Amendments have been made to the basic Federal Law No. 209-FZ, which defines the concept of small and medium-sized businesses, the basic principles and areas of support for this sector.

Small and medium businesses are currently assigned important role in economic transformation. Without changing the approaches to regulating the SME sector, which were laid down seven years ago by the federal law "On the development of small and medium-sized businesses in Russian Federation”, it would be difficult to reform. Practice dictates new requirements: the structure of the sector in terms of number, turnover and other indicators is changing; more and more in demand in terms of the implementation of investment projects are joint ventures with foreign participation or with the participation of large companies; the overall coordination of the many and disparate support mechanisms established by the state is required.

What are the main changes introduced by the Federal Law of June 29, 2015 No. 156-FZ to the Federal Law "On the development of small and medium-sized businesses in the Russian Federation"?

The changes can be divided into two blocks.

The first concerns the change in the attribution criteria legal entities to SMEs.

The second is the creation of a special sector support institution - the Federal Corporation for the Development of Small and Medium Enterprises.

The threshold for the participation of foreign legal entities, as well as Russian legal entities that are not small and medium-sized businesses, in the authorized (share) capital of small and medium-sized businesses has been increased from 25% to 49%. In addition, organizations that have received the status of participants in a project for the implementation of research, development and commercialization of their results are endowed with the status of an SME subject in accordance with federal law o Skolkovo, regardless of the share of participation in the authorized capital of such organizations of other legal entities (both foreign and Russian).

What will SMEs gain by increasing the share of participation of foreigners and non-SMEs in SMEs?

First of all, this additional opportunity attraction of investments in Russian economy. One of the common forms of implementation of investment projects is the creation of joint ventures.

Previously, most joint ventures did not fall under the criteria of small and medium-sized businesses due to the share of foreign participation in the authorized capital. This situation cut off significant amount companies from government programs support, designed exclusively for the sector of small and medium-sized businesses. And the law corrected this situation, ”the head of the Russian Chamber of Commerce and Industry emphasized in a comment for RG Sergei Katyrin.

An important amendment was the increase in the period during which the enterprise retains the status of an SME, despite the change in the limit values for the criteria of small and medium-sized businesses. This period has been extended from two to three years.

Director of the Department of Entrepreneurship and Services of the Chamber of Commerce and Industry of the Russian Federation Anna Palagina noted that the basic law on the development of small and medium-sized businesses should correspond to realities, keep up with them. Ideally, to be proactive, stimulating the development of the sector. The adopted changes will have a positive impact on the economy, as they will open access to a new pool of companies to programs for the development of the small and medium business sector.

The creation of the Federal Corporation for the Development of Small and Medium Enterprises is the second important block of changes.

Separate articles on the Federal Corporation, art. 25.1 and Art. 25.2, which describe in detail the tasks and functions of the corporation as an institution for development in the field of small and medium-sized businesses. The functions of the Federal Corporation included the authority to coordinate the activities of the SME support infrastructure, to ensure the inclusion of small businesses in the procurement processes from large companies with state participation, to develop mechanisms for financial support of the sector and direct financing of credit and microfinance organizations. According to the law, the corporation is obliged to send an annual report on the implementation of its activities to the President of the Russian Federation, the State Duma, the Federation Council, and the Government.

The law indicates a significant number of areas that should be worked out at the level of by-laws. For example, the composition, form, procedure, deadlines for reporting by businesses that have received support and organizations that form the SME support infrastructure will be determined later. The government should establish a procedure for monitoring and evaluating the compliance of procurement plans and annual reports on procurement of large companies from SMEs.

In general, the tasks and functions of the Federal Corporation are designed to synchronize efforts towards the creation favorable environment for the development of small and medium-sized businesses in the country.

There should be a single, convenient, understandable “access point” for all business representatives to support measures. We note the timeliness and relevance of the creation state institute development of SMEs, notes the President of the Chamber of Commerce and Industry of the Russian Federation Sergei Katyrin.

Department of Entrepreneurship and Services, N. Kovalenko

Small business in Russia enjoys special, intended only for him, benefits. The state is trying to reduce the tax and administrative burden of small businesses, receiving in return an increase in employment and a decrease in social tension. What does the definition of “small business entities” mean and who belongs to them in 2019?

