 1-NDFL The form contains several sections for entering information on different types destination.

Tax card for personal income tax accounting for 2018 form free download

This document refers to the primary tax documentation, so its maintenance is mandatory: the form is filled out monthly after the cash payments are made and income tax is withheld from them. The basis for filling is the contractual relationship between the employer and the individual. Note that the card is also required to be filled out if the parties labor relations concluded a civil law contract.

Back to content How to fill out 1-NDFL? Form 1-NDFL has an approved form, and the procedure for filling it out is regulated by the relevant normative documents FTS of Russia. The card is filled out for each individual who received cash payments from the employer in the reporting period, including those for which tax deductions are provided.

If not, the field should be left blank; Passport data; Date of Birth; residential address; Status (1 - resident, 2 - non-resident, 3 - highly qualified foreigner). Third section: Income taxable at a rate of 13% from previous place work, if any; Basis for granting standard deductions (application for deduction); For a property deduction, you must specify the details of the document (usually this is a certificate with tax office, which indicates the IFTS code, date of issue, certificate or notification number). Further for each month the tabular part is filled. Fill in based on the available data.

Suppose that an employee has fully worked for three months, without vacation and sick leave. Then for each month we put down the full salary for the month in the amount of 50,000 rubles. This is a payment under an employment contract, so the income code is 2000.

Tax card for personal income tax in 2018

personal income tax. Tax card for accounting of income and personal income tax. Approved by order of the Ministry of Taxes of the Russian Federation dated October 31, 2003 N BG-3-04 / 583. Tax card 1-NDFL is the primary document of tax accounting. It must be drawn up by tax agents of Russian organizations, representative offices of foreign organizations, individual entrepreneurs, private notaries, who are a source of income for individuals. The card is maintained on a monthly basis, taking into account the peculiarities of calculating the amounts of tax provided for various kinds income taxed at a rate of 13%, 30% or 35%, based on the income accrued to the taxpayer. Card 1-NDFL is filled in in case of accrual and payment of the relevant income as in execution labor agreements(contracts) and civil law agreements (relationships) arising between tax agents and individuals.

Individual entrepreneurs who employ employees bear additional obligations to pay taxes and for them. In addition, as a tax agent, an entrepreneur must periodically prepare various documentation on withholding income tax. One of these documents is the 1-NDFL form.

Few people remember her, but tax law provides for its mandatory completion by tax agents, including individual entrepreneurs.

What is 1-personal income tax?

Tax card 1-NDFL serves to record income and tax on income received by an individual from this tax agent. This document refers to the primary tax documentation, so its maintenance is mandatory: the form is filled out monthly after the cash payments are made and income tax is withheld from them.

The basis for filling is the contractual relationship between the employer and the individual.

Note that the card is also required to be filled out if the parties to the employment relationship have concluded a civil law contract.

How to fill out 1-personal income tax?

Form 1-NDFL has an approved form, and the procedure for filling it out is regulated by the relevant regulatory documents of the Federal Tax Service of Russia. The card is filled out for each individual who received cash payments from the employer in the reporting period, including those for which tax deductions are provided. The document does not reflect payments that are not subject to taxation under the law, for example, social benefits.

A sample of filling out the 1-NDFL form can be found both in the tax office at the place of registration of the entrepreneur, and on numerous sites on the Internet. But this sample may not be necessary for many. The fact is that since January 1, 2011, the 1-NDFL form has not been applied, since changes have been made to the Tax Code of the Russian Federation: since 2012, all tax agents must maintain tax registers instead of the 1-NDFL tax card.

The form of this document has not been approved, so entrepreneurs and other tax agents have the right to develop them on their own. At the same time, the FTS recommends that the following information be included in the forms:

The form of this document has not been approved, so entrepreneurs and other tax agents have the right to develop them on their own. At the same time, the FTS recommends that the following information be included in the forms:

- Information about the taxpayer.

