AT individual cases in accordance with the norms of legislative acts, civil proceedings are carried out in a simplified manner. In such a situation, the defendant is not invited to the court session where his case is being heard.

The justice of the peace is vested with the right to single-handedly issue a court order for the recovery of borrowed Money or claims for movable property. It is issued on the basis of an application submitted by credit institutions.

What it is

The wording "court order" means the decision of the magistrate that the debtor be collected from the debtor. It serves as the basis for opening enforcement proceedings. federal service bailiffs. For example, a bank may apply to a Justice of the Peace to issue an order.

The writ is signed by the justice of the peace and certified official seal judicial authority. A copy of it is sent to the debtor in accordance with the provisions of Article 130 of the Civil procedural code. He is entitled to 10 days file an objection after receiving it.

If it is not received within the prescribed period, then the justice of the peace sends a copy of the order to the exactor for enforcement. His admission testifies to the education controversial situation between the interested parties.

The total duration of the debt collection procedure takes about one month, if all deadlines are met.

The Justice of the Peace must issue a ruling whereby the writ is set aside. He must give clarifications to the claimant regarding the filing of a statement of claim with the judicial authority. The ruling on cancellation is sent to interested parties in the continuation 3 days counted from the day of its issuance.

In the future, the legitimate interests and rights of the applicant are ensured in the course of claim proceedings. It provides for legal proceedings as a result of the initiation of a civil case for the recovery of debt.

In accordance with the provisions of Article 127 of the Code of Civil Procedure, a court order is issued in 2 copies on a special form with unified form. One of them is filed in the case of writ proceedings, and a copy of it is sent to the debtor.

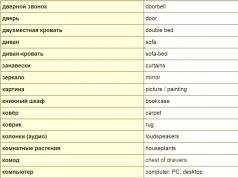

It states:

- serial number of production;

- date of issue;

- the name of the judicial body;

- personal data of the justice of the peace;

- Name, legal address the debtor, if the case concerns a legal entity;

- personal data, date of birth, place of main work, place of residence, if the debtor is an individual;

- base legislative act, according to which the requirement is satisfied;

- the amount of monetary obligations that are subject to collection or the name of the movable property with an indication of its value;

- the amount of the penalty, penalty fee established by the terms of the loan agreement, the norms of legal acts;

- the amount of the state duty to be paid by the debtor;

- requisites bank account claimant;

- arrears period.

If the court order is issued regarding the recovery of maintenance payments, then in addition to the data listed above, it is entered given name a child under the age of majority, his date of birth, place of birth, the amount of maintenance payments that are collected monthly and the period for their collection.

When issued

Often, a court order is issued for the purpose of collecting receivables. For example, maintenance payments, tax arrears and mandatory payments. Questions regarding removal court order provided by the legislator in the provisions of the current Code of Civil Procedure.

List of requirements satisfied by the justice of the peace without excitation judicial trial, is enshrined in the provisions of Article 122 of the Code of Civil Procedure of the Russian Federation. He issues a writ in continuation 5 days without calling the persons interested in the case to give explanations. The term is counted from the date of registration of the creditor's application by the office in the journal of incoming information.

The writ is subject to issue in accordance with the provisions of the above act under certain conditions.

These include:

- a claim has been made for the recovery of maintenance payments established for the maintenance of a minor child or as a result of motherhood;

- the claims are substantiated by a transaction certified by a notary public or made in a simple written form. The same applies to protests of a bill of non-payment, non-acceptance and acceptance, in which the date is not indicated, drawn up in a notarial order;

- a demand has been made to recover from citizens a certain part of taxes, mandatory payments and fees that have not been paid within the prescribed period, including;

- claim for recovery wages, which was accrued, but for some reason was not handed over to the employee;

- a claim was made for the recovery of expenses spent on the search for the defendant. The same applies to cases where, by decision of a judicial authority, a minor child is taken away from the debtor;

- a claim has been made for the recovery of expenses for the storage of property under arrest, confiscated from the debtor or property of the debtor, who was evicted from the living space he occupied.