A small business entity is a Russian commercial organization or an individual entrepreneur who is aimed at making a profit. Also included in this category are:

- peasant (farm) farms;

- production and agricultural cooperatives;

- business partnerships.

A non-profit organization, as well as a unitary municipal or government agency is not a small business.

Who belongs to SMEs

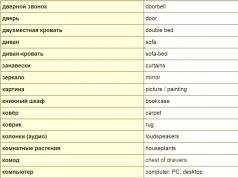

The criteria for classifying small businesses in 2019 are established by the state. The main requirements, subject to which it is possible to classify a businessman as a small and medium-sized business (SME), relate to the number of employees and the amount of income received. Who is the SME, i.e. refers to small businesses, defines the law of July 24, 2007 N 209-FZ in article 4. Let's consider these criteria, taking into account innovations.

Thanks to the amendments made to Law No. 209-FZ, a greater number of enterprises and individual entrepreneurs can be classified as small businesses.

- The maximum allowable amount of annual revenue without VAT for the previous year for micro-enterprises increased from 60 to 120 million rubles, and for small enterprises - from 400 to 800 million rubles.

- The permitted share of participation in the authorized capital of a small enterprise of other commercial organizations, which are not subjects of small and medium business - from 25% to 49%.

But the allowable average number of employees has not changed: no more than 15 people for micro-enterprises and no more than 100 people for a small enterprise.

In a relationship individual entrepreneurs the same criteria for division into business categories apply: by annual revenue and number of employees. If an individual entrepreneur has no employees, then his SME category is determined only by the amount of revenue. And all entrepreneurs working only on the patent system of taxation are classified as micro-enterprises.

The period during which a businessman continues to be considered an SME has been extended, even if he has exceeded the allowable limit on the number of employees or the revenue received. Until 2016 it was two years, and now it is three. For example, if the limit was exceeded in 2017, then the organization will lose the right to be considered small only in 2020.

What to do in a situation where the status of a small enterprise is lost due to the achievement of the previously existing limit of 400 million rubles, because it is lower than the current one? The Ministry of Economic Development believes that after the act of the Government of the Russian Federation dated July 13, 2015 No. 702 comes into force, such an enterprise can return the status of a small one if the annual revenue does not exceed 800 million rubles.

State Register of SMEs

Since mid-2016, the Unified Register of Small and Medium-Sized Businesses has been in operation. A list is posted on the portal of the Federal Tax Service, which includes all subjects of small and medium-sized businesses of the Russian Federation. Information about SMEs is entered into the register automatically, based on data from the Unified State Register of Legal Entities, EGRIP and tax reporting.

The following mandatory information is publicly available:

- the name of the legal entity or full name IP;

- TIN of the taxpayer and his location (residence);

- the category to which small and medium-sized businesses (micro, small or medium enterprises) belong;

- information about activity codes according to OKVED;

- an indication of the presence of a license, if the type of activity of a businessman is licensed.

In addition, according to the application of a businessman belonging to small and medium-sized businesses, additional information can be entered in the register:

- about the manufactured products and their compliance with the criteria of innovative or high-tech;

- on the inclusion of an SME entity in partnership programs with government customers;

- on the existence of contracts concluded as a participant in public procurement;

- complete contact information.

To transfer this data to the Unified Register, you need to log in to the information transfer service using an enhanced qualified electronic signature.

After the formation of the official register, small businesses are no longer required to confirm with documents that they correspond to this status in order to participate in state support programs. Previously, this required the submission of annual accounting and tax reporting, a report on financial results, information on the average number of employees.

You can check the information related to small and medium-sized businesses, and their reliability, by making a request for information on the TIN or name in the Register. If you find that there is no data about you or they are unreliable, then you must send a request to the Registry operator to verify the information.

What gives the status of a small business entity

As we have already said, the state creates special favorable conditions for micro and small businesses entrepreneurial activity, pursuing the following financial and social goals:

- ensure a way out of the shadows and self-employment of persons providing services to the population, engaged in small-scale production, working as a freelance;

- create new jobs and reduce due to the growth of the welfare of the population social tension in society;

- reduce budget spending on unemployment benefits, health insurance and pension provision officially unsettled persons;

- develop new activities, especially in the field of innovative industries that do not require significant costs.