- Type of income.

- Types of provided tax deductions.

- The amount of income.

- date of receipt of income.

- Date of withholding and transfer of personal income tax.

Despite the fact that the 1-NDFL form has not been used since 2012, in practice you can find many cases of filling it out: many tax agents preferred not to bother developing register forms and still maintain income cards. Therefore, 1-NDFL will be in demand in 2019 as well.

But it should be remembered that given form the document is no longer valid and during the audit, the fiscal authorities can make reasonable comments on this matter. To avoid this, it is worth switching to the use of tax registers, especially since the practice of using them, as well as the variants of forms, has already been developed sufficiently.

Personal Income Tax: Video

Ask your accountant whether it is necessary to fill out form 1 of the personal income tax. If a young specialist works for you, then he has never heard of such a thing. If you have an experienced accountant, then they will tell you that earlier you had to fill out cards in the form of 1 personal income tax for all your employees. This article will explain to you what form 1 of the personal income tax is and what is now being filled out instead of it.

All individual entrepreneurs, hiring employees, become tax agents, transferring taxes for employees to the budgets of various levels and extra-budgetary funds. Therefore, the employer is obliged to keep all documentation related to this process. One of the forms of reporting are declarations in the form of personal income tax. Among them is a registration card, that is, form 1 of the personal income tax.

What is 1 personal income tax

So, 1 personal income tax is a form of a card that reflects the income of the taxpayer, all the taxes that he pays. This document was introduced in 2003 with the prize of the Ministry of Taxation and was one of the main documents of all tax accounting. This form worked for 8 years and from January 1, 2011 was eliminated. To date, individual entrepreneurs are not required to fill it out. Instead, it is the responsibility of the employer to fill out the personal income tax register, and which contains the same data about the employee, the filling procedure is also identical.

But here is an interesting situation: the tax register must be developed by an entrepreneur, that is, a tax agent, independently. And the income tax in this register must be calculated independently. All these functions are required to be performed by large organizations, that is, legal entities, individual entrepreneurs, as well as notaries working in private, and foreign organizations that have opened their representative offices in Russia.

In the tax register, according to the Tax Code, the following information must be indicated. This is all the personal data of the employee that allows him to be identified, this is the status of the employee as a taxpayer, all the amounts of his income, types of income indicating the codes in force today, the taxes that were withheld from the employee, and their current codes. To this information are added the dates of payment of income and tax deductions, as well as the dates of transfer of taxes to the budgets of the Russian Federation. Next to each entry on the transfer of tax, it is necessary to put down the name of the payment document, its details, all this is done to confirm the facts of the transfer of funds.

Some entrepreneurs practice maintaining a common register, one for all employees. In companies where few specialists work, this is very convenient. But the correct filling in accordance with the law provides for the maintenance of a register for each individual employee. Therefore, it is best to spend an accountant a couple of hours more time, but make the correct register and fill it out as required by law.

What is the difference between form 1 of the personal income tax and the tax register

It is completely logical that many entrepreneurs take form 1 of the personal income tax as the basis for their register. And this is no coincidence, because they are similar in many ways. But the tax card does not contain some important items that must be in the personal income tax register. Yes, you can base tax card, but you need to add the following lines to it. Each transfer of personal income tax must be accompanied by the date of the actual transfer of money, details of the payment order. Also, the register should include data on social deductions provided by the tax agent, as well as on the property deductions of the employee. If the register is filled out by a non-resident of Russia, then all of his income from activities in the territory of our country is also taxed and is included in this document.

Tax card 1 personal income tax and tax register are designed to record the income of an individual and the taxes that he pays. This is the primary tax documentation, which in without fail should be conducted by every organization, every individual enterprise. All data is entered into the card (we will keep in mind a register similar to it), once a month, after wages and all remunerations have been paid, all taxes have been accrued and paid.