Each claim for debt collection must be documented. Otherwise, the justice of the peace may reject the issuance of the writ.

Applying

The procedure for filing an application for debt collection is established by the provisions of Articles 28-29 of the Code of Civil Procedure. It is submitted in writing, based on the generally accepted rules of jurisdiction at the place of residence of the debtor.

The application contains information regarding:

- justice of the peace;

- court lot number;

- personal data of the debtor, his home address;

- requirements substantiated by the relevant references of regulatory legal acts;

- documents certifying the stated requirements;

- list of documents attached to the application.

If the application is filed regarding the recovery of movable property, then its value is indicated in it.

However, in accordance with the instructions federal law“On the organization of the provision of state and municipal services” a state fee is paid. The act was issued on July 27, 2010 under the number 210-FZ. Its instructions stipulate the obligation to pay fees by individuals and legal entities for the services of state bodies.

Its amount when filing an application for debt collection is equal to 50% from total amount cases of order production. Persons who filed an application for the recovery of alimony payments and wages are exempted from paying the state duty.

The amount of money collected

Civil cases falling within the jurisdiction of justices of the peace include property disputes related to non-return of sums of money in the amount of 50,000 rubles. The basis for issuing a court order is the provisions of Article 23 of the Civil Code of the Russian Federation. Also, to resolve the dispute, the instructions of Article 3 of the Federal Law "On Justices of the Peace in the Russian Federation" are applied. The act was issued on December 17, 1998 under the number 188-FZ.

It should be noted that in the acts there is no clear definition regarding the amount of monetary obligations. Such cases should not be limited to any specific amount, according to the judiciary.

As shows arbitrage practice In some cases, large sums of money are collected.

For example, in the case of the recovery of interest on a bill of exchange, a court order was issued, according to which 3,000,000 rubles were recovered. An example is given in the decision of the Presidium of the Supreme Arbitration Court of the Russian Federation, issued as a result of the consideration of case No. A40-49035 / 10-102-404. It was published on July 19, 2011 under the number 3085/11.

Court order for the recovery of debt on a loan

Each bank solves the problems associated with debts with its own well-established methods. Some banks sell them to collectors, thus getting rid of urgent problems that need to be solved. Others apply to the judicial authority with, trying to somehow influence the debtor, and still others submit an application to the justice of the peace in order to obtain a court order.

What is more profitable for the bank

The institution of writ has gained some popularity among commercial establishments, although it is not so long ago. It is endowed with the legal force of two documents at the same time - a court order on the collection of debt and a writ of execution. With his help, many banks returned the loans issued to the population of the country.

As a rule, debt collection based on it is much more profitable for the bank compared to filing a lawsuit with a judicial authority. The bank receives a writ of execution in a short period of time, which, of course, increases the likelihood of making a profit from the returned credit funds.

In addition, his presence in court to issue an order is not necessary, which is also an advantage.

The justice of the peace satisfies the requirements of the bank in in full regardless of the factors due to which the borrower has a delay. Most borrowers unquestioningly accept the requirements of banks issued by a court order, therefore, they fulfill all the obligations presented.

What to do when you receive a claim

The person in arrears may set aside the writ by filing an objection against it with the magistrate. To submit it, 10 days, which is counted from the time the debtor receives a court order. The norm is provided by the legislator in the provisions of Article 122 of the Civil Code of the Russian Federation. The debtor is not obliged to substantiate his objections by proving his case and presenting any documents in his defense.

Missing the deadline for filing an objection

As practice shows, many citizens learn about the issuance of a court order from the bailiff, who must enforce it. They should find out in the magistrate's office why he was not sent to the address. The debtor must file an application with the Justice of the Peace, who issued the writ to set aside it. In addition to it, they file a petition for the restoration of the deadline for filing an objection.

The court order in the current situation is canceled on the basis of Article 129 of the Code of Civil Procedure with the subsequent suspension of enforcement proceedings.