The easiest way to achieve these goals is to make the state registration procedure simple and quick, reduce administrative pressure on businesses, reduce tax burden. In addition, targeted financing in the form of non-repayable subsidies has a good effect on the activities of start-up entrepreneurs.

The main list of preferences for small businesses looks like this:

- tax incentives. Special taxation regimes (STS, UTII, ESHN, PSN) allow you to work at a reduced tax rate. Since 2016, regional authorities have the right to further reduce taxes on UTII (from 15% to 7.5%) and on USN Income(from 6% to 1%). On the simplified tax system Income minus Expenses, the opportunity to reduce the rate from 15% to 5% has existed for more than a year. In addition, from 2015 to 2020, individual entrepreneurs, first registered after the entry into force of the regional law on, have the right not to pay tax at all under the PSN and STS regimes for two years.

- Financial perks. This is direct financial state support in the form of grants and gratuitous ones, issued within the framework of the all-Russian program, which is valid until 2020. Funding can be obtained to reimburse leasing costs; interest on loans and credits; to participate in congress and exhibition events; co-financing projects (up to 500 thousand rubles).

- administrative benefits. This refers to such concessions as simplified accounting and cash discipline, supervisory holidays (limitation of the number and duration of inspections), the ability to arrange urgent employment contracts. When participating in public procurement, there is a special quota for representatives of small businesses - at least 15% of the total annual volume of purchases by state and municipal institutions have to produce from them. When obtaining loans, government guarantors act as guarantors for small businesses.

Entrepreneurial activity in the Russian Federation is developed and therefore it is quite difficult to introduce something new. For successful business development, entrepreneurs attract investors to their activities. Thanks to investments, any business has a chance to win in competition in the Russian markets.

According to the legislation of the Russian Federation, an entrepreneur can be a legal entity or an individual (individual entrepreneur). To regulate the relations that arise in the process of doing business, law No. 209 “On the development of small and medium-sized businesses” was created, which will be discussed below.

Description of Federal Law-209 "On the development of small and medium-sized businesses"

Federal Law No. 209 "On the development of small and medium-sized businesses in the Russian Federation" was adopted by the State Duma on July 6, 2007, and approved 5 days later of the same year. Last changes were submitted on July 26, 2017. The law contains one chapter and 27 articles.

Federal Law No. 209 was created to regulate relations between:

- Individuals and legal entities;

- State bodies. Russian authorities;

- State bodies. the authorities of the constituent entities of the Russian Federation;

- bodies local government working on the development of small and medium businesses.

Article 3 of this Federal Law on enterprises and entrepreneurial activities lists in detail the following concepts:

- Small and medium business entities;

- Subject support infrastructure;

- Forms and types of support.

Federal Law No. 209 contains articles on the basis of which statistical data are collected on the activities of medium and small businesses. The collected statistics are sorted into monthly and quarterly reports. If a small business is not yet developed, but continues to work, then the leaders of the organization must provide data to the statistics bureau every 12 months. Sometimes there are selective statistical observations on business activities by decision of the Government of the Russian Federation.

Download the law on private entrepreneurship of the Russian Federation

For the development of business activities in the Russian Federation, a separate public policy, which is implemented local authorities. It is aimed at achieving the goals and principles established by Federal Law No. 209.

State policy objectives:

- Formation of a competitive environment in the Russian economy;

- Providing favorable conditions for the conduct of activities of small and medium-sized businesses;

- Ensuring competitiveness;

- Providing assistance to business entities in the field of promoting goods and services;

- Increasing the number of medium and small businesses;

- Increase in the share of taxes paid by business entities.

Principles of public policy:

- The division of duties between the state. authorities in providing assistance to medium and small businesses;

- A responsibility federal bodies state authorities for doing business right. Creation necessary conditions for economic development business entities.

To download the Federal Law with the amendments and additions, go to.

Changes in the law on the development of entrepreneurship

The last amendments to the Federal Law were made on July 26, 2017. It's about on Article 4 of Law No. 209.

P 2 article 4

Item 2 refers to the number of employees in small enterprises. Up to 100 employees can work in such an organization. The management of a micro-enterprise can employ up to 15 people. The number of employees in medium-sized enterprises should not exceed 200 people.