The main basis for filling out the card (register) is an agreement between the employee and the employer. It is filled in under any contract, even under civil law. The main condition is that taxes must be paid from the amounts indicated in the contract, and all tax amounts must be taken into account and presented in the form of reports in the card.

In order to compile a competent register, you need to download the form of form 1 of the personal income tax, and add your points to it. Filling out the card is quite simple, it is carried out for each employee individually. All income is entered on the form, except for those that are not taxed. These are social benefits, financial assistance, if it is less than 4 thousand rubles. Also not included in the register the following types income: maternity allowance, one-time allowance for pregnant women with early registration in a medical institution, allowance for the birth of a child or adoption. This list also includes child care allowance up to 1.5 years and unemployment benefits.

The main points of the register that were transferred from the personal income tax card 1

First point document - information about the tax agent (source of income). Here you will need to indicate the TIN / KPP (for an organization or TIN for a tax agent - individual entrepreneur), as well as the code of the tax authority where the tax agent is registered, the name (last name, first name, patronymic) of the tax agent and OKATO code. All this data is always in the accounting department, there will be no problems with filling it out.

Further, in the second paragraph, you must specify information about the taxpayer (recipient of income). This is the TIN and pension number insurance certificate, last name, first name and patronymic of the employee, type of identification document. If this document is a passport, then you must specify the code, series and number, date of birth (day, month, year), citizenship with country code, address permanent place residence, including country code, subject of the Russian Federation, region, region, district, city, street, house, building, apartment. Next, you need to indicate whether the taxpayer is a resident of the Russian Federation, and whether tax deductions are claimed.

In the third paragraph the calculation of the tax base and the tax on the income of an individual is carried out (for income taxed at rates of 13% and 30%). The indication of tax deductions is carried out with a simultaneous description of the details of the documents that became the basis for the calculation of deductions. It will also be necessary to make a detailed calculation of the tax base and tax on income of an individual from equity participation in the activities of the organization (dividends), calculation of tax on income taxable at a rate of 35%.

In the following paragraphs the following information must be provided: total amount tax at the end of the tax period, information on income, the taxation of which is carried out tax authorities, the results of tax recalculation for previous tax periods. And at the end, information on the submission of certificates provided to the taxpayer is indicated.

All these data are transferred from their cards to a new accounting form - the register, and submitted in the form of a report to the tax office. If you have any questions, it is best to consult the tax office at the place of residence and registration of individual entrepreneurs.

Form 1-NDFL is needed to record information regarding income tax and total income. After registration of this document by the entrepreneur, it is given to the IFTS. The rules say that 1-NDFL should be formed every month, not only when the tax is transferred to the treasury, but also at the time of payroll.

Starting from 2011, 1-NDFL certificates were converted into form of tax registers. But the document is considered using the same rules as before. Employers still use the reporting form.

The document contains special fields that display information on:

- The amount of actual personal income tax payments that were sent to the treasury.

- which contributed to the reduction of the tax base.

- Income that individuals received in a quarter or in one year.

Thanks to the information provided public services it is easier to identify taxpayers, to grant them this or that status.

Thanks to the information provided public services it is easier to identify taxpayers, to grant them this or that status.

References are integrated into the 1C program. in the Tax Code of the Russian Federation is devoted to all issues related to income tax for individuals.

It has already been said that the basis for the formation of 1-personal income tax is the data for each person and receipts Money for him. But filling out the certificate - not the responsibility of the citizen. She switches to the so-called.

This function is in most cases transferred to employers. For the organizations themselves, 1-NDFL is a kind of primary document, without which accounting itself is impossible.

About the submission procedure

Usually the compilation process is reduced to the execution next steps that are not complex.

- The accounting department draws up statements related to the fact of payroll. At the same time, it is required to display information on vacation and compensation, bonus payments.

- Only after that they proceed to the design of the 1-NDFL certificate itself. It should include data for each individual worker.