The deadline for filing an objection regarding its execution is restored on the basis of an application, if the person recognized as a debtor in absentia has them. In accordance with the provisions of regulatory legal acts, its cancellation serves as the basis for filing a claim with the judicial authority.

Which was issued on the basis of an application filed in writing one of the parties. From a legal point of view, a court order has the same force as a writ of execution, and is issued by the court in order to enforce any indisputable requirement, for example, the recovery of any movable property.

Differences between a court order and other court decisions

What is the difference between a court decision, which is issued in the form of a court order?

- Firstly, a court order is issued on the basis of documents that are recognized as indisputable, do not contradict the current legislation, and do not raise additional questions and doubts. Thus, the final is certainly clear and obvious.

- Secondly, the consideration of applications for the issuance of court orders takes place without calling the parties to participate in the court session. The judge issues a court order without hearing explanations and arguments.

The basis for sending an application for the issuance of an order may be the presence of an unfulfilled requirement for, notarized. In accordance with legal provisions Code of Civil Procedure Russian Federation the existence of a loan agreement certified by a notary is a sufficient basis for sending an application to the court for issuing a court order.

Requirements on the basis of which a court order can be issued

The judge alone issues a court order if the applicant's claim meets at least one of the following conditions:

- the requirement is based on documents that confirm the completed transaction and must be certified by a notary;

- the basis of the requirement is a transaction that is made in writing;

- the applicant indicated the requirement to recover from one of the parents the amount that has not yet reached the age of majority, this requirement does not entail necessity or motherhood;

- a claim was sent to the court to recover the amount of the debt on payment;

- the requirements of the internal affairs bodies aimed at collecting funds, to search for the defendant, the debtor or the child who was taken away from the parents in accordance with the court decision.

The procedure for appealing court orders

In practice, the debtor often objects to the issued court order for the recovery of the debt. However, in the process of considering the application, there is no opportunity to give additional arguments and provide evidence, because the consideration of the application for the issuance of a court order takes place without the participation of the debtor.

To this end, the law provides special procedure for appealing court orders. The judge cancels the made order if objections are received from the debtor within the time limits established by law. Even if the stated objections are not motivated, and the position is not supported by the relevant legal norms, the court order must be canceled. At the same time, the creditor has the right to subsequently apply to the court with the same requirements.

In order to exercise the right to appeal against the court order, the debtor is obliged to send his objections to the court within ten days from the date of receipt of the said document. Objections are sent in writing, necessarily in two copies. If the court order was received already after the ten-day period, then it is necessary to submit to the court an application for the restoration of the missed period with a list of all valid reasons for the absence.

There are cases when the judge refuses to cancel the court order. As a rule, this happens due to missing the deadline for appealing the order without sufficient good reasons. A refusal is issued in the form of a court ruling, which can also be appealed.

Entry into force of court orders

Only court orders that have already entered into force can be executed. As explained earlier, the debtor can submit his objections, on the basis of which the court order must be canceled. Thus, the date of entry into force of the order is directly related to the expiration of the period provided for its appeal. In the postal notice of delivery of the court order, which is returned to the court, there must be a note on the date the debtor received the order. It is from this date that the period for appealing the document is counted. If, at the end of the ten-day period, the court has not received objections from the debtor, therefore, the court order is considered to have entered into force and can be executed.

|

|

|

|

- What is a debt collection order?

- How is the interaction with the court.

- What to do to the debtor who received the order.

- What steps are required to cancel an order.

A court order to recover debt on a loan is one of the extreme measures, which is applied by the court to debtors at the request of the creditor. Knowing what a foreclosure is, how a foreclosure is made, and how it can be avoided will go a long way in resolving a debtor's problems. We invite you to learn more from this article.

Some banks sell unpromising debts from their point of view to collection agencies, while other banks prefer to deal with debtors through the courts. Moreover, more and more banking organizations do not waste time waiting for the moment when the client pays off his debts, and instead immediately apply for a court order.

What is a court order for the recovery of debt on a loan

A court order is a formal order issued in person by a judge without a public or private hearing. The decision is issued after the banking organization applies to the Magistrate's Court and provides it with evidence that the debtor really does not cope with the repayment obligations loan. In this case, the judge decides to issue a court order, which is a writ of execution.