P 2.1 Article 4

P 2.1 of the article of the Federal Law "On the development of small and medium-sized businesses in the Russian Federation" states that deputies State Duma can independently set the maximum threshold for the number of employees in the enterprise.

Ch 3 Article 4

This part describes the rules by which the category of a medium and small business entity is determined. If an individual or legal entity (a citizen as an individual entrepreneur) during the previous year did not employ other citizens of the Russian Federation on labor activity, then the category is determined based on the amount of profit for the previous year. Other categories of entities are determined depending on the number of employees in the enterprise.

The category of a business entity can be changed if changes have been made to the sorting indicators. If an individual entrepreneur is again registered in the state register, then the category of the subject remains the same.

All Federal Laws on entrepreneurial activity in the Russian Federation

Federal laws mean legislative acts, which contain norms and rights governing relations arising between entrepreneurs or directly with their participation in entrepreneurial activities.

List of federal laws regulating entrepreneurial activity:

- - describes the state of the market on the territory of the Russian Federation;

- - describes legal status entrepreneurial activity;

- describes the legal provisions that govern certain types entrepreneurial activity;

- - contains correct order conducting business activities.

Despite a considerable number of federal laws, not a single legislative provision contains the principles of interaction between the state and business. Articles Civil Code In the Russian Federation, as a rule on trade turnover, there is an indication that the state cannot interfere in the private affairs of entrepreneurial activity without any reason.

But if the law contained the principles of interaction between the state and entrepreneurship, there would be no contradictions between several federal laws.

To download amendments and additions to this Federal Law No. 209 "On the development of small and medium-sized businesses in the Russian Federation", go to .

Not many people know the difference between small, medium and large businesses. To understand the differences between these concepts should, especially, a novice entrepreneur. In the case of defining the idea of entrepreneurship and writing a business plan, you should have ideas about the future occupation.

What it is

Small business is the most common form of entrepreneurship, which is chosen by most start-up businessmen.

Small business is the most common form of entrepreneurship, which is chosen by most start-up businessmen.

Medium business̶ it is a form of entrepreneurial activity that, compared to a small business, has a more impressive annual income and more extensive and diverse resources for commercial activities.

Big business is a form of entrepreneurship that includes popular companies covering an entire country or more than 2 countries of the world, as well as having a strong demand from consumers.

Key Features of Entrepreneurship

Each form of commercial activity ̶ SME or big business, has its own characteristics, which distinguish them from each other.

small features

Small businesses are not only individual entrepreneurs, but also companies whose average annual number of employees is at least 50 people.

The territorial activity of these companies is small, and the list of their areas of activity may include:

- the shops;

- firms with a small production that produce small volumes of goods;

- companies with tourism activities;

- medical offices (dental, etc.);

- varied training courses etc.

For small businesses, the period for conducting inspections has been reduced and annually is no more than 50 hours.

Until December 31, 2018, these businesses are granted a two-year supervisory vacation, during which no supervision will be carried out. Sanepidemnadzor and fire inspection visits are not threatened, and the activity license will not be checked.

According to part 2 of article 10 of the Federal Law “On the protection of the rights of legal entities and individual entrepreneurs in the exercise of state control (supervision) and municipal control”, upon receipt of complaints from consumers about violations of the law, an audit will be carried out.

According to part 2 of article 10 of the Federal Law “On the protection of the rights of legal entities and individual entrepreneurs in the exercise of state control (supervision) and municipal control”, upon receipt of complaints from consumers about violations of the law, an audit will be carried out.

In 2018, entrepreneurs who:

- register for the first time;

- carry out industrial, social or scientific activities;

- provide services to the public.

Small businesses do not need proof of status. It is only necessary to adhere to the above limits (income, number of employees and share in the authorized capital). If the limits were exceeded within 1 or 2 years, then this is not a reason for losing status. In this case, it will be kept for 3 calendar years.

signs of mean

Compared to a small business, medium business includes entire networks of enterprises working for a large consumer audience. This entrepreneurial form can carry out its activities not only within the whole city, even within the region.

Compared to small businesses, where big role allocated to staff on average - the quality of goods (services) is put in the foreground. Since the average enterprise is not large, it will not be difficult for it to adapt to changing market conditions.

Large or big business

Large businesses can spend money advertising their products on the most popular television channels. AT different cities and countries given form business has its own branches and representative bodies, employing hundreds of thousands of employees.