- The last stage is the transfer of documents to the IFTS, thanks to which the tax office receives everything that it needs to account for each individual taxpayer.

Requirements and rules

Not all types of income are reflected in 1-NDFL. For example, an indication is not required for:

- Unemployment payments.

- Child care allowance.

- Transfers in connection with the appearance of children. It doesn't matter if it's adoption or birth.

- Benefits for pregnancy, childbirth.

About the forms and composition of the certificate

Usually the form consists of nine sections. They are designed specifically to make it convenient for managers to present information about their employees. The contents of the individual parts are explained in more detail.

Section 1: about the withholding agent

Here the employer writes about himself. In particular, you will need:

- Contact telephone number businesses along with the address and .

- OKTMO tax agent, name in full.

- IFTS code to which the organization belongs.

- , TIN.

Section 2: about taxpayers

Here they write about individuals who are payers of income tax. AT this case indispensable without:

Here they write about individuals who are payers of income tax. AT this case indispensable without:

- Living place, .

- Passport data.

- Name, date of birth.

- TIN, SNILS.

The country of registration code will be needed if the employee is not. An address in that country also becomes a prerequisite.

Section 3: tax base

This part of the document is trying to give maximum importance. We are talking about the tax base on which the income tax itself is charged, with a rate of up to 13%. For non-residents, it increases to 30%.

This section is in the form of a table. It contains data related to:

- The amount of taxes that have been accrued, as well as actually paid. And the amount of debt, if any, to the IFTS.

- Withdrawal amount.

- The amount of tax deductions.

- The amount of income.

The section ends with the details of the document used when transferring taxes. It is in it that the tax itself is initially reflected.

Next

AT fourth section describes the decisions of the founders of the company, which relate to the payment of dividends. Be sure to have not only the amounts themselves, but also specific dates when this happens. Don't forget about income taxes accrued on such payments. The essence of this section is to display the tax base, taxed at a rate of nine percent.

AT fourth section describes the decisions of the founders of the company, which relate to the payment of dividends. Be sure to have not only the amounts themselves, but also specific dates when this happens. Don't forget about income taxes accrued on such payments. The essence of this section is to display the tax base, taxed at a rate of nine percent.

If someone wins a competition or lottery, income is taxed at a rate of 35%. These funds are reflected in fifth section.

sixth section needed for summary information on all types of taxes. Each month has a separate summary.

Seventh section becomes a kind of total income for each individual. It also shows tax collections for employees, in the total amount, and you can also say about deductions, if they were applied.

Concerning eighth, then it is specially created to correct errors made in the previous tax period. First, they report about the recalculations, and then, they proceed to the surcharge or form a request to the Federal Tax Service to return the amounts paid earlier.

There are fields that any tax agent must fill out, regardless of specific situation. This applies to:

There are fields that any tax agent must fill out, regardless of specific situation. This applies to:

- Accrued income tax amounts.

- Deductions on social, investment, professional, standard and property grounds.

- Bases for taxes in general for all types of activities, as well as separately in case of rate changes.

According to the information provided, the IFTS assigns the status to the taxpayer. In this case, the value is given to a group of parameters, consisting of:

- personal data of an individual;

- details of specific payment documents;

- actual payments, debts;

- due deductions;

- income amounts.

Form 1-NDFL is convenient in that it is maintained for each of the specific payers.

What to do when errors are found

Accountants sometimes encounter errors in their work. Then it is worth knowing the rules related to their correction in a particular document. There are few such rules for 1-NDFL certificates.

- Incorrect data can be crossed out if an error is made in the first two sections. Information that is correct is entered next to it. At the end of the document, you need to indicate that it is the corrected parameters that should be trusted.

- Corrections are not allowed when working with sections from the third to the ninth. Inaccuracies are simply transferred to the declaration for the next tax period. Error information is contained in the eighth section.

In sections three through nine, correction of errors is permissible only if the company ceases to operate, goes through the liquidation procedure.