Often banks do not file an application with a regular court, but immediately go to the world court. This is due to the fact that issuing a court order to collect a debt takes a minimum of time and effort. Details of the court order can be found in Article 121 of the Code of Civil Procedure of the Russian Federation and Article 229.1 of the APC of the Russian Federation.

Differences from filing a claim

Practice shows that banks, to which clients owe not very large sums of money, prefer collection through a court order rather than through filing a claim. The reasons are:

- The judge decides on the issuance of a court order on his own. In this case, there is no trial; the personal participation of the accused and the injured parties is not required. In addition, the debtor will not be able to file a counterclaim, put forward own requirements, to prove the absence of guilt within the framework of the delay in paying the debt. Therefore, it is easier for banks to return their money in this way.

- It takes significantly less time to process a debt claim.. With the traditional scheme - filing a claim - the time spent on resolving a dispute can be six months, a year or even more. It depends on the workload of the court, the presence of objections and petitions from both parties, and other factors. Recovery through a court order takes just a few days, a maximum of weeks.

- Many debtors do not know their rights and perceive the court order as a fact with which nothing can be done. This psychological trick used by many banks, because he pushes the client to pay off the debt as soon as possible. In practice, a court order can be canceled if an objection is filed in a timely manner. Next, you will learn how the debtor can cancel the execution of the order.

If a verdict and a writ of execution were issued against you, it is possible to cancel the execution, reduce the risk to the minimum.

Filing an application for the formation of a court order is rational only if the debtor does not deny his own guilt and does not waive the obligation to pay the debt. Otherwise, an appeal to the Magistrate's Court will not bring any result, since the defendant can cancel the order with one statement. The way out is litigation.

When banks go to the world court

Most banking organizations are quite loyal even to those customers who have made a delay in the fulfillment of credit obligations. Some banks are taking steps to address the issue in pre-trial procedure, thereby going towards the client.

Banks have the right to apply to the world court for a writ of execution after the first two delays in payment. The same applies to situations in which debt is considered not on a loan, but on tax payments, alimony, unpaid wages, and so on. For this reason, a person against whom actions within the framework of judicial proceedings can be applied must immediately be on the alert.

How to Convince a Bank to Reduce Debt

"General Director" tells what arguments will convince the bank to restructure the loan and interest rate thereby reducing the company's loan debt to a minimum.

The procedure for issuing a court order to collect a debt

Before applying to the branch of the Magistrate's Court in order to initiate debt collection, the bank or other collector makes sure that the amount collected is within the limits allowed by law. This limit is 500,000 ₽. If the amount of the debt is significantly greater than this, it makes sense to demand payment of the debt through a lawsuit. This is usually done by banks that have large debtors.

The order of interaction between the plaintiff and the judicial authority in the framework of the penalty in question is as follows:

- The injured party draws up an application and submits it to the Magistrate's Court at the place of residence of the debtor.

- The applicant pays a mandatory state fee for the details taken on the website of the court.

- Documentation is attached to the application, which most fully proves the correctness of the creditor.

- A package of documents with an application is sent to the court located at the place of registration of the debtor.

Within three days after the application, together with the attached documentation, is received by the court, a court order is issued against the person in debt. Documents can be submitted to the court not only with the personal application of the victim, but also by mail or through a person who has a power of attorney.

Reasons for refusal to issue an order

There is always the possibility that the application will be rejected by the Magistrates' Court. This happens for reasons that have a solid foundation. Most often, the court refuses the creditor in such situations:

- Was not provided full package documentation required for the issuance of the order.

- The person against whom debt collection is planned no longer resides in Russia.

- A demand is put forward that is not considered within the limits of writ proceedings.

- The magistrate decides that there is a conflict between the debtor and the applicant.

The situation can be corrected only in the first case - it is enough to carefully collect the documentation and once again submit it to the appropriate department of the Magistrate's Court. In other situations, legal proceedings in the magistrate's court will not bring any result. We will have to use such an alternative as litigation.