The subjects of large business are large companies that:

- engaged in the production of equipment: Apple, Bosch, Samsung, Lenovo, etc.;

- produce food: MC.Donald, Nestle, Coca Cola etc;

- produce vehicles car brands: Ferrari, Bogati, Alfa Romeo, BMW, etc.

The criteria are easy. In order to be a major entrepreneur, you must meet the following:

The criteria are easy. In order to be a major entrepreneur, you must meet the following:

- have at least 251 employees:

- receive income of at least 2 billion rubles;

- timely inventory and revaluation of fixed assets.

Since 2016, a unified register of SMEs has been operating, which contains enterprises that have received the status of SMEs.

These forms of entrepreneurship acquire the status of SMEs if they meet the criteria below:

- have a certain amount of income;

- have a certain number of employees;

- have a certain share of participation of other companies in the authorized capital.

According to article 4 of the Federal Law "On the development of small and medium-sized businesses in the Russian Federation", these limits do not apply:

- persons holding shares in the economic high-tech sector;

- persons participating in the Skolkovo project;

- companies that practice the latest technology, which are developed by their owners ̶ budgetary and scientific institutions;

- companies whose founders are included in the government list of persons who provide state support for innovation.

If an individual entrepreneur does not have employees, then his status is determined by the criterion of their annual income. If individual entrepreneurs and LLCs were included in the unified register of SMEs for the first time, then their status should be determined by the criterion of the number of employees.

If an enterprise receives the status of an SME, then certain benefits are provided to it, namely:

- the right to keep as much money in the cash register as you want and there will be no fine for this.

- the ability to maintain simplified accounting. This does not apply to individual entrepreneurs, since they are not required to keep records. And companies are required to charge annual depreciation, and not once a month.

- endowed with an advantage in the purchase of state and municipal real estate, etc.

List of enterprises that meet the specified criteria, annually formed by the Ministry of Industry and Trade of the Russian Federation. This list is provided to the Federal Tax Service of Russia, after which certain information is entered in the register by the tax authorities.

We bring to your attention a video that talks about why big business wins.

Main advantages

Both SMEs and large companies have their own strengths and weaknesses.

The list of advantages of small business is as follows:

- the presence of a small need for initial capital;

- relatively low costs during the implementation of entrepreneurial activities;

- availability of a quick response to changes in the market sphere;

- the presence of a relatively fast turnover of equity capital;

- the trend of growth of vacant vacancies, which has a beneficial effect on the increase in populated employment.

The main advantages of medium-sized enterprises are:

- creation of new places of employment;

- high productivity of capital investments;

- relatively high profitability;

- high competitiveness and mobility.

Big business is also endowed positive qualities, namely:

- the ability to ensure economic stability in the country;

- ability to change external environment business;

- the ability to save on production costs;

- implementation in business modern technologies etc.

Cons and risks

In order to start building your business, an entrepreneur must familiarize himself with the main disadvantages of various enterprises. For example, small business has the following disadvantages:

In order to start building your business, an entrepreneur must familiarize himself with the main disadvantages of various enterprises. For example, small business has the following disadvantages:

- relatively high level of risk;

- dependence on big business;

- low professional level leaders;

- difficulties in obtaining loans and subsidies.

The size of the initial capital also matters. For example, if given size is large, then the firm will be able to hold out during the crisis period.

Medium business also has certain disadvantages, namely:

- the presence of fierce competition and the threat of being taken over by large companies;

- the presence of barriers and difficulties in obtaining a license and patents;

- frequent shortage of working capital;

- difficulties in obtaining loans due to lack of confidence in banks.

Big business is also not without problems. The main disadvantages of this business are the presence:

- excessive economic concentration;

- localization of economic relations;

- blocking horizontal commercial links that do not go beyond a particular company.

Differences among themselves

For good example differences between small medium and large businesses, we can cite the following table.

Basis for success

Despite the dependence on the external environment, small business can also be successful. Only the best employees in their field work here. The success of this business is determined by having a strategic plan for the development of the enterprise.

Despite the dependence on the external environment, small business can also be successful. Only the best employees in their field work here. The success of this business is determined by having a strategic plan for the development of the enterprise.

Medium business can easily adapt to changing market conditions. Success also depends on having effective management.