Differences from the tax register

Many entrepreneurs take 1-personal income tax as the basis for the register. There is nothing strange in this, because the documents are similar to each other. But the cards still lack some important points inherent in the register.

Many entrepreneurs take 1-personal income tax as the basis for the register. There is nothing strange in this, because the documents are similar to each other. But the cards still lack some important points inherent in the register.

It can also be the basis, but then it becomes necessary to add a few points.

Details of the money transfer, along with the date of actual payment, must be present for each. The register must contain information relating to social deductions provided by tax agents, or property deductions, if they were applied.

Participating in the completion foreign citizen It should be borne in mind that incomes placed outside the territory of the Russian Federation are also taxed. Therefore, the information is also entered into the relevant documents.

An employment contract is the main basis on which cards or registers are filled out. Their maintenance becomes a mandatory requirement when concluding any types of agreements.

Information about disability benefits and vacation pay

Tax officials believe that temporary disability benefits do not apply to wages. Therefore, they are not classified as income received for the performance of certain duties. It is enough just to write that the amounts were paid.

As for vacation pay, it is necessary to immediately decide whether they will be paid for work or not? If yes, then the tax is withheld, on the very last day of the month. If the answer is no, then the withholding occurs on the same day that the income is paid.

What is the best way to account for income?

There are a few advice, which make it easier to work with income.

There are a few advice, which make it easier to work with income.

- Not only monthly fixation, but also separate for each type of payment. Then it will be easier to determine the tax base, the amount of the calculated and withheld personal income tax. This is especially true for income that rolls over from one month to the next. For example, vacation pay, which is paid in advance.

- Separate display of tax deductions that are actually granted and due. For example, the standard deduction exceeds the amount of income for an employee for a given month. Then the difference in the results will simply be transferred to another time. True, the rule continues to operate only for one calendar year.

What else to remember

In 1-NDFL cards, only those that were actually paid should be reflected, that is, cash amounts transferred personally into hands or transferred to a bank account. You do not need to enter amounts that were simply accrued on the form.

Different sections take into account income in the form of dividends for, because tax rates differ for them by as much as 9% and 15% (for the second category).

As for the unified material assistance, only those payments that should be subject to personal income tax, in accordance with the current law, are included in the certificate. It is not necessary at all to reflect transfers in the card that are completely exempt from taxes.

The tax code provides full list with the so-called preferential payments.

Tax authorities and officials believe that cards should reflect all information related to gifts. Even if their amount does not reach 4000 rubles. There is nothing surprising in this position, because there is a separate limit on gifts that can be received in one year.

It is possible that the next gift just exceeds these established limits. At the same time, we are talking not only about employees, but also about customers and partners. However, while the latter position plays the role of initiative. Nowadays, it is important to give information about gifts for employees.

Learn more about the terms of payment of personal income tax - in this video.

The form for filling out information on tax on money paid to employees is called 1-NDFL. This document is compiled exclusively by tax agents. It is one of the primary documents for tax accounting at the enterprise.

These include:

- enterprises registered in the territory of the Russian Federation;

- branches or representative offices of European companies;

- private notary offices related to the income of individuals.

Filling order

Form 1-NDFL is filled out once a month, taking into account a certain rate of 13.3% or 35%, which is calculated based on the income of an individual. It is filled out both during the execution of the employment contract and contracts civil law. If there is a payment for goods, any work or services between the second party and an individual entrepreneur, and the individual entrepreneur will submit a document stating that he is not registered as entity, then the 1-NDFL card is not compiled.

A tax card is compiled by an individual employee of the organization who has a monthly taxable (for any reporting period) income. There are incomes that are not subject to taxation, regardless of the amount of the payment received, namely:

A tax card is compiled by an individual employee of the organization who has a monthly taxable (for any reporting period) income. There are incomes that are not subject to taxation, regardless of the amount of the payment received, namely:

- payments on the occasion of pregnancy and childbirth;

- one-time income for registration in the clinic for pregnancy;

- social payment upon the birth of a child or the establishment of guardianship over a child;

- allowance for looking after a child up to 1.5 years;

- social benefits for job loss.