How is a plaintiff's application made?

In order to initiate the recovery of unpaid debts, the injured party must correctly fill out and submit a special application to the Magistrate's Court branch. In addition, it is required to go through a whole procedure, the beginning of which is the preparation of an application, and the end is the collection of the debt itself.

The document, which is submitted by the injured party to the department of the Magistrate's Court, must necessarily indicate detailed information about the requirements of the claimant. You will also need to correctly write in the document the name of the court where it is planned to receive an order to collect the debt, the name of the debtor and the collector. The requirements must be accompanied by documents that substantiate the existence of the requirements.

What is a debt collection order for?

In practice, a court order to recover the amount of debt can be issued not only in relation to a borrower who has a debt in a banking organization. The Civil Procedure Code of the Russian Federation also speaks of other cases in which it is possible to issue a court order to collect a debt. They are presented below:

- Failure to pay child support. In the situation under consideration, a court order against a non-payer of alimony can be issued if there is no dispute about the place of residence of the children, about paternity, and also if the debtor pays alimony in relation to other persons.

- Non-payment of accrued unpaid wages. In the case when the accounting department calculates salaries, but the employees never receive it, dissatisfied employees may initiate the creation of a court order to collect the employer's debts. You need documents that prove the existence of a debt.

- Failure to complete a notarized transaction. If one or both parties fail to comply with the terms of a notarized transaction, they may apply to the magistrate's court for a writ of injunction. In this case, you will need to provide the court with the original notarized contract.

- Failure to complete a deal in writing. In order to recover money from a party that does not fulfill its obligations, a written agreement, correctly concluded between citizens, will be required. The contract must describe all the details, conditions, terms of execution and the essence of the transaction.

Also, a court order to recover the amount of the debt may be issued on the basis of the initiative of the authorized bodies to recover the money spent on the search for the accused party. The list of situations within which a court order can be issued is strictly regulated by the legislation of the Russian Federation.

What to do if a court order is received

A serious mistake many debtors make is that when they receive a court order, they think that nothing can be done about it. There are thoughts about where to get money to fulfill the requirements of the creditor, in general, the situation is developing negatively. Receiving an order does not mean at all that the bailiffs will come in a day and take everything away.

The actions that follow the receipt of a copy of the executive document by the debtor in his hands depend entirely on his agreement with the decision of the judge. Based on this fact, the situation can go two ways:

- Consent with the order. In this case, the debtor does not deny the fact that he has a debt for reasons that cannot be called convincing. Recovery occurs in different ways, depending on what will be appointed by the court. This may be the collection of part of the income, the seizure of property or other options.

- Disagreeing with an order. Much more common situation compared to the previous one. In this case, the only option available to the debtor is to promptly draw up a statement expressing disagreement with the decision of the justice of the peace. Learn more about this procedure below.

The annulment of the judgment gives the defendant some extra time in order to prepare the evidence base and minimize their own losses.

Cancellation of a court order - what needs to be done

Regardless of the situation in which the court order was issued, its copy must be sent to the debtor at the address indicated by the claimant in the application. After the debtor receives a copy of the order, he has no more than 10 calendar days in order to formally express to the court his objection to the issuance of a court order. This period is counted from the moment of registration of receipt of the order.

The debtor has the great advantage that he does not need to explain the reasons why he disagrees with the issuance of a court order. The very fact that the debtor does not agree is already a convincing reason for the order to be canceled. This right of the defendant is more clearly explained in Article 129 of the Code of Civil Procedure of the Russian Federation.

What is the result of canceling the order

Despite the fact that the grounds for refusal of the debtor are not required, the cancellation of the court order does not relieve the person of the obligation to pay the debt. The order acts as a dispute between the plaintiff and the defendant. As soon as the magistrate's court receives an application demanding the cancellation of the penalty, the court promptly cancels the document. After the debtor can defend the interests through the action proceedings.