Major success large enterprise is the presence of effective business models that are built in such a way that even after 10 years they continue to work, surviving crisis situations and bringing huge income.

January 6, 2019 , About support of the centers of youth innovative creativity Subsidies provided to the Foundation for the Promotion of the Development of Small Forms of Enterprises in the Scientific and Technical Sphere can be used to support projects to involve young people in innovative activities implemented by centers of youth innovative creativity.

January 4, 2019 , On the inclusion of micro-enterprises in the deposit insurance system in Russian banks From January 1, 2019, the deposit insurance system individuals in Russian banks applies to small and micro-enterprises. The maximum amount of insurance compensation will be similar to the amount of compensation for individuals and individual entrepreneurs - 1.4 million rubles.

December 31, 2018 , Social innovations. non-profit organizations. Volunteering and volunteering. Charity On the submission to the State Duma of a bill on legal regulation relations in the field of social entrepreneurship The draft law proposes to single out social entrepreneurship as a separate area of activity for small and medium-sized businesses. The concept of "social enterprise" is legally fixed. The criteria for classifying SMEs as social enterprises, special forms and types of support for social enterprises are determined. The adoption of the bill will make it possible to provide targeted state support to social enterprises.

December 28, 2018 , Business environment. Development of competition The President of Russia signed the federal law developed by the Government on the establishment of a unified procedure for the prolongation of lease agreements for state and municipal property without bidding Federal Law of December 27, 2018 No. 572-FZ. The draft federal law was submitted to the State Duma by Government Decree No. 2200-r dated October 13, 2018. Federal law states that a lease agreement for new term with a tenant who duly performed his duties will be renegotiated without holding a tender, auction, unless otherwise provided by the contract and the term of the contract is not limited by law, while simultaneously observing the established conditions.

December 28, 2018 , Small and medium enterprises The President of Russia signed the federal law developed by the Government on improving state support for small and medium-sized businesses and organizations Federal Law of December 27, 2018 No. 537-FZ. The draft federal law was submitted to the State Duma by Government Decree No. 54-r dated January 22, 2018. The federal law establishes that the annual mandatory audit of the accounting (financial) statements of a regional guarantee organization may be carried out by an individual auditor, except for cases where, in accordance with the law, a mandatory audit is carried out only by an audit organization.

December 25, 2018 , Small and medium enterprises The President of Russia signed the Federal Law developed by the Government aimed at expanding the access of small and medium-sized businesses to financial resources Federal Law of December 25, 2018 No. 487-FZ. The draft federal law was submitted to the State Duma by Government Decree No. 2586-r dated November 26, 2018. The federal law establishes that in order to fulfill the obligations of SME Corporation JSC under independent guarantees issued in order to ensure the fulfillment of obligations of small and medium-sized businesses, it will be provided with state support at the expense of federal budget in the manner, forms and sizes, which are determined by the budgetary legislation.

December 24, 2018 , Small and medium enterprises Report by Maxim Oreshkin at a meeting of the Presidium of the Council under the President of the Russian Federation for Strategic Development and National Projects About the national project "Small and medium business".

December 5, 2018 , Small and medium enterprises On the submission to the State Duma of a bill on improving the legal regulation of the organization of non-stationary and delivery trade Order dated December 4, 2018 No. 2677-r. The purpose of the draft law is to establish general principles and rules for regulating non-stationary trade, creating favorable conditions for trading activities using non-stationary and mobile shopping facilities. The draft law, in particular, proposes to enshrine in the legislation options and general principles legal registration of the right to place non-stationary and mobile shopping facilities, establish the possibility of conducting trading activities using a non-stationary or mobile shopping facility on a declarative principle by any business entity in places recognized as publicly accessible for the placement of shopping facilities. The adoption of the bill will contribute to the development of entrepreneurship in the field of trade, ensuring additional channels sales of products of small and medium-sized commodity producers, including agricultural producers, and providing the population with shopping services within walking distance.

December 3, 2018 , General issues of the implementation of national projects On the agenda: about the national projects "Labor productivity and employment support", "Small and medium-sized businesses and support for individual entrepreneurial initiative", "International cooperation and export".