Form 1-NDFL consists of 8 sections, which are subject to mandatory completion. Let's consider each of them in more detail.

Section 1

This section contains general information about the source of income (tax agent). They include here:

- individual tax number of the organization;

- number (code) of the tax service where the company is registered;

- area code municipality to whose budget the tax is transferred;

- information about the agent - name or full name (for individual entrepreneurs).

Section 2

It contains information about the taxpayer.

It contains information about the taxpayer.

Initially, the TIN of an individual is filled in, which is indicated in the document issued by the tax service of the Russian Federation (clause 2.1).

Clause 2.2 - Code of the insurance certificate of the taxpayer in the Pension Fund of the Russian Federation.

Clause 2.3 - The surname, name and patronymic of the individual are indicated, in accordance with the passport of the Russian Federation. If the taxpayer is a citizen of another country, the data is filled in in Latin letters.

Clause 2.4 - Type of identity document (selected from a specific directory).

Clause 2.5 - Details of the passport (series and number).

Clause 2.6 - Date of birth (in accordance with passport data).

Calculation of the tax base

Section 3

This section calculates the tax base and the amount of personal income tax. If a person is a resident of the country, the tax rate will be 13.3%, if he is a citizen of another country, the rate reaches 30% of the amount of income.

Initially, the amount at the beginning of the reporting period is displayed:

Initially, the amount at the beginning of the reporting period is displayed:

- debt to the organization;

- debt for an individual.

- the day the payment is received at the taxpayer's account;

- the date of transfer of the amount in kind (from the cash desk to the hands);

- payment by individuals of interest on loans.

After making all the calculations, the card records the amount of accrued and withheld personal income tax, as well as the debt at the end of the reporting period for the tax agent and the taxpayer.

Section 4

In this section, the tax base and personal income tax on dividends are calculated. Provide information on the following items:

- the total amount of dividends;

- assessed tax;

- withheld tax;

- debt for the tax agent and the taxpayer;

- the amount transferred to the tax service;

- returned excess amount of personal income tax, if any.

If the taxpayer is a resident, the personal income tax rate will be 6% of the amount of dividends, non-resident - 30%.

Section 5

Form 1-NDFL is filled out in this section according to the following criteria:

Form 1-NDFL is filled out in this section according to the following criteria:

- the amount of winnings, prizes;

- voluntary life insurance payments;

- interest on the deposit received by the client;

- and much more.

This certificate (1-NDFL) is filled out for each criterion separately. Sometimes there can be several of them in one table. Separately, 35% is deducted from the amount and transferred to the “Calculated amount” item. Next, the withheld tax is filled in, then - the remaining debt for the enterprise or employee at the end of the calculated period, the tax transferred and the amount excessively withheld, if any.

Form 1-NDFL also contains section 6, where the total deductions at rates are calculated (35%, 30%, 13%, 6%).

A sample of filling out sections 7 and 8 can be seen in orders approved by tax legislation.

The difference between 1-NDFL and the tax register

These forms of reporting are somewhat similar to each other. But, as practice shows, filling out 1-personal income tax is much easier. It does not have part of the items that are indicated in the tax register. For reporting to be in full, you need to take form 1 as a basis, but add additional lines to it.

The tax register, like Form No. 1, is source documents for tax reporting. This document flow is necessary and obligatory for every organization or individual entrepreneur. All data is recorded here at the end of each reporting period (month), when employees received their wages.

The basis for document management is an employment contract. The main task is all the amounts indicated in the civil law or employment contract must be paid to an employee of the company, and from them the accountant is obliged to make deductions to the tax service.

On the this moment many documents are filled in automatically.