Debtors may have doubts that the cancellation of the order gives a result, so that it would be rational to file an application. Practice shows that it makes sense to apply for cancellation. After the abolition of the ruling on recovery by the world court, the debtor receives some time in order to collect evidence of his own innocence and prove it already in the order of action proceedings.

On average, it takes a justice of the peace to review an application for annulment no more than 3 days. In the event that the cancellation actually occurred, both parties - the plaintiff and the defendant - will be notified of this as soon as possible.

Proper filing of an application

In order to cancel the collection of debts by the sole order of the justice of the peace, the defendant must make efforts to properly execute the application for cancellation. There are no strict requirements for content and structure. When creating an application for the cancellation of a court order, the debtor is recommended to follow the algorithm below:

- A blank sheet of white A4 paper is placed vertically - this is the basis of the statement.

- The name, phone number and registration address of the applicant is described in the upper right corner.

- In the same place, at the top right, the name of the court where the application is being submitted, as well as the full name of the judge, is written.

- The word “Objection” is written below with center alignment - this is the name of the document.

- Under the word "Objection" in free form, the reasons for disagreeing with the order are described.

- The following is an appeal to the court with a request to cancel the court order for recovery.

- Under the description of the appeal, the date of writing the application, as well as the signature of the applicant, is written.

The fifth paragraph is optional, since the defendant is not required to explain the reasons why he disagrees with the court order. If you do not understand the structure of the application, it is recommended that you review the sample court order for the recovery of the amount of the debt.

An application for the cancellation of a court order to collect a debt should be submitted to the same court in which the decision to collect a debt was issued. You can transfer the document not only in person, but also through a legal representative. If this is not possible, the respondent may use the postal service.

What to do if the deadline has already passed

Situations are different, and there may be a problem with the delay in filing an application to set aside a court order. Fortunately, a person who did not have time to submit an application within the ten-day period allotted by law can take advantage of the extension of the appeal period. To do this, you must send an application to the court, which freely describes good reasons for which it was not possible to file a petition for cancellation on time.

The privilege of simply extending the deadline for submitting an application is available only to individuals. Companies will have to indicate in the statement much more convincing factors that served as obvious reasons delay in sending an application for a request to cancel the collection. This is due to the fact that, by definition, companies must work effectively even in the absence of a manager in the workplace.

The possibility of extending the time limits that are given to appeal the decision of the world court is present when the debtor has not received a copy of the order due to problems with delivery. In this case, the reason for the delay is valid, since a private person cannot influence the work of transport services. The court considers the reasons and makes a decision strictly on an individual basis.

Conclusion

From the foregoing, we can conclude that for the debtor, receiving a copy of the recovery order with the right approach is nothing more than a warning. Such a document shows that between the parties to a loan or other agreement describing material relations, there is a dispute. Right Action help the debtor cancel the order and save their own property.

There is always a possibility that the creditor will apply to the justice of the peace if the borrower does not repay the loan at all or there is a debt to pay the debt. In this case, the judge has the right to issue a writ about. In the Russian Federation, the institution of a court order has been operating for more than a year, but questions still arise regarding its necessity and features.

When applying to the court, the creditor submits an application prepared in a certain form. As a result, the judge issues an order that is simultaneously endowed with the force of a court decision and an executive document. Borrowers will learn about the adoption of such an order after receiving a notification, which most often comes by mail.

Dear readers! The article talks about typical ways solving legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and IS FREE!

Not all recipients of such notifications understand what a court order is and what needs to be done if such a document was found in mailbox what legal force it has and how it can be challenged or blocked.

Definitions

The justice of the peace has the power to issue several types of orders, one of them is a writ of debt collection. Orders are issued by the judge most often if we are talking on consumer lending, that is, those loans that were provided without collateral and support from guarantors.

The basis for issuing an order is an application submitted by a bank or other financial structure about the collection of outstanding debts. Since the order is also a writ of execution, banking institutions prefer to apply directly to justices of the peace, and not to ordinary courts. Such an appeal threatens to wait for a writ of execution during the term 6 to 12 months.

What advantages does the borrower receive if the bank does not file an application for a court order, but a lawsuit:

- the borrower receives subpoenas, thanks to which he has the opportunity to attend each court session and monitor the progress of the case;

- the defendant can personally familiarize himself with the claims that the bank makes against him and receive copies of all documents that are of interest to him;

- the debtor may apply for a deferment in the performance of his debt obligations;

- the borrower is entitled to file a counterclaim against the bank, demanding that all paid commissions and insurance premiums be returned to him;

- Another advantage is the possibility of achieving a reduction in the amount of penalties and interest that the debtor must pay in connection with the delay in repaying the debt.

Entry into force

The debtor has the opportunity to correct the situation even if he has already received notice that the justice of the peace has issued an order to collect the debt. To do this, the debtor needs 10 days upon receipt of the notice, apply to the court and file objections regarding the issuance of such a decision.

To confirm that the notification has not been received ahead of time, which is reserved for challenging the decision, you need to fix the date and time upon receipt of the notification. The debtor must submit objections to the court in writing. The order will be canceled by the justice of the peace in accordance with Art. 129 of the Civil Procedure Code of Russia.

In the ruling, which will be issued by the justice of the peace, the exactor will be given an explanation that the requirements put forward by him cannot be met due to the existence of significant reasons for this. Such document shall be sent to the parties within 72 hours from the moment it was issued.

There are situations when the debtor learns about the existence of a court order from the bailiff. In this case, you need to find out why he did not know about the existence of a debt collection order earlier. It must be remembered that there is always a chance to restore the deadline for filing an application to cancel the order, especially in situations where the rights of the borrower have been violated and all procedural points have not been observed.

If you paint the scheme for the annulment of a court order step by step, then it looks like this:

- the debtor prepares and submits to the judge an application in which he sets out his objections, substantiating them;

- the decision made by the magistrate loses its force;

- the bank will not leave its attempts to claim the debt from the borrower, however, its next step will be to apply to the ordinary court with a statement of claim;

- defendant has access to court sessions and has the ability to reduce the amount of penalties or delay the payment of the debt.

Also, the defendant gets a chance to delay the course of the trial, and given that this is unprofitable for the bank, at this time he has the opportunity to agree with the financial structure on a peaceful resolution of the conflict on mutually beneficial terms

Appeal

In practice, quite often there are situations when debtors do not agree with the legality of the issued court order. However, borrowers do not have the right to express their opinion and provide evidence of their innocence during the consideration of the bank's application by the justice of the peace. This is due to the fact that according to the law this document considered without the direct involvement of the defendant.

That is why there is a special procedure for appealing the decision. The order may be canceled by the judge if the debtor submits his objections to the justice of the peace in the prescribed terms. To cancel the order, the borrower will not even need to provide evidence or substantiate his objections.

But one should not think that the abolition of the order is the end point and the borrower does not need to fear that the debt will be collected from him one way or another. The creditor has the right to state his claims again in statement of claim and take it to court.

The debtor may exercise his right to appeal within 10 days from the date of receipt of the notice of the issuance of the order. To do this, it is enough to file personal objections to the court against the decision. Such objections must be stated in writing and submitted to the judge for consideration in 2 copies.

If a 10 days passed, and the borrower did not have time to file objections within the time limit, he has the right to apply to the judge with an application to restore this period, indicating good reasons, as a result of which the time frame was violated.

There are cases when judges refuse to cancel the order. Often this is due to the fact that the term allotted for appeal was omitted, and the borrower did not provide information about good reasons that prevented compliance with time limits. Such a refusal is also formalized as a judicial ruling, which, if there are grounds for it, can be appealed.

Differences

It will not be superfluous to understand the main differences that exist between an ordinary court order and one that was issued in the form of an order.

First important difference consists in the fact that the issuance of a court order for the recovery of a debt occurs on the basis of an evidence base, which is recognized by the court as beyond doubt and which does not conflict with the current legislation of the Russian Federation. It follows from this that the final decision of the magistrate should be obvious and beyond any doubt.

Writ proceedings are a simplified procedure for considering certain categories of cases in a shortened time frame. Cases are considered by the judge alone, without summoning the parties.

concept

The essence of the court order is disclosed in Art. 121 of the Civil Procedure Code of the Russian Federation and Art. 229.1 of the Arbitration Procedure Code of the Russian Federation. The basis for it is the statement of the plaintiff for the recovery of money.

The order is both a verdict and an executive document.

Types of disputes

Let's take a look at the types of charges:

- alimony;

- arrears, fines, taxes and other obligatory payments;

- on transactions made in a simple written form or certified by a notary;

- wages;

- expenses incurred to search for a debtor, a child taken from the debtor in accordance with a court decision;

- requirements for a notarial protest of a bill.

A limitation on the amount of claims has been established: 500 thousand rubles in the case of justices of the peace and 400 thousand rubles in arbitration.

How to file a debt collection order

The order is issued by the justice of the peace at the place of residence of the defendant. The only exceptions are cases on the recovery of alimony for the maintenance of a child, for which you can apply at the place of your registration or permanent residence.

If the place of residence of the defendant is unknown, then the court should apply at the last famous place his residence in the Russian Federation.

In case of a dispute between legal entities, the case is considered in arbitration court at the place of registration of the organization.

Documents for issuing a court order:

- statement.

Compiled in simple written form. Mandatory indication: details and name of the court site, F.I.O. persons, names of the organization and contact information of the parties, description of the situation and claims for debt collection;

- receipt for payment of state duty.

For the issuance of a court order, the fee is 50% less than when considering a case in an action proceeding. The amount of the fee is specified in Article 333.19 of the Tax Code of the Russian Federation. Details can be obtained from the office or on the website of the court;

- a copy of the passport (first page and registration);

- evidence supporting the applicant's position.

For example, if we are talking about the recovery of alimony, then the evidence will be a birth certificate of the child, where the defendant is listed as the father, a copy of the marriage / divorce certificate, a certificate of paternity (if the parents are not or were previously in a registered relationship).

A package of documents can be submitted in person, through a representative by proxy, or by registered mail with notification.

If the judge returned the application, as an incomplete set of documents was submitted, then you can apply again with a full set of papers.

A decision to refuse to accept an application is issued if:

- the defendant lives outside the Russian Federation;

- the claim is not subject to consideration in the order of writ proceedings;

- after examining the documents, the judge found that there was a dispute between the parties.

Deadlines

After receiving the documents within 5 days (10 days in arbitration), a court order is issued. The grounds for issuance are indisputable documents, therefore the case is considered without calling the parties, by the judge alone.

The document is drawn up in 3 copies: for the court, the applicant and the debtor. Copies are sent to the parties by mail.

What should a debtor who has received a court order do?

In accordance with the Code of Civil Procedure of the Russian Federation, a person who has received an order has 10 days to appeal it. To do this, you must apply to the court where the decision was made, with an objection.

If the deadline has been missed good reason, then you can apply for the restoration of the period and attach written evidence: documents about your stay on a business trip, on inpatient treatment in a hospital.

Objection to a court order

The document is drawn up in free written form. The main thing is to indicate your disagreement with the decision.

The legislation does not require that the objection be motivated and supported by evidence.

When filing an objection, you do not need to pay a state fee.

Cancellation of a debt collection order

Upon receipt of an objection, the judge issues a decision to cancel. The ruling clarifies the applicant's right to resolve the dispute in an action proceeding in a court of general jurisdiction.

Not later than 3 days (5 days if the parties - legal entities) from the moment the ruling is made, copies of the document are sent to the parties.

If no objections are received from the defendant within 10 days, the order shall enter into force. To enforce the decision, the applicant should apply to the judge for the issuance of a second copy of the decision already with the official seal. At the request of the claimant, the order may be sent to the bailiffs in paper or electronic form.

On the basis of the document, the bailiffs open enforcement proceedings. The defendant is given the opportunity to voluntarily fulfill obligations within 5 days, in case of refusal, methods of forced collection of the debt are applied to the debtor.