November 27, 2018 , National project "Small and medium-sized businesses and support for individual entrepreneurial initiatives" On the submission to the State Duma of a bill aimed at expanding the access of small and medium-sized businesses to financial resources Order dated November 26, 2018 No. 2586-r. In order to implement national project“Small and medium-sized businesses and support for individual entrepreneurial initiatives”, the bill proposes to legislate the possibility of providing JSC “Corporation SMEs” with state support from the federal budget to finance the fulfillment of obligations under guarantees provided to SMEs in 2019–2024, in order to increase the volume of guarantee support in as part of the expansion of lending to SMEs.

November 27, 2018 , Small and medium enterprises The President of Russia signed federal laws on conducting an experiment in a number of subjects of the Federation to simplify the payment of tax on professional income for self-employed citizens Federal laws of November 27, 2018 No. 422-FZ, 423-FZ, 425-FZ. Federal laws provide for the holding in Moscow, the Moscow and Kaluga regions, in the Republic of Tatarstan from January 1, 2019 to December 31, 2028, an experiment to establish a special tax regime"Professional Income Tax".

November 26, 2018 , Eurasian Economic Union. Integration in the CIS space On approval of the supplier system development plan Order dated November 21, 2018 No. 2549-r. A plan for the development of a supplier system was approved, which ensures the expansion of the scale of subcontracting, including within the framework of the activities of the largest companies with state participation and subcontracting centers. Target decisions taken– to ensure the fulfillment of international obligations to form the Russian segment of the network of industrial cooperation and subcontracting, to stimulate the development of small and medium-sized businesses as potential suppliers, performers, contractors.

October 23, 2018 , Small and medium enterprises

The main goal of the forum is to discuss and popularize the mechanisms for the implementation of the national project in the development of small and medium-sized businesses and support for individual entrepreneurial initiatives.

The main goal of the forum is to discuss and popularize the mechanisms for the implementation of the national project in the development of small and medium-sized businesses and support for individual entrepreneurial initiatives.

October 18, 2018 , Small and medium enterprises On the involvement of small and medium-sized businesses in the provision of services for the transportation of municipal solid waste Decree of October 18, 2018 No. 1245. The Rules for bidding, which result in the formation of prices for services for the collection and transportation of solid municipal waste for a regional operator, have been amended, according to which at least 15% of the volume of services for the transportation of solid municipal waste should be allocated in separate lots for bidding among subjects of small and medium business.

October 16, 2018 , Small and medium enterprises On the submission to the State Duma of a draft law on the establishment of a unified procedure for the prolongation of lease agreements for state and municipal property without bidding Order dated October 13, 2018 No. 2200-r. The amendments proposed by the draft law are aimed at establishing a unified approach to regulating the procedure for renegotiating lease agreements for state and municipal property when a tenant, who duly fulfills its obligations, sells the pre-emptive right to conclude a lease agreement for a new term without bidding. It is proposed to establish a unified procedure for renewing property lease agreements for a new term, regardless of when such agreements were concluded, as well as the procedures by which they were concluded.

October 15, 2018 , Small and medium enterprises On changes in the procedure for lending at a preferential rate to small and medium-sized businesses in order to implement projects in priority sectors Decree of October 10, 2018 No. 1212. Aimed at increasing the availability of the soft lending program, including loans for the implementation of investment projects, for small and medium-sized businesses. In order to increase the availability of concessional lending for SMEs maximum amount a loan issued to an SME for investment purposes at a reduced rate from RUB 1 billion to RUB 400 million. Wherein maximum size the total amount of loans that can be issued to one borrower for these purposes does not change and amounts to 1 billion rubles. So the banks will lend more SMEs. Small and medium business The President of Russia signed the Federal Law on Deposit Insurance in Russian Banks Federal Law of August 3, 2018 No. 322-FZ. The federal law, in particular, provides for the extension of the deposit insurance system to legal entities belonging to small enterprises, information about which is contained in the unified register of small and medium-sized businesses.

August 3, 2018 , Small and medium enterprises The President of Russia signed the federal law developed by the Government on changes in the legal regulation of relations in the development of small and medium-sized businesses Federal Law of August 3, 2018 No. 313-FZ. The draft federal law was submitted to the State Duma by Government Decree No. 617-r dated April 7, 2018. The federal law establishes that small and medium-sized businesses include economic partnerships registered in accordance with Russian legislation and in accordance with the established conditions.